Hey there, folks! If you’re scratching your head wondering, “Can I use PPP to buy a car?” then you’ve landed in the right spot. I’m gonna lay it out plain and simple for ya Nope, you can’t The Paycheck Protection Program (PPP) wasn’t set up for splurging on a shiny new ride, whether it’s for personal use or even for your biz. But don’t click away just yet—I’m diving deep into why that’s the case, what you can use those funds for, and what happens if you mess up Stick with me, ‘cause we at [Your Company Name] got your back with the real talk.

What’s the Deal with PPP Anyway?

Before we get into the nitty-gritty, let’s break down what PPP is all about. Born outta the chaos of the COVID-19 mess, the Paycheck Protection Program was a lifeline for small businesses struggling to keep the lights on. The government, through the Small Business Administration (SBA), handed out loans to help cover payroll and a few other key costs. The best part? If you used the money the right way, a big chunk—or even all of it—could be forgiven. Sweet deal, right?

But here’s the catch there are strict rules on how you can spend this cash The whole point was to keep employees paid and businesses afloat, not to fund personal wish lists or big-ticket purchases like a car So, if you’re thinking of cruising down the highway in a new whip thanks to PPP, I’m sorry to burst that bubble.

Why Can’t I Use PPP to Buy a Car?

Alright, let’s get to the meat of it. Why exactly is buying a car with PPP funds a no-go? Here’s the breakdown in easy-to-digest bites:

- PPP is for Specific Business Expenses Only: The SBA laid out clear guidelines on what’s allowed. At least 60% of the loan gotta go to payroll costs—think salaries, wages, and benefits for your team. The rest can cover stuff like rent, utilities, and mortgage interest on business property. A car purchase? Not on the list, fam.

- Personal Use is a Big Fat No: Even if you’re a sole proprietor, PPP ain’t your personal piggy bank. Buying a car for yourself, even if you claim it’s “kinda” for business, doesn’t cut it. The rules are crystal clear—personal expenses are off-limits.

- Asset Purchases Ain’t Covered: Cars are assets, and PPP wasn’t designed to help you buy stuff like that. You mighta noticed that interest on an auto loan for a vehicle used strictly for business (like making deliveries) might qualify for forgiveness, but that’s just the interest on an existing loan—not the purchase itself.

- New Expenses Are Shady Territory: PPP is meant to help with ongoing costs, not new splurges. If you didn’t have a car loan or need before getting the loan, trying to buy one now with PPP funds is asking for trouble.

So, whether you’re dreaming of a sleek sedan for personal use or a work truck for your business, PPP ain’t the way to fund it. The program’s got a narrow focus, and vehicles just don’t fit the bill.

What Can You Use PPP Funds For?

Now that we’ve crushed the car-buying dream let’s talk about what you can do with that PPP money. Here’s a handy list of eligible expenses that won’t get you in hot water

- Payroll Costs: This is the biggie. At least 60% of your loan should go to paying your employees’ wages, salaries, tips, and benefits. If you’re self-employed, you can pay yourself through what’s called “owner compensation replacement,” but there’s limits on that too.

- Rent: Got a business space? You can use PPP to cover the rent payments during the covered period (usually 8 to 24 weeks after getting the loan).

- Utilities: Think electricity, gas, water, phone, and internet for your business. These gotta be services you had before mid-February 2020 to qualify.

- Mortgage Interest: If you’ve got a mortgage on a property used for biz, the interest payments (not the principal) can be covered.

- Operational Stuff: Things like software for accounting, HR, or payroll tracking are fair game. Same goes for cloud computing services that keep your business running.

- Property Damage Costs: If your biz got hit by vandalism or looting in 2020 and insurance didn’t cover it, PPP can help with those repairs.

- Supplier Costs: Payments to suppliers for essential goods under pre-existing contracts are okay.

- Worker Protection Expenses: Costs for safety measures like PPE or social distancing setups to comply with COVID-19 rules are covered too.

See a pattern? It’s all about keeping your business going and your people safe and paid. No room for a new set of wheels in there.

What If I Use PPP Funds for a Car Anyway?

I get it—sometimes temptation’s a real beast. But lemme warn ya, using PPP funds for something like buying a car is a risky move, and the consequences ain’t pretty. Here’s what could happen if you ignore the rules:

- You’ll Have to Pay It Back: If you use the money for something not on the approved list, that portion of the loan won’t be forgiven. You’re on the hook to repay it to the SBA, with interest.

- Penalties and Fines: Misusing funds can slap you with hefty fines. We’re talking thousands of bucks, depending on how much you misused.

- Criminal Charges: If the SBA or feds think you knowingly misused the funds—like lying about what you spent it on—you could face fraud charges. Penalties for stuff like wire fraud or bank fraud can mean jail time, up to 20 or even 30 years in some cases. Ain’t worth it, right?

- Reputation Damage: Even if you dodge legal trouble, word gets around. Getting caught misusing federal aid can tank your business rep and make future loans or partnerships a nightmare.

Real talk: don’t play fast and loose with PPP. It’s serious business, and the feds don’t mess around when it comes to tracking how this money gets spent.

But What If I Need a Car for My Business?

I hear ya—if your business legit needs a vehicle, like for deliveries or client visits, it feels like a bummer that PPP can’t help. So, is there a workaround? Kinda, but not with PPP directly. Here’s a couple thoughts:

- Auto Loan Interest Might Qualify: If you already own a car used for business purposes—like a delivery van—and you’re paying interest on the loan, that interest could be an eligible expense for PPP forgiveness. But again, this ain’t about buying a new one; it’s just covering existing costs.

- Look for Other Funding: If you need a car for your biz, consider other options like a traditional business loan, personal savings, or even leasing instead of buying. There’s other SBA programs or local grants that might help with asset purchases—PPP just ain’t the one.

- Talk to a Pro: Before you spend a dime of PPP, chat with an accountant or financial advisor. They can help you figure out if any part of a vehicle expense (like that interest I mentioned) fits the rules, or point you to better funding sources.

Bottom line, don’t force PPP into something it wasn’t meant for. You’ll save yourself a world of hurt by playing it straight.

A Quick Note for Auto Dealership Owners

If you’re in the auto dealership game and wondering how PPP ties into buying or selling a dealership, there’s some extra stuff to know. PPP loans come with strings attached if you’re transferring ownership or selling big chunks of your business. You might need to notify your lender or even get SBA approval before closing a deal, and often, funds gotta sit in escrow until forgiveness is sorted. It’s a whole other can of worms, but if that’s your situation, make sure you dot every “i” and cross every “t” to avoid defaulting on the loan.

How Do I Make Sure I’m Using PPP Right?

Now that we’ve covered the “no car” rule, let’s talk about staying on the straight and narrow with your PPP funds. Here’s a lil’ checklist to keep you outta trouble:

- Track Every Penny: Keep detailed records of how you spend every dollar of that PPP loan. Receipts, invoices, payroll reports—save it all.

- Stick to the 60/40 Rule: Remember, at least 60% for payroll, and no more than 40% on other stuff like rent or utilities. Mess this up, and forgiveness might slip through your fingers.

- Double-Check Eligibility: If you’re unsure if an expense qualifies, don’t guess. Look up the latest SBA guidelines or ask a pro.

- Apply for Forgiveness ASAP: Once you’ve spent the funds during the covered period (8 or 24 weeks, depending on your loan), get that forgiveness app in. The sooner you’re cleared, the less stress you got.

- Don’t Mix Funds: Keep PPP money separate from personal or other business accounts. Mixing it up makes tracking a nightmare and could look shady to auditors.

We at [Your Company Name] know running a biz is tough enough without tripping over red tape. Follow these steps, and you’ll be golden.

What If I’ve Already Spent PPP on a Car?

Uh-oh. If you’ve already dropped PPP cash on a car, don’t panic just yet—but you gotta act fast. First, fess up to yourself that it wasn’t an allowed expense. Then, get in touch with your lender or an accountant to figure out how much you owe back. You’ll likely need to repay that amount, plus interest, since it won’t be forgiven. If you’re upfront about the mistake, you might dodge worse penalties, but don’t wait for the SBA to come knocking. Be proactive, ‘cause hiding it only makes things uglier.

Why Was PPP So Strict Anyway?

You might be wondering why PPP got such tight rules. Well, think about it—the program was rolled out during a crazy time to help millions of businesses. The government wanted to make sure the money went to keeping folks employed, not funding random purchases. With limited funds to go around, they had to draw hard lines to prioritize payroll over, say, a new car or fancy office furniture. Plus, with so much cash flowing, they needed to crack down on fraud to protect taxpayers. Makes sense, even if it feels like a pain sometimes.

Alternatives to PPP for Buying a Car

Since PPP ain’t gonna help with that car, let’s brainstorm other ways to get behind the wheel without breaking the bank—or the law. Check these out:

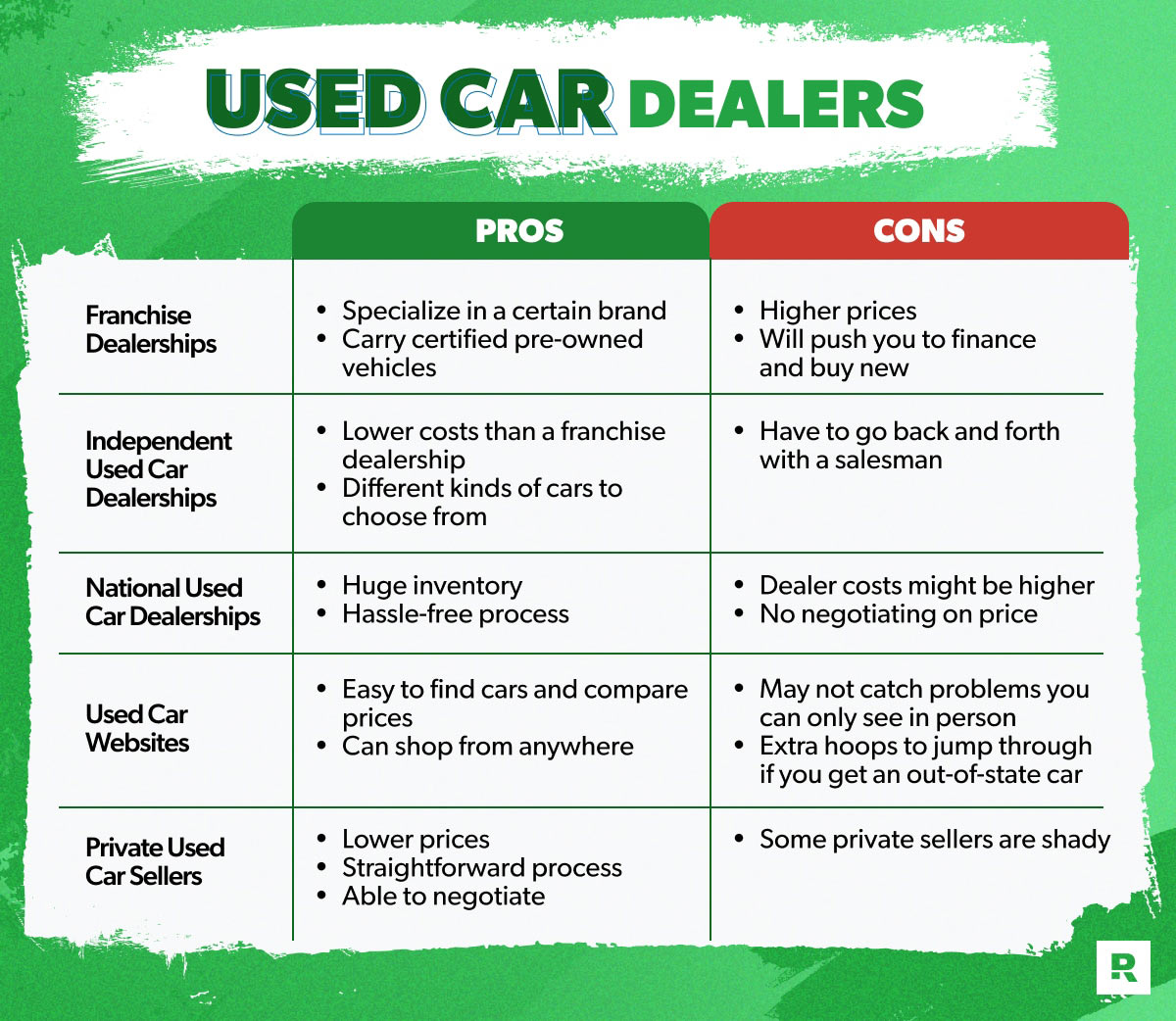

| Option | Pros | Cons |

|---|---|---|

| Traditional Auto Loan | Easy to apply for, fixed rates. | Interest adds up, need good credit. |

| Business Loan | Can cover biz-related vehicles. | Harder to qualify, more paperwork. |

| Leasing a Vehicle | Lower upfront cost, flexible terms. | No ownership, mileage limits. |

| Personal Savings | No debt, no interest. | Drains your cash reserves. |

| SBA 7(a) Loan | Good for biz assets, decent terms. | Long approval, strict requirements. |

I’ve used a mix of these myself back in the day when I needed a work van for a side hustle. Leasing worked best for me ‘cause I didn’t wanna commit long-term, but your mileage may vary (pun intended). Do some digging and see what fits your situation.

Wrapping It Up: Play It Safe with PPP

So, can you use PPP to buy a car? Nah, not a chance. The Paycheck Protection Program was built to keep businesses breathing through payroll, rent, utilities, and a few other essentials—not to fund a new set of wheels. Trying to bend the rules could land you in a heap of trouble, from repaying the loan to facing fines or worse. Stick to the approved expenses, keep good records, and if you really need a car, look for other funding like a biz loan or personal savings.

We at [Your Company Name] are all about helping you navigate this kinda stuff with no fluff, just facts. Got more questions about PPP or other business funding? Drop a comment or hit us up—I’m happy to chat and steer ya in the right direction. And hey, if this post helped ya out, share it with a fellow biz owner who might be wondering the same thing. Let’s keep the hustle strong, y’all!

Get assistance for declared disasters

Get information about the SBA loan program that helped businesses keep their workforce employed during the COVID-19 crisis.

Feds: Mustafa Qadiri Of Irvine Used $5 Million In Fraudulent PPP Loans To Buy Ferrari, Bentley, And

FAQ

What can you use PPP money for?

Small Business Paycheck Protection Program

Funds can also be used to pay interest on mortgages, rent, and utilities. The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses.

Can I use an SBA loan to buy a car?

Unfortunately, the SBA 504 loan cannot be used to purchase vehicles, unless those vehicles qualify as heavy equipment vital for the business to pursue its …

Are PPP loans still being investigated?