You can no longer apply for a Help to Buy: Equity Loan for properties in England.

Find out about other ways to get financial help from the government to buy a home.

The Help to Buy equity loan scheme has been a popular way for first-time buyers to get on the property ladder since its introduction by the UK government in 2013. With Help to Buy, the government lends you up to 20% of the cost of a newly built home, so you only need a 5% deposit and a 75% mortgage to make up the rest.

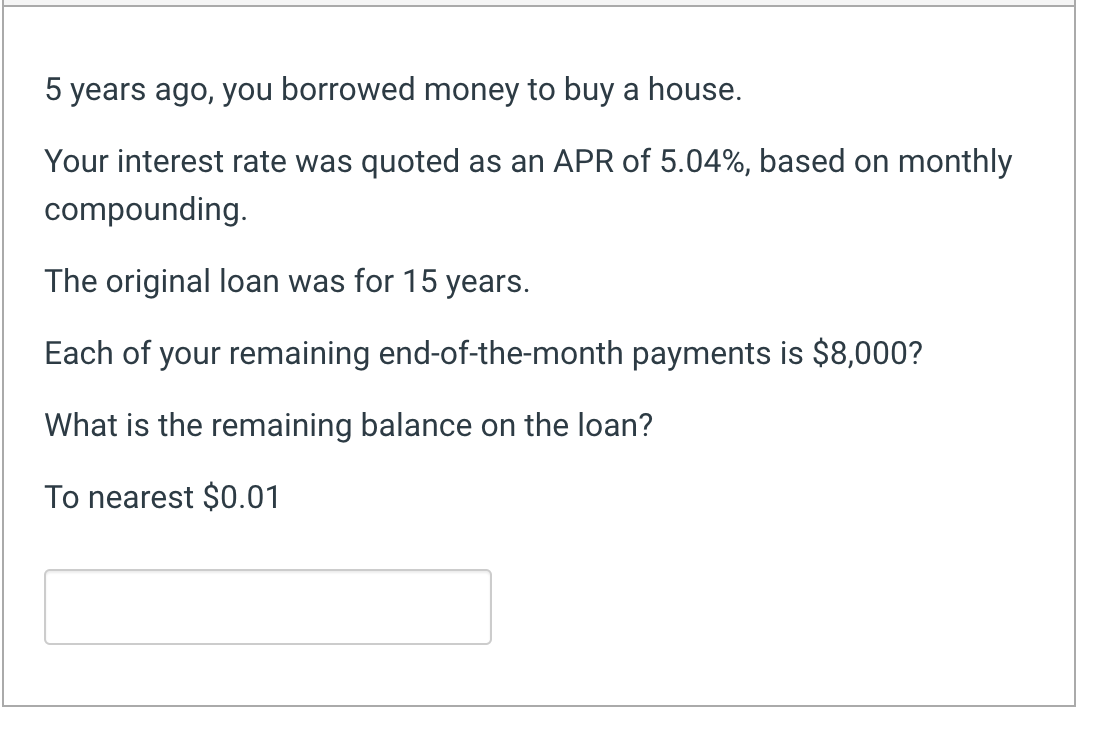

But what happens when you’ve had your Help to Buy equity loan for 5 years? This article will explain everything you need to know

The 5 Year Interest-Free Period Ends

The key thing that happens after 5 years of Help to Buy is that the interest-free period on your equity loan ends. For the first 5 years, you pay no interest at all on the amount the government loaned you. You just pay a £1 monthly management fee.

But from year 6 onwards you start paying interest on the equity loan. This means your monthly costs will go up as you now have interest to pay in addition to your usual mortgage payments.

Interest Rates Kick In

In year 6, the interest rate on your Help to Buy equity loan will be 1.75%. This interest is charged annually on the amount you originally borrowed.

So if your home cost £200,000 and you borrowed a 20% equity loan of £40,000, in year 6 you’ll pay interest of 1.75% of £40,000. That works out at £700 for the year or £58 per month.

The interest rate then increases every year in April, going up by the Retail Price Index (RPI) measure of inflation plus 1%. So your interest costs will gradually creep up each year.

You Start Making Monthly Interest Payments

Because the interest is charged annually, you pay it in 12 monthly instalments. So from year 6 onwards, you’ll have to budget for these new monthly interest payments on your Help to Buy loan in addition to your usual mortgage costs.

For example, if your interest for the year was £700, your monthly payments would be £700/12 = £58. This extra monthly payment continues until you pay off the equity loan.

Your Costs Will Rise Each Year

The creeping annual interest rate rises mean your Help to Buy costs will go up every year. For instance, if inflation was 2%, your interest rate would increase by 3% (2% + 1%) each year.

So your monthly payments would rise annually too. To keep up, you’d need to ensure your household budget can absorb these increasing costs.

You Should Aim to Repay Within 10 Years

The Help to Buy equity loan is intended to be a start-up loan to get you on the ladder. The government expects you to repay the loan within 10 years if possible.

After year 10, the compounding interest rates can really accelerate, so it becomes much harder to repay the loan. Leaving it longer also increases your overall interest costs. Repaying earlier is advisable if you can.

Repayment Options

Once the 5 year interest-free period ends, you have several options:

-

Remortgage – If you’ve built up enough equity in your home, you may be able to remortgage and pay off your Help to Buy loan.

-

Staircasing – Making part repayments of 10% or more of your home’s value to reduce your equity loan.

-

Sell your home – Repaying the equity loan when you sell the property.

-

Save up – Building up your savings so you can repay the loan in future.

Requirements if Selling Your Home

If you choose to repay your Help to Buy equity loan by selling your property, there are certain steps you’ll need to follow:

-

Obtain an RICS valuation to determine the amount owed. This depends on what percentage equity loan you originally took out.

-

Inform the administrator (currently Homes England) of your intention to sell.

-

Get their authority before proceeding with the sale.

-

Repay the equity loan percentage owed when the sale completes.

Specialist Help is Recommended

It’s advisable to get help from a mortgage broker or solicitor who specialises in Help to Buy. They can guide you through the process of remortgaging, staircasing or selling your home to repay the equity loan after 5 years.

The Help to Buy scheme has helped thousands realise their dreams of homeownership. By understanding what happens after 5 years, you can plan ahead and continue your property journey. The key is knowing your options and getting specialist support.

Paying back part of your equity loan

The smallest repayment you can make is 10% of the market value of your home.

Paying back part of your equity loan will reduce the monthly interest payments you’ll need to pay from the sixth year of taking out the equity loan.

| Market value of your home | Equity loan percentage | Amount |

|---|---|---|

| Bought for £200,000 | Borrowed 20% | £40,000 |

| Value at time of repayment £220,000 | Paying back 10% | £22,000 |

Your remaining equity loan is 10% of the market value of your home.

From the sixth year, you’ll be charged interest monthly at a rate of 1.75% on 10% of the original property purchase price. The interest rate will increase every year in April, by adding the Consumer Price Index (CPI) plus 2%.

Manage your Help to Buy loan

Read guidance on how to:

Contact the Help to Buy customer service team for help managing your equity loan.

Help to Buy customer services PO Box 5262 Lancing BN99 9HE

You can also read the Help to Buy: Equity Loan homebuyers’ guide.

Why I’m not repaying my help to buy equity loan! | what happens at the end of help to buy loan term?

FAQ

What happens after 5 years of fixed rate mortgage?

5 year fixed rate mortgage

This means you won’t switch to the lender’s standard variable rate (SVR) until the end of the 5 year period. With a 5 year mortgage, you keep the same interest rate for that 5 year period. After that time, you can remortgage without paying an early repayment charge (ERC).

What is the maximum house price for help to buy?

You can buy a home up to £450,000 anywhere in the UK. – The Help to Buy ISA can be used for a property costing up to £250,000, or £450,000 in London.