Thereâs no specific number of hard inquiries thatâs too many or too few. Although some hard inquiries might hurt your credit scores a little, credit scoring models also ignore many hard inquiries when consumers shop for a new loan.

Hard inquiries in your credit report might hurt your credit scores, but theres no specific rule for how many inquiries are too many. Depending on why the hard inquiries occurred and the type of credit score, some hard inquiries may not affect your score much at all.

Even when they do affect your scores, hard inquiries tend to be a minor scoring factor. Still, if you want to minimize the potential impact on your scores, its important to understand how, when and which hard inquiries will affect your scores.

Your credit report contains important information about your financial history, including your payment history, outstanding debts, and any bankruptcies or foreclosures. This information is used by lenders, landlords, insurers and employers to evaluate your creditworthiness when you apply for loans, housing, insurance policies and jobs.

Every time someone requests your credit report, it’s called a “hard inquiry” or “hard pull”, and it gets noted on your report. Too many hard inquiries in a short period of time can negatively impact your credit score so it’s important to understand when and how often creditors and others can pull your credit report.

How Often Can Potential Creditors Pull Your Credit Report?

When you apply for new credit such as a credit card, auto loan or mortgage the lender will request your credit report to evaluate your creditworthiness. In general, each potential creditor is allowed to pull your credit report once as long as you’ve applied for credit with them. This is called a “soft inquiry”.

If you submit multiple credit applications within a short period of time, such as rate shopping for an auto loan mortgage or student loan credit scoring models will count those as a single hard inquiry as long as they are within 30-45 days. This prevents your score from being negatively impacted just for shopping around for the best rates and terms.

While rate shopping, creditors are not allowed to pull your credit report multiple times. They can pull it once when you submit your initial application. If they need to re-check your credit after 30 days, they generally must request your permission to pull it again.

How Often Can Landlords Pull Your Credit Report?

Most landlords will check your credit report before approving a lease application. In general, they are allowed to pull your credit once when you submit the initial rental application. If too much time passes before final approval, they may request your permission to pull your credit again for an updated report.

Some landlords may use tenant screening services that provide periodic credit monitoring. This allows them to check your credit on an ongoing basis to identify any new negative information. However, they still need your consent to pull your credit report initially and authorize the monitoring service. You have the right to decline this type of credit monitoring.

How Often Can Insurance Companies Pull Your Credit Report?

Insurance providers commonly check your credit when processing applications for coverage. The first credit check is generally permitted without additional consent. But if more requests are made after the initial pull, they typically need your authorization.

For example, if your policy renews after a year and they want an updated credit report, they should get your approval. Or if you originally applied through an insurance broker and the insurer needs to pull your credit separately, they would need your consent.

Insurers cannot access your credit report perpetually without boundaries. The Fair Credit Reporting Act (FCRA) requires them to have a legitimate purpose for each pull. And you have the right to ask them to inform you when and why your credit was checked.

How Often Can Employers Pull Your Credit Report?

Many employers review credit reports during background checks on job applicants. In most cases, they need your written consent before pulling your credit report for employment purposes.

Some states have laws restricting employer credit checks. For example, employers in California can only check credit when the job involves access to money, valuables or confidential information. And in Maryland, credit checks are only permitted for managerial positions or jobs involving money or finances.

Unless your state has stricter regulations, federal law allows employers to pull your credit report once without asking your permission first. But they have to get your consent for any subsequent pulls, and they can’t check your credit after you’re hired without an authorized purpose.

How Often Do Credit Monitoring Services Pull Your Credit?

Credit monitoring services track your credit reports and alert you whenever key changes occur, such as new accounts, inquiries, late payments, etc. These services need your authorization before accessing your credit reports.

Many credit monitoring companies check your credit reports daily or weekly from one or more credit bureaus. This constant access enables them to immediately notify you about any new negative or fraudulent activity. However, you must specifically agree to this level of credit monitoring for it to be permitted.

Some monitoring services only check your credit monthly. Others allow you to choose your desired monitoring frequency. As long as you provide consent, they are legally allowed to access your credit as often as they stated in your agreement.

How Often Can the Government Pull Your Credit Report?

Government agencies generally need a court order or subpoena to pull your credit report. However, some exceptions exist.

For example, the FBI and IRS can request your credit report without your consent as part of special investigations permitted under the Patriot Act. Child support enforcement agencies can also access your credit to locate parents who owe payments.

Outside of specific legal authorizations, government entities need your permission to pull your credit report. If you did not initiate contact or submit an application to the agency, they are unlikely to have a valid purpose for checking your credit.

How Can You Check Who Is Accessing Your Credit Report?

You have the right to ask the credit bureaus for a complete list of everyone who has obtained your credit report. This record is called your credit inquiry history. It shows the names of creditors, employers, insurers and any other parties who pulled your credit, along with the date of each inquiry.

Checking your inquiry history enables you to verify that all credit checks were authorized and legitimate. If you see any names you don’t recognize, it could be a sign of identity theft. Always review this information closely and follow up on any suspicious inquiries.

Most credit monitoring services also track your inquiry history and alert you about any new companies accessing your credit. This is an easy way to monitor your report and catch unauthorized pulls.

How Many Hard Inquiries Is Too Many?

While several inquiries from auto, mortgage and student loan shopping over a short period are generally treated as one pull, having too many new inquiries can lower your credit score.

As a general guideline, try to avoid accumulating more than 2 or 3 hard inquiries per year. Too many in a short timeframe can give the impression that you’re desperately applying for new credit accounts because you need cash.

Space out credit applications by 45-60 days to avoid excessive hard pulls on your report. Also be cautious about letting companies you don’t plan to do business with check your credit. Every hard pull can impact your score, so don’t consent to credit checks from businesses you aren’t serious about.

Can You Ask Creditors to Check Your Credit Less Frequently?

You have options if a creditor, landlord or insurer wants to check your credit too often for your liking. Here are some steps you can take:

-

Revoke authorization for them to periodically access your credit report. They need your consent.

-

Ask them to limit checks to only when absolutely necessary due to a major change in circumstance.

-

Provide alternative documentation, such as recent utility bills, paystubs, tax returns or bank statements.

-

Close unused credit accounts so your report shows less credit availability.

-

Offer to become an authorized user on a spouse or family member’s account.

-

Build your credit history by responsibly managing new accounts.

-

Ask the company to perform a soft inquiry instead to avoid new hard pulls on your report.

-

Offer to pay a security deposit or upfront premium in lieu of a credit check.

-

File a dispute if you notice errors or unauthorized hard inquiries on your credit report.

Being proactive can help minimize unnecessary credit checks while also building your credit history over time.

The Bottom Line

Checking your credit report periodically is important to verify accuracy and check for fraud. But you should also pay attention to how often it’s being pulled by others to avoid potential negative impacts. While most inquiries are from legitimate applications, questionable hard pulls could indicate identity theft.

Know your rights, carefully monitor your credit report’s inquiry history, and take action to reduce unnecessary hard pulls. This will help you maximize your control over who can access your sensitive information.

How Do Hard Inquiries Impact Your Credit Score?

Hard inquiries can have no impact on your credit score or a relatively small negative impact, such as a score drop of 10 points or less. The exact impact can depend on the entirety of your credit reportâa hard inquiry isnt worth a certain number of points.

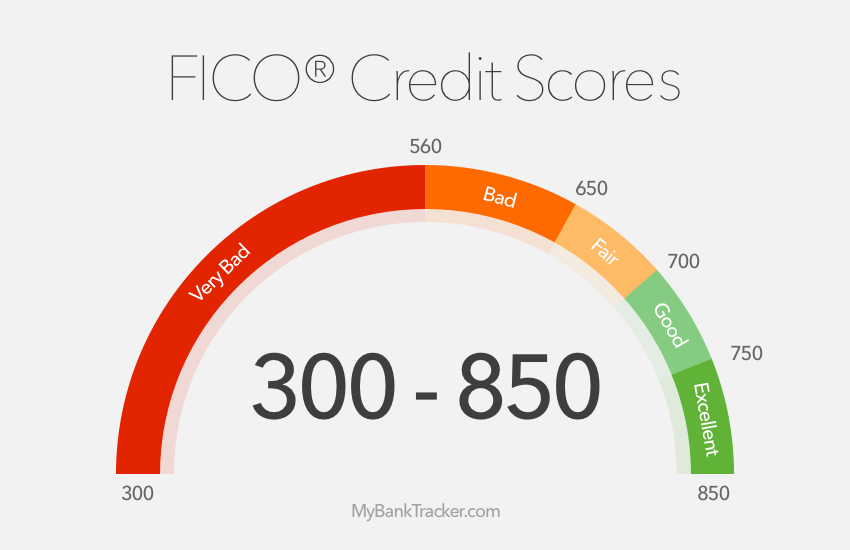

The impact can also depend on the type of credit score (FICO® ScoreΠor VantageScore® credit score)and its scoring rules.

How to Avoid Too Many Hard Inquiries

You can avoid having too many hard inquiries that hurt your credit scores by understanding how credit scores treat hard inquiries and strategically applying for credit.

- Rate shop during a 14-day period. Try to group your applications when youre shopping for a new auto, home or private student loan (federal student loan applications dont lead to hard inquiries). Keeping the applications and resulting hard inquiries in a 14-day period could limit the impact on all your credit scores.

- Get preapproved for personal loans and credit cards. FICO® Scores dont deduplicate hard inquiries for personal loans and cards. However, some lenders and card issuers offer preapprovals, which can tell you if youll likely get approved with a soft credit checkâthe type that doesnt affect your credit scores.

Also, dont overthink the occasional hard inquiry. Building good credit is only helpful if you use it, and you shouldnt be afraid to apply for a new credit card with great benefits or take out an important loan.

Additionally, you can focus on the other, more important scoring factors. For example, paying your bills on time and decreasing your credit utilization ratio by paying down credit card balances could help your credit scores more than sporadic hard inquiries hurt them.

How long Hard Inquiry Stays on YOUR Credit Report (& how long a Hard Pull affects YOUR credit score)

FAQ

How many times can my credit be pulled?

Hard inquiries in your credit report might hurt your credit scores, but there’s no specific rule for how many inquiries are too many. Depending on why the hard inquiries occurred and the type of credit score, some hard inquiries may not affect your score much at all.

How often are you legally allowed to get your credit report?

Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. In addition, the three bureaus have permanently extended a program that lets you check your credit report from each once a week for free at AnnualCreditReport.com.

Will 3 inquiries hurt my credit score?

Although a single hard inquiry might only hurt your credit scores a little, multiple hard inquiries could increase the impact. And an application can lead to a hard inquiry even if the creditor denies your application.Aug 30, 2024

Is 7 hard inquiries bad?