In deciding whether refinancing is right for you, theres more to consider than just mortgage interest rates.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Sure, when interest rates are dropping, mortgage refinance tends to be in the news. But falling interest rates arent the only reason it might be the right time to refinance your mortgage.

Keep reading to learn more about what you should consider before refinancing and different scenarios that might lead you to refinance your mortgage. Then you’ll be better equipped to decide if its a good time for you to refinance.

Refinancing your mortgage can seem like a smart move when interest rates drop but how do you really know if it’s the right decision for your financial situation? Determining if refinancing is worth it requires careful consideration of several key factors. This guide provides a comprehensive overview of what to consider when evaluating if refinancing makes sense for you.

Assess Your Current Mortgage Situation

First, look at your existing mortgage and determine:

- Your current interest rate and monthly payments

- Remaining loan balance

- Loan term and years left

- Type of mortgage (fixed, ARM, etc)

- Any prepayment penalties

Make sure you have all the key details of your current home loan handy before assessing refinance options. This provides a baseline to compare potential savings and costs.

Check Current Interest Rates

Next, research current mortgage refinance rates being offered Interest rates fluctuate frequently, so it’s essential to check up-to-date rate information rather than relying on advertised “rates as low as” which may not apply to your situation.

Many experts consider refinancing worth it if the new rate is around 1% lower than your existing rate. However, even a 0.5% or 0.25% drop could provide savings, depending on your loan amount and terms.

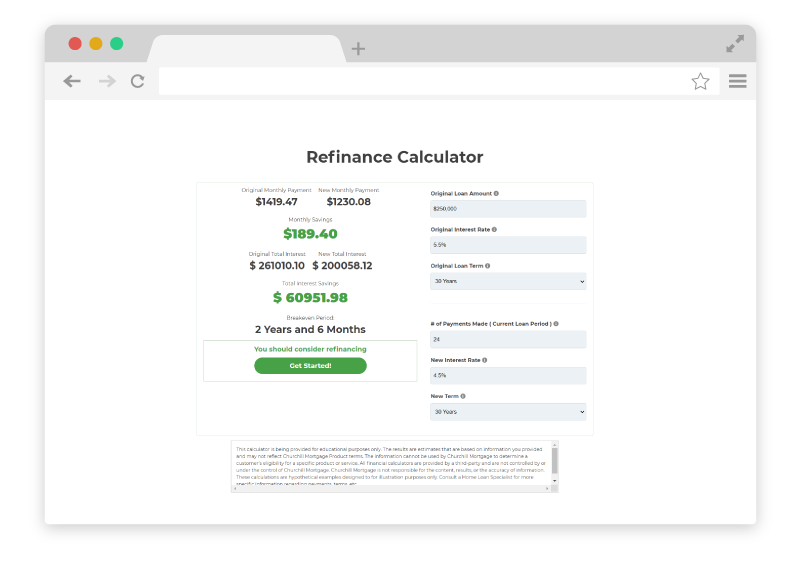

Run the numbers to see potential savings at today’s rates compared to your existing mortgage costs. Online mortgage calculators can help estimate your breakeven point and monthly payment differences.

Factor In Closing Costs

One major factor that can determine if refinancing is worth it is the closing costs you’ll have to pay as part of the transaction. Closing costs typically range from 2% to 5% of your total loan amount.

For a $300,000 mortgage, you may pay $6,000 to $15,000 in various refinancing fees for appraisals, application fees, title insurance, taxes, and more. It’s essential to weigh these upfront costs against your potential long-term savings from reduced interest rates.

Calculate your “breakeven point” by dividing your estimated closing costs by the monthly savings from refinancing to see how long it will take to recoup the upfront expenses.

Assess Your Financial Goals

Take time to consider your financial goals and how refinancing aligns with your overall money situation and plans. For instance:

- Do you want to reduce monthly payments and free up cash?

- Are you focused on paying off your home faster?

- Do you need to tap equity to consolidate other debts?

Refinancing can help achieve different objectives, so make sure your motivations match the type of refinance loans you’re exploring.

Compare Loan Terms Carefully

Critically compare all the costs and terms of any refinanced mortgage you’re considering to your current home loan. Look at:

- Loan amount

- Interest rate

- Monthly payments

- Loan term and type

- Total interest paid over the life of the loan

It’s essential to understand how much you’ll pay overall, not just monthly, to determine if refinancing is your most cost-effective option. Don’t just look at potential lowered monthly payments in isolation.

Know Your Break-Even Horizon

To determine if refinancing is worth it, you need to estimate how long you’ll stay in your home. Refinancing often only pays off if you’ll keep the home long enough to recoup closing costs and realize ongoing savings.

Generally, plan to stay at least 5 years after refinancing to make it worth the upfront costs. If you may move sooner, additional analysis is required to see if lower monthly payments still warrant refinancing.

Seek Professional Guidance

Speaking with a mortgage broker or advisor can provide expert perspective on your financials and goals to help decide if refinancing makes sense for you. Their market insights and mortgage comparison tools can give you confidence in your decision.

Refinancing seems worth it when rates drop but requires thorough financial analysis of your situation and goals. By following this guide and crunching the numbers carefully, you’ll know if the time is right to refinance your home loan.

What to know before you refinance

No matter your reason for refinancing, youre going to want to figure out a few numbers before you apply.

- Your current interest rate. Take a look at your most recent mortgage statement to confirm your mortgage interest rate. Since even small fractions of a percentage point can really add up, its important to know the real number, not just “about 6%.” If rates have decreased, you can figure out how much youd save. But if rates have increased, consider whether the other benefits of refinancing are worth the additional interest.

- An estimated amount for your refinance. Whether youd simply be refinancing the amount left on your mortgage or youre looking to take out a larger loan, keep that sum handy, too. Refinancing comes with closing costs, which usually run between 2% and 6% of the amount of the new loan. Knowing how much youll be borrowing allows you to estimate those costs.

- How long you plan to stay in the house. If your goal is to save money by refinancing, you need to figure out your break-even point. Thats when your savings from refinancing is larger than the amount you spent on closing costs. For example, if you pay $3,600 in closing costs to save $100 a month, it will take 36 months to break even ($3,600 divided by $100 equals 36). To make back that money in savings, youll need to stay in the home for at least three years after your refi.

You could save by changing your home loan’s term

When youre refinancing, in addition to getting a new interest rate, you can also change the term, or length, of your mortgage.

When they can afford it, many people refinance from a 30-year to a 15-year loan. Paying off your loan over a dramatically shorter amount of time usually means significantly higher monthly mortgage payments, but it can also substantially lower the amount of interest paid over the life of the loan.

You can also refinance to a longer term. That can lower your monthly payments, because youre paying over more time. But youre also paying more interest because youve extended the life of the loan.

If you’re already 10 or more years into your loan, refinancing to a new 30-year or even 20-year loan — even if it lowers your rate considerably — will tack on interest costs. That’s because interest payments are front-loaded; the longer you’ve been paying your mortgage, the more of each payment goes toward the principal instead of interest.

You dont have to change the term, though — you can opt to refinance to the same payoff date as your current loan. That strategy can be useful when you want to pay off the mortgage by a certain deadline, like before you retire. For example, if your 30-year mortgage is exactly five years old when you refinance, you can request to pay off the new loan in 25 years. Ask the lender to amortize the mortgage for 25 years (or whatever number of years you wish).

Ask your lender to run the numbers on different scenarios so you can see how your costs might change depending on your loans term.

Refinance 101 – Mortgage Refinance Explained

FAQ

At what point is it worth it to refinance?

For most borrowers, the ideal time to refinance is when market rates have fallen below the rate on their current loan.

How to know if it makes sense to refinance?

Historically, the rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough of an incentive to refinance. Using a mortgage calculator can help you see how much you might save.

What is a good rule of thumb for refinancing?

A good rule of thumb is to refinance when you can reduce your interest rate by at least 2%. For example, a $250,000, 30-year fixed-rate mortgage at 7% interest has a monthly principal and interest payment of $1,663. Refinancing at 5% would reduce your payment to $1,342 – a substantial savings.

What’s the downside to refinancing?

Refinancing allows you to lengthen your loan term if you’re having trouble making your payments. The downsides are that you’ll be paying off your mortgage longer and you’ll pay more in interest over time.