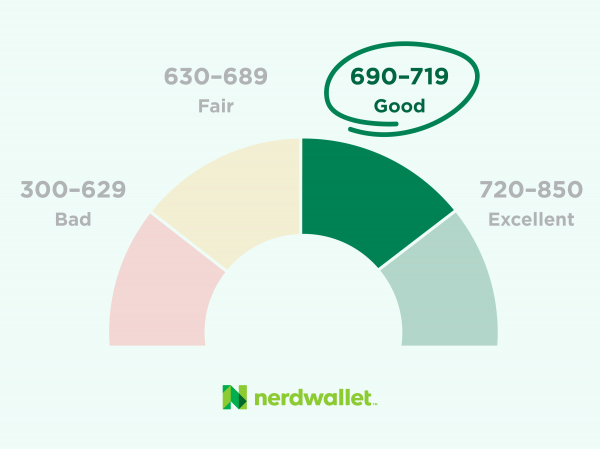

A 710 credit score falls into the “good” band and will qualify you for some credit cards and loans, but may not get you the lowest rates.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Hey there friend! If you’ve just checked your credit score and saw that magic number 710 pop up you’re prolly wonderin’, “Is this good enough? Am I in the clear, or do I gotta hustle harder?” Well, I’m here to break it down for ya, straight-up and no fluff. Spoiler alert Yeah, 710 is a good credit score! It lands smack dab in the “good” range on both FICO and VantageScore scales. But, there’s more to the story than just a pat on the back. Let’s dive into what 710 really means for your wallet, your loans, and how you can push it even higher. Stick with me—we’re gonna get into the nitty-gritty!

What Does a 710 Credit Score Even Mean?

Alright, let’s start with the basics A credit score is like a report card for how well you handle your money—specifically, how you borrow and pay it back It’s a number between 300 and 850, and the higher you are, the better you look to lenders. So, where does 710 fit in this puzzle?

- FICO Score Range: This is the most common scoring model out there. A 710 falls in the “good” category, which is between 670 and 739. You’re above average here, since the typical FICO score in the U.S. hovers around 715.

- VantageScore Range: Another popular model, and guess what? 710 is still “good” here, fitting into the 700-749 bracket. The average VantageScore is about 703, so you’re edging out a lotta folks.

Basically with a 710, you’re sittin’ pretty in the “good” zone. Lenders see you as a solid bet—not perfect but reliable. You’re likely to get approved for stuff like credit cards and loans, though you might not snag the absolute lowest interest rates. Those are reserved for peeps in the “excellent” range, like 750 or 800 and up. Still, 710 ain’t nothin’ to sneeze at!

Why 710 Is a Good Score—And Why It Matters

Now that we know 710 is “good,” let’s chat about why that’s a big deal. Your credit score is like a key that unlocks doors to financial goodies. Here’s the real talk on what 710 gets ya:

- Loan Approvals: Whether it’s a personal loan, car loan, or even a mortgage, a 710 score usually means a thumbs-up from most lenders. Over 60% of auto loans and 40% of first mortgages go to folks with scores under 740, so you’re in the game.

- Credit Cards Galore: Many cards—especially ones with no annual fees or decent rewards—are within reach. You might qualify for cash-back or travel perks, though some fancy 0% intro APR or premium travel cards might want a higher score.

- Decent Terms: You’re not gonna get hit with crazy-high interest rates like someone with a 600 score would. But, compared to someone with a 780, you might pay a bit more. For instance, on a used car loan, you could be lookin’ at around 9% interest while the higher-score crowd pays closer to 6.8%.

The flip side? You’re not in the elite club yet. Those super-low rates and VIP perks often kick in at 740 or higher. Plus, a 710 means you gotta stay sharp—one wrong move, like a late payment, could knock ya down hard, maybe even 100 points! So, it’s good, but it’s worth protectin’ and buildin’ on.

How Does 710 Stack Up Against Others?

I know you’re curious—how does your 710 compare to the rest of us out there? Let’s peek at the numbers and see where you stand in the crowd.

| Credit Score Range | Category | Percentage of Americans |

|---|---|---|

| 720 – 850 | Excellent | 38.12% |

| 660 – 719 | Good | 17.33% |

| 620 – 659 | Fair/Limited | 13.47% |

| 300 – 619 | Bad | 31.08% |

Look at that! With a 710, you’re in the “good” bracket, and you’re ahead of nearly half the country. Only about 38% of folks have a score in the “excellent” range above 720, so you’re doin’ better than a huge chunk of peeps. Plus, since the average FICO is around 715, you’re right there with the typical American, maybe even a tad ahead. Not too shabby, right?

Somethin’ else cool to note—your score can vary by age and income. Folks makin’ over $50,000 a year tend to have scores of 700 or more, and older peeps often score higher ‘cause they’ve had more time to build credit history. But even if you’re younger, like in the 18-24 range, a good chunk still hit 700+, so there’s hope for everyone!

What Can You Get With a 710 Credit Score?

Alright, let’s get practical. What doors does a 710 score actually open for ya? I’ve been there, wonderin’ if my score was gonna cut it for a big purchase, so let’s break down the main areas where it matters most.

Car Loans

Got your eye on a sweet ride? A 710 score should get you approved for a car loan without much hassle. Since over 60% of auto loans go to folks with scores below 740, you’re golden. The catch? Your interest rate might not be the best. You could be payin’ a bit more than someone with a top-tier score, but it’s still doable. Shop around for deals—don’t just take the first offer!

Home Loans (Mortgages)

Dreamin’ of buyin’ a house? Technically, 710 is high enough to qualify for a mortgage. Over 40% of first-time homebuyers have scores under 740, so you’re in the mix. But, in a tight market, some lenders get picky and want higher scores to lower their risk. Plus, you might not get the rock-bottom interest rates. Still, it’s a strong startin’ point—just know you might pay a lil’ extra compared to the 800 club.

Personal Loans

Need some cash for a big expense or to consolidate debt? A 710 score is solid for gettin’ a personal loan. Most lenders see you as a safe bet, and you’re likely above any minimum score requirements (often around 660 or 700). You can probly score competitive rates and avoid nasty fees like origination costs. Again, compare offers to get the best bang for your buck.

Credit Cards

Credit cards are where a 710 score shines. You’ve got a good shot at cards with no annual fees, cash-back rewards, or even travel perks. Some popular options might include cards that give ya cash back on everyday buys or points for trips. However, the super-fancy cards with 0% intro rates for long periods or premium travel benefits might need a score closer to 750. Still, there’s plenty of great choices out there for ya!

The Not-So-Good Side of 710

I ain’t gonna sugarcoat it—while 710 is good, it ain’t perfect. There’s some downsides we gotta talk about so you know the full picture.

- Higher Interest Rates: Compared to someone with an “excellent” score (750+), you’re gonna pay more in interest over time. On a big loan like a mortgage, that could mean thousands of extra bucks. Ouch!

- Limited Elite Options: Some top-tier credit cards or loan products might be outta reach. Lenders save their best stuff for the 780-850 crowd.

- Vulnerability to Drops: A single late payment can slam your score hard—sometimes droppin’ it by 100 points or more. Since you’re on the lower end of “good,” you gotta be extra careful not to slip into the “fair” range below 670.

I’ve seen buddies mess up with one missed bill and regret it big time. A 710 score is somethin’ to be proud of, but it’s also somethin’ to protect like a treasure chest.

How to Keep Your 710 Score—or Make It Better!

Alright, now that we’ve covered what 710 means and what it gets ya, let’s talk action. How do you hold onto this score, or even bump it up to “excellent” territory? I’ve got some tried-and-true tips that’ve helped me and plenty of others. Let’s roll through ‘em.

Pay On Time, Every Dang Time

This is the golden rule, y’all. Payment history makes up a huge chunk of your score—about 35%. Missin’ a payment, even by a day or two past 30 days, can hurt ya bad. Set up reminders on your phone, use auto-pay if you can, or stick a note on your fridge—whatever it takes to never be late. If you’ve slipped up before, don’t sweat it too much. Just focus on payin’ on time from now on to dilute the damage.

Watch How Much Credit You Use

Next biggie is credit utilization—fancy term for how much of your credit limit you’re usin’. It’s about 30% of your score. Keep it under 30% if you can, and under 10% if you wanna be a rockstar. So, if your card limit is $10,000, try not to carry more than $3,000 balance at a time. Pay down balances quick, or make multiple payments a month to keep it low. Trust me, this works wonders!

Don’t Close Old Cards

Thinkin’ of ditchin’ an old credit card? Think twice. Closings cards can shrink your total credit limit, which messes with your utilization rate. Plus, it can lower the average age of your accounts, which is about 15% of your score. If it’s an old card with no fees, just let it sit there. Or, ask the issuer if they’ve got a better card to switch to without losin’ the history.

Space Out New Applications

Every time you apply for new credit, it can ding your score a few points ‘cause of the hard inquiry. Multiple apps in a short time? Even worse. Space ‘em out by at least six months if you can. And if you’re plannin’ a big loan like a mortgage soon, chill on new credit for a while. Those dings fade after a year and drop off your report after two, so it ain’t permanent.

Mix Up Your Credit Types

Having a variety of credit—like a credit card, a car loan, maybe a mortgage—can help your score. It shows lenders you can handle different kinds of debt. About 10% of your score comes from this mix. Don’t go takin’ on debt just for the sake of it, but if it makes sense for your life, a lil’ diversity ain’t bad. I know peeps who boosted their score just by addin’ a small personal loan and payin’ it off steady.

Check Your Report for Goofs

Mistakes happen, y’all. Sometimes your credit report might have wrong info—like a late payment you never made or an account that ain’t yours. Grab your free report from the big three bureaus once a year and scan it. If somethin’s off, dispute it. Fixin’ errors can give your score a quick lift. I’ve had to do this once myself, and it felt like findin’ free money!

What Happens If You Slip Up at 710?

Let’s talk worst-case for a sec. Say you’ve got your 710, feelin’ good, and then—bam—you miss a credit card payment. What’s the damage? Well, if it’s reported as late (after 30 days), it could drop your score by a lotta points, maybe even 100 if your history was clean before. The higher your score, the harder the fall, ‘cause lenders expect better from ya. You might also get hit with late fees or higher interest as a penalty. The good news? Pay within 30 days, and it won’t even hit your report. So, act fast if you mess up!

If it’s already reported, don’t panic. Keep payin’ everything else on time to lessen the impact over time. Focus on the stuff you can control, like keepin’ utilization low. I’ve seen folks bounce back from a slip-up by just stayin’ consistent after.

Pushin’ Past 710—Why Aim Higher?

Sure, 710 is good, but why stop there? Climbin’ to the “very good” range (740-799) or even “exceptional” (800-850) can save ya serious cash. Lower interest rates on loans mean less money outta your pocket over time. On a 30-year mortgage, the difference between a 710 and a 780 score could be tens of thousands in interest! Plus, you’d unlock those elite credit cards with killer rewards or 0% intro deals.

Gettin’ there ain’t impossible. Follow the tips I just laid out—pay on time, keep usage low, build history—and track your score regular-like to see progress. There’s apps and free services out there to help ya keep an eye on it. I’ve been pushin’ my own score up bit by bit, and it feels dang good to see that number creep higher!

Real Talk: My Take on 710

Lemme get personal for a minute. When I first saw a score around 710 on my report, I was like, “Alright, I ain’t doin’ half bad!” But I also knew I wasn’t at the top of the heap. I could get a car loan or a decent card, but I was payin’ more interest than I wanted. So, I buckled down, paid off some balances, and made sure every bill was on time. Slowly but surely, I inched up, and man, it felt like winnin’ a small lottery when I hit that next bracket.

That’s what I want for you. A 710 score is a fantastic place to be—it means you’ve got a handle on your finances better than a lotta folks. But it’s also a nudge to keep goin’. Whether you’re just tryin’ to maintain it or shoot for the stars, know that every lil’ step counts. We’re in this money game together, and I’m rootin’ for ya to crush it!

Wrappin’ It Up—Your Next Move

So, is 710 a good credit score? Heck yeah, it is! It puts you in a strong spot to borrow money, get cards, and build your financial life. You’re above average, and lenders see you as a safe bet for most things. But, it ain’t the peak—there’s room to grow for better rates and perks if you push to 740 or beyond. Protect what you’ve got by payin’ on time and keepin’ credit usage low, and think about how you can climb higher with smart moves.

Got a 710 and wonderin’ what to do next? Check your credit report for any weird stuff, set up auto-payments to avoid late fees, and maybe look for a new card that fits your vibe. Or, drop a comment below if you’ve got a specific goal—like buyin’ a house—and I’ll try to help ya brainstorm. Let’s keep this convo goin’! What’s your credit score story? Spill the beans—I’m all ears!

Personal loans

Provided an applicant meets other qualifications, a 710 is a solid score for getting a personal loan.

Car loans

A 710 credit score should look acceptable at the car lot. If youre financing a used car, though, you might pay 9.06% in interest while your neighbor with a score north of 780 pays 6.82%, according to Experian’s State of the Automotive Finance Market report for the first quarter of 2025Experian Information Solutions . State of the Automotive Finance Market Q1 2025. Accessed Jun 9, 2025.View all sources. You can get better rates as your score climbs.

Is 710 Credit Score Good? – CreditGuide360.com

FAQ

What will a 710 credit score get me?

Quick insights. A 710 credit score is considered “good” by the two main credit scoring models. You may be able to access several financial opportunities with a good credit score, such as more favorable rates for mortgages. There are ways to help improve your credit score, including improving your debt-to-income ratio.

Can I buy a house with a 710 credit score?

How rare is a 720 credit score?

Additionally, because a 720 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669). 39% of consumers have FICO® Scores lower than 720.

How to get 800 credit score?

The most significant factor in your credit score is a strong payment history, and Lending Tree found that 100% of people they surveyed with an 800 credit …May 2, 2025

Is a 710 credit score a good credit score?

Our content is accurate to the best of our knowledge when posted. A 710 credit score is considered a good credit score by many lenders. “Good” score range identified based on 2023 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms.

What is a good credit score?

The base FICO ® Scores range from 300 to 850, and the good credit score range is 670 to 739. FICO creates different types of consumer credit scores. There are “base” FICO ® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

What are the best personal loans for a 710 credit score?

The best personal loans for a 710 credit score are from LightStream, SoFi and Wells Fargo. A score of 710 is in the good credit range, and people with this score should have a decent shot at qualifying for most personal loans on the market.

Can a 710 credit score get a home loan?

You can get better rates as your score climbs. Technically, a 710 credit score is high enough to qualify for a home loan. In the tight real estate market, some lenders choose more restrictive qualifications to further reduce the risk that the loan won’t be repaid.

Can you get a car loan with a 710 credit score?

You should be able to get approved for a decent car loan with a 710 credit score, considering that more than 60% of all auto loans go to people with credit scores below 740. Still, it’s important to compare your auto loan options carefully if you want to get a low APR.

Can a late payment affect a 710 credit score?

A single late payment can do serious damage to a 710 credit score. And the higher the score, the worse the damage tends to be. A high score resulting from a history without late payments could fall about 100 points. If you can pay within 30 days of the due date, it won’t be reported as late.