Having a good credit score is important for getting approved for loans and credit cards with favorable interest rates. One of the most widely used credit scoring models is the FICO score which ranges from 300 to 850. So is a FICO score of 781 considered good? The short answer is yes, a credit score of 781 is very good and well above average. In this article I’ll explain more about what a FICO score of 781 means and how you can work to maintain or improve your credit score.

What Does a Credit Score of 781 Mean?

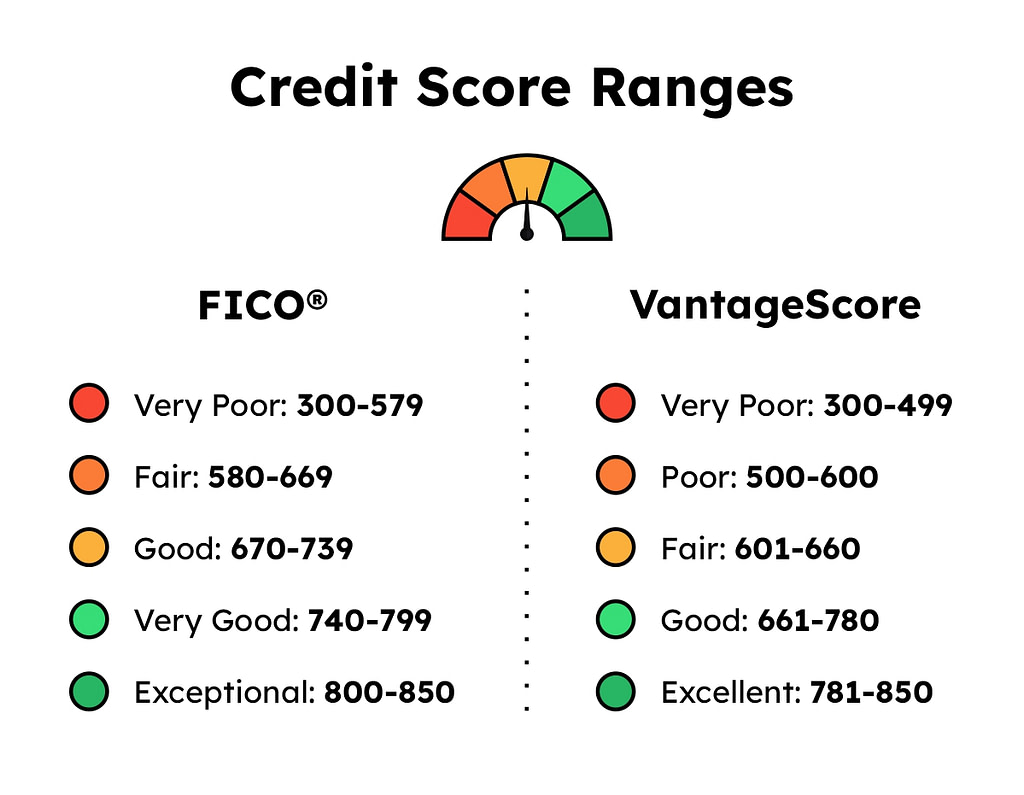

A FICO score of 781 falls in the “very good” credit range, which is 740-799. This means your credit is well above average and indicates you likely have a long history of managing credit responsibly by making payments on time, keeping credit card balances low, and avoiding negative marks like late payments, collections, and bankruptcies.

Only about 25% of consumers have credit scores in the very good range, so a 781 FICO puts you ahead of many other borrowers Here is how credit scores are typically categorized

- Exceptional Credit: 800-850 – Top 21% of borrowers

- Very Good Credit: 740-799 – Next 25% of borrowers

- Good Credit: 670-739 – Next 21%

- Fair Credit: 580-669 – Next 17%

- Poor Credit: 300-579 – Bottom 16%

With a 781 FICO score, you should have access to the best interest rates and loan terms from most lenders since you are considered very low-risk. A score in this range is especially helpful for qualifying for the lowest rates on large loans like mortgages and auto loans You’ll also likely qualify for premium rewards credit cards with excellent benefits.

Credit Card and Loan Approval Odds with a 781 FICO

Your 781 FICO score means you should have no trouble getting approved for credit cards and loans at excellent rates. Here is a breakdown of your approval odds:

Credit Cards

A 781 FICO score makes you look highly attractive to credit card issuers. You should qualify for just about any card you want, including rewards cards with valuable perks and travel cards that offer features like airport lounge access and airline miles. Just be sure to always make payments on time and keep balances low.

Personal Loans

Most online lenders will happily approve borrowers with FICO scores around 780. You’ll likely qualify for the lowest advertised interest rates. Just keep in mind income, existing debt levels and other factors also play a role in the loan decision.

Mortgages

FICO scores of 740+ qualify borrowers for the best mortgage rates. With your 781 score, you can expect fast approvals and incredibly low interest rates from lenders, saving you thousands over the life of the loan. You may even get lender credits to cover closing costs.

Auto Loans

A 781 FICO score makes you a prime borrower in the eyes of auto lenders. You should have no problem qualifying for 0% financing deals or other low interest rate auto loans. This gives you exceptional leverage when negotiating price at the dealership.

How to Maintain or Improve a 781 FICO Score

Since your credit is already in excellent shape, maintaining your 781 score should be your priority. Here are some tips:

-

Monitor your credit reports – Review your credit reports from Experian, Equifax and TransUnion at least annually for errors or suspicious activity that could hurt your scores. Dispute any mistakes immediately.

-

Keep credit card balances ultra low – Experts recommend keeping individual and total revolving credit card balances below 10% of your credit limit. This helps optimize your credit utilization ratio.

-

Don’t close old accounts – Keeping longstanding credit card and loan accounts open preserves your length of credit history, an important scoring factor.

-

Apply for new credit sparingly – Each application causes a hard inquiry that can ding your scores a few points temporarily. Space out applications by at least 6 months unless you have an urgent need.

-

Set up autopay – Paying bills even one day late can devastate your scores. Autopay ensures you never miss a payment due date.

-

Monitor your credit scores – Check your FICO score every few months to catch any sudden changes that could indicate credit report errors or identity theft.

If you do want to try improving your already excellent 781 FICO score, here are a few advanced tactics:

-

Pay down balances before the statement date – This reduces your credit utilization without waiting for the full monthly payment cycle. Just be sure to leave a small balance to avoid reports of $0 owed.

-

Become an authorized user – Ask a family member with great credit to add you as an authorized user on a longstanding account. This can build your credit history.

-

Limit hard inquiries – Each application triggers an inquiry, so only apply for credit when needed. Too many hard inquiries in a short time can negatively impact scores.

-

Improve credit mix – Lenders may like to see you managing both revolving (credit cards) and installment (mortgage, auto, student loans) accounts successfully.

With some minor fine-tuning, it’s possible to push your credit into the 800+ range, qualifying you for the very best interest rates and terms from lenders. But maintaining your current 781 FICO score is admirable too.

Is a 781 FICO Score Good Enough to Buy a House?

Absolutely! A credit score of 781 is considered excellent for mortgage approvals. Conventional lenders generally require a minimum FICO score of 620-680 for qualification, so your 781 FICO exceeds that by a wide margin.

In fact, a recent study by FICO found that borrowers with credit scores between 760-850 enjoyed average interest rates of just 3.003% on 30-year fixed-rate mortgages. Meanwhile, those with scores of 700-759 paid 3.295% on average. So your 781 credit score could easily save you thousands of dollars in interest over the life of your home loan.

The difference of half a percentage point or more in mortgage rates results in over $50 in savings per month on a $300,000 loan. So if you’re considering buying a home soon, your excellent 781 FICO score will qualify you for the very best mortgage terms lenders have to offer.

How a 781 FICO Can Save Money on Auto Loans

Your 781 FICO score also gives you an advantage when financing a vehicle. Data from Experian shows that borrowers with “very good” credit (781 falls squarely in this range) enjoy average auto loan rates around 4-5%, compared to 11% for those with “poor” credit.

Based on current average interest rates, having a 781 score could mean:

- 3.941% APR on a new auto loan

- 4.457% APR on a used auto loan

Whereas subprime borrowers often pay 10-20% APR or higher on auto financing.

So if you plan to buy a $30,000 vehicle, a 781 FICO score qualifies you for over $100 in monthly savings on your car payment versus someone with poor credit. That’s over $3,600 in savings over a 5-year loan term!

Your excellent credit also gives you maximum negotiating leverage when shopping for a car, since dealers know lenders will approve you at the lowest rates available. Avoid getting trapped paying the dealership’s inflated interest rates by securing pre-approval from your bank or credit union before heading to the lot.

The Perks of a 781 FICO Score

Beyond saving money on auto and mortgage rates, a 781 credit score unlocks other advantages, including:

-

Better credit card rewards – Premium travel cards with airport lounge access, travel credits, and bonus points for purchases often require 740+ scores for approval.

-

Higher credit limits – Issuers are willing to extend higher limits to borrowers with excellent credit. Higher limits help keep credit utilization low.

-

Security deposits waived – Landlords and utility companies often waive security deposits for renters with very good credit.

-

Better insurance rates – Insurers offer discounted premiums to customers with excellent credit scores.

-

Cell phone plan perks – Carriers like Verizon and T-Mobile offer discounted rates and benefits for customers with high credit scores.

-

Job offer leverage – Employers sometimes use credit checks in hiring, so a 781 FICO can give you an advantage and negotiating power.

While someone with poor credit tends to pay more for everything from auto loans to insurance, your 781 score unlocks the opposite – lower rates and great perks across the board!

How to Check Your Credit Score

Wondering what your own FICO score is? There are a few ways to check:

-

Get your free credit report – Your report will include a credit score from Experian. AnnualCreditReport.com provides one free report from each bureau per year.

-

Use a credit monitoring service – For full 24/7 monitoring of your credit reports and FICO or VantageScores from all three bureaus, services like MyFICO or Credit Karma provide this for free or low monthly fees.

-

Check with your credit card company – Many issuers like Chase, Citi and Discover provide free FICO scores to cardholders as an account benefit. Just log into your account.

-

Try a free trial of MyFICO – This lets you access your 28 FICO Scores based on data from all three credit bureaus starting at $19.95 per month. But they offer 7-day trials so you can get your scores for free if you just need a one-time look.

Checking your credit score periodically is wise to monitor for identity theft and ensure you maintain “very good” or “exceptional” credit standing. With a 781 FICO score, you’re already doing well!

The Bottom Line

A FICO credit score of 781 is considered very good or even exceptional by lenders. This high score signifies to lenders that you pose very little risk of defaulting on credit obligations. A 781 FICO score qualifies you for the very best interest rates and loan terms, saves you money on everything from mortgages to car insurance, and makes creditors want to court your business. Maintaining this high credit score should be your priority as you pursue loans and credit cards. An excellent 781 FICO score is an achievement to be proud of!

How an excellent credit score can help you

An excellent credit score can help you receive the best APRs from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, youll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if youre looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year and 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year — but youll need good or excellent credit. Terms apply.

Take note that even if your credit score falls within the excellent range, its not a guarantee youll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Selects best credit cards for excellent credit.

What factors influence your credit score

Credit scores are calculated differently depending on the credit scoring model. Here are the key factors FICO and VantageScore consider.

- Payment history (35% of your score): Whether youve paid past credit accounts on time

- Amounts owed (30%): The total amount of credit and loans youre using compared to your total credit limit, also known as your utilization rate

- Length of credit history (15%): The length of time youve had credit

- New credit (10%): How often you apply for and open new accounts

- Credit mix (10%): The variety of credit products you have, including credit cards, installment loans, finance company accounts, mortgage loans and so on

- Extremely influential: Payment history

- Highly influential: Type and duration of credit and percent of credit limit used

- Moderately influential: Total balances/debt

- Less influential: Available credit and recent credit behavior and inquiries

How to Maintain a Credit Score Between 781-799

FAQ

How good is a 781 FICO score?

A 781 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range (800-850), you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

What is an excellent FICO score?

An excellent FICO score is generally considered to be 800 or higher.

How rare is credit score over 800?

What it means to have a credit score of 800. A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How to go from 768 to 800 credit score?

- Pay on Time. You don’t have to be a perfectionist to become a member of the 800 Club, but it does help. …

- Limit Credit Use. …

- Mix and Match Methods of Borrowing. …

- Credit History Matters. …

- Don’t Apply for Credit …

Is a credit score of 781 considered good?

A credit score of 781 is often considered very good, or even excellent. With excellent credit, your scores become more of a bridge and less of a roadblock. A high score can help you qualify for premium rewards credit cards, auto loans, and mortgages with the best terms.

Is a FICO ® score of 781 considered good?

A FICO ® Score of 781 is considered good, falling within the Very Good range (740-799). This score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers. Approximately 25% of all consumers have FICO ® Scores in the Very Good range.

What does a 780 FICO score mean?

Your FICO ® Score ☉ falls within a range, from 740 to 799, that may be considered Very Good. A 780 FICO ® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers. 25% of all consumers have FICO ® Scores in the Very Good range.

What is the average utilization rate for a 781 credit score?

The average credit utilization rate for consumers with a 781 credit score is 17.0%. To determine how to improve your credit score, check your FICO ® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file.

What is a good FICO score?

A FICO ® Score of 781 is considered good. In statistical terms, only 1% of consumers with scores in this range are likely to become seriously delinquent in the future. This is above the average credit score of 714, but there’s still some room for improvement.

What is a 780-799 credit score & a 700-719 credit score?

According to Wonder, individuals with scores in the 780-789 range have a 0.8% estimated probability of defaulting on a loan. Those with scores in the 719 range have a 2.5% probability of defaulting on a loan obligation.