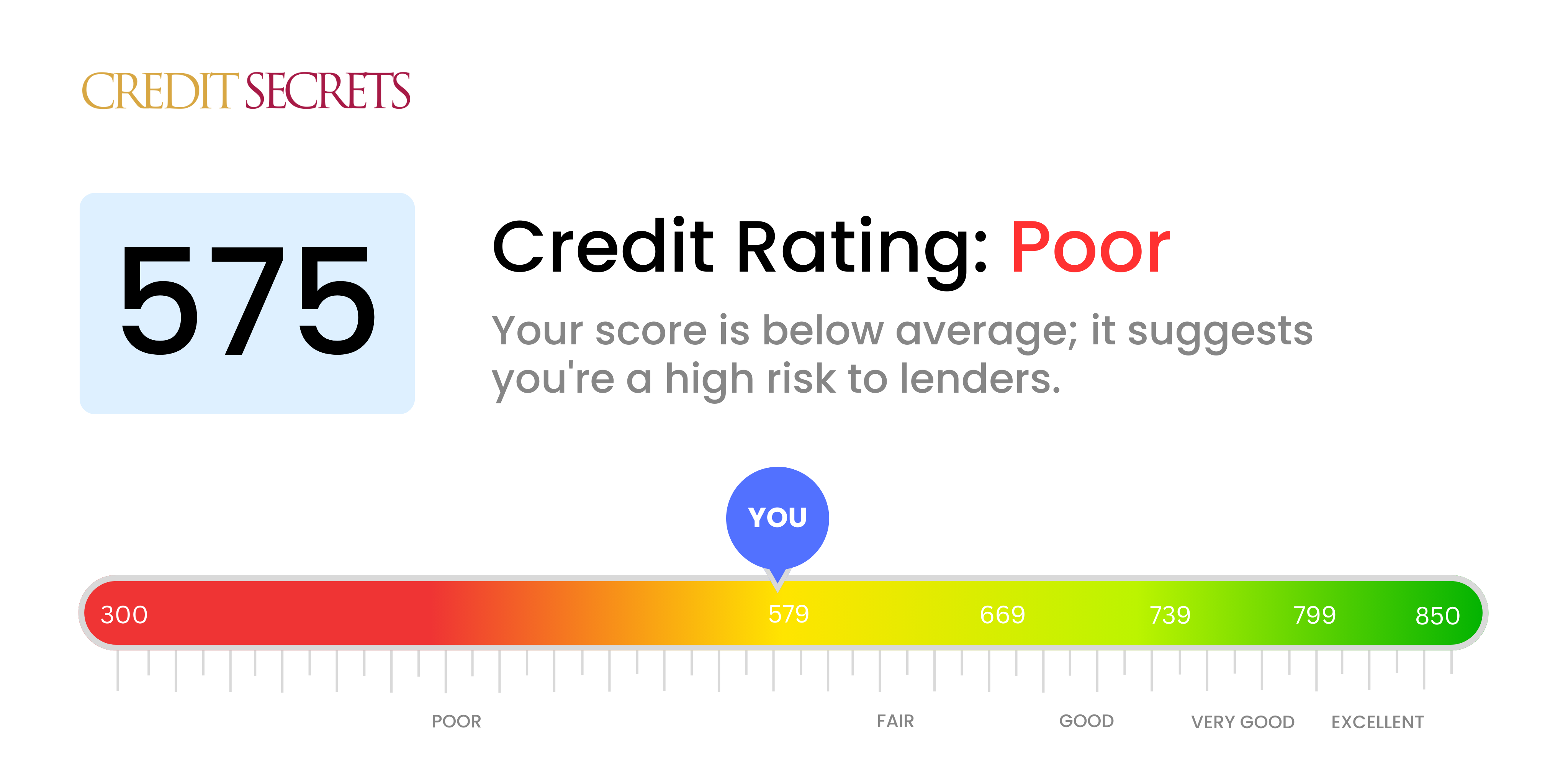

Having a credit score of 575 can make getting approved for an auto loan more challenging, but it is still possible with the right strategy. As someone with a “fair” credit score, you’ll have fewer lender options and pay higher interest rates than borrowers with excellent credit. However, you can take steps to improve your chances of getting a car loan that fits your budget.

Understanding Your 575 Credit Score

According to FICO, the most widely used credit scoring model, a 575 credit score is considered “fair.” This means lenders see you as a higher risk compared to borrowers with “good” or “excellent” credit scores.

With a 575 credit score, you can expect:

-

Higher interest rates – Lenders will charge you more interest to make up for the increased risk. This results in higher monthly payments and overall borrowing costs.

-

Limited lender options – Not all lenders will work with borrowers who have fair credit You may have to shop around more to find a willing lender

-

Stricter loan terms – Lenders may require a larger down payment or shorter loan length to lower their risk exposure.

While getting a car loan with a 575 credit score is harder, it’s not impossible if you know where to look and take the right steps.

Types of Auto Loans Available with a 575 Credit Score

Here are some of the most common types of car loans available to borrowers with fair credit:

Subprime Auto Loans

Subprime lenders offer loans specifically tailored for borrowers with fair or poor credit histories. They typically charge higher interest rates and require shorter loan terms than prime lenders.

Bad Credit Auto Loans

Bad credit auto loans are designed for borrowers with credit scores below 600. They usually come with even less favorable terms like very high interest rates.

Co-signed Loans

Asking a friend or family member with excellent credit to co-sign your loan can help you qualify for better rates and terms. Their good credit offsets some of your risk.

Credit Union Loans

Since credit unions are member-owned nonprofits, they may offer more competitive rates and flexible terms to borrowers with weaker credit.

Tips for Getting Approved with a 575 Credit Score

If you have a 575 credit score, use these tips to boost your chances of auto loan approval:

-

Shop around – Get rate quotes from multiple lenders and compare offers. Even a small rate difference can save you hundreds over the loan term.

-

Make a larger down payment – Putting down more money upfront reduces the amount you have to borrow. It shows lenders you’re financially committed.

-

Ask for a co-signer – Adding a cosigner with excellent credit can get you approved at lower rates. Make sure you and the co-signer discuss expectations beforehand.

-

Consider buying used – Since used cars cost less than new ones, your monthly payments will be lower. This helps offset the higher interest rate.

-

Improve your credit first – Even slightly boosting your score before applying can help you land better rates. Pay down debts and make timely payments.

-

Prepare for stricter terms – Be ready to accept a shorter loan length or steeper down payment requirement than borrowers with higher scores.

Weighing the Pros and Cons of Car Loan Options

When you have fair credit, it pays to understand the advantages and drawbacks of different auto loan types:

Subprime Auto Loans

Pros

-

Specifically designed for fair/poor credit borrowers

-

More widely available than standard loans

Cons

-

Very high interest rates

-

Short 12-36 month loan terms

Bad Credit Auto Loans

Pros

-

Available with credit scores below 600

-

May offer slightly better terms than deep subprime loans

Cons

-

Extremely high APRs

-

Loan terms usually 24 months or less

Co-signed Loans

Pros

-

Co-signer’s good credit secures better rates/terms

-

Allows you to build positive payment history

Cons

-

Co-signer is equally responsible for repaying loan

-

Late payments hurt both your credit and co-signer’s

The Bottom Line

A 575 credit score makes getting a car loan more difficult but not impossible. Shopping around, comparing loan offers, providing a larger down payment, and taking other steps to improve your application can go a long way. While you may pay higher rates and accept stricter terms, responsible borrowing is still feasible. Don’t get discouraged – with the right strategy, you can get the car you need even with fair credit.

Expert insights on bad credit car loans

“Don’t just take the first car loan offer you find. Even with bad credit, you can benefit from comparing offers from multiple lenders. It is important to temper your expectations around those loans, of course. With crummy credit, you’re not going to get that sweetheart deal you’re hoping for. However, shopping around can still help you save money.” — Matt Schulz, chief credit analyst

Matt points out that no two loans are alike. Every lender has its own way of calculating rates. Just like insurance, you have to compare rates before you can be confident you’re getting the best deal.

Here are other ways to avoid a lemon of a car loan:

→ If a loan shows a range of possible rates, pay attention to the maximum, not the minimum. Borrowers with a bad credit history tend to qualify for rates on the high end of the range.

→ You might have a high rate, but if you pay your car loan off fast, you can pay less overall interest.

→ Lenders may not be willing to give you a big loan, so consider limiting your search to used cars.

→ Bad credit car loans often come with high documentation (or doc) fees. This can make a car look cheaper than it really is. Ask for the out-the-door price so you know exactly what to expect.

The best car loans for credit scores 580 and below

| Lender | User ratings | Best for… | Minimum credit score | Starting APRs | Loan terms |

|---|---|---|---|---|---|

| User ratings coming soon | Convenient used car financing | No minimum credit score | 5.75% | 24 to 72 months | See Personalized Results |

| User Ratings & Reviews Ratings and reviews are from real consumers who have used the lending partner’s services. |

Car loan refinancing for bad credit | 460 | 5.49% | 36 to 84 months | See Personalized Results |

| User Ratings & Reviews Ratings and reviews are from real consumers who have used the lending partner’s services. |

Dealership loans for bad credit | 500 | 5.59% | 24 to 84 months | See Personalized Results |

| User Ratings & Reviews Ratings and reviews are from real consumers who have used the lending partner’s services. |

Stretching out payments | 580 | 4.85% | 24 to 96 months | See Personalized Results |

How a Car Loan Affects Credit Score – Auto loans raise or lower scores? How fast? How many points?

FAQ

Can I get a car loan with a 575 credit score?

What credit score do I need to buy a $50,000 car?

… to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above …Mar 31, 2025

What credit score do I need for a $10,000 personal loan?

Requirements will vary across lenders. However, qualifying for a $10,000 personal loan typically requires a credit score that exceeds 640, an active checking account, and a steady, verifiable income, among other factors.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)