Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your payment history, the amount of debt you have and the length of your credit history are some of the factors that make up your credit scores.

There are many different credit scoring models, or ways of calculating credit scores. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

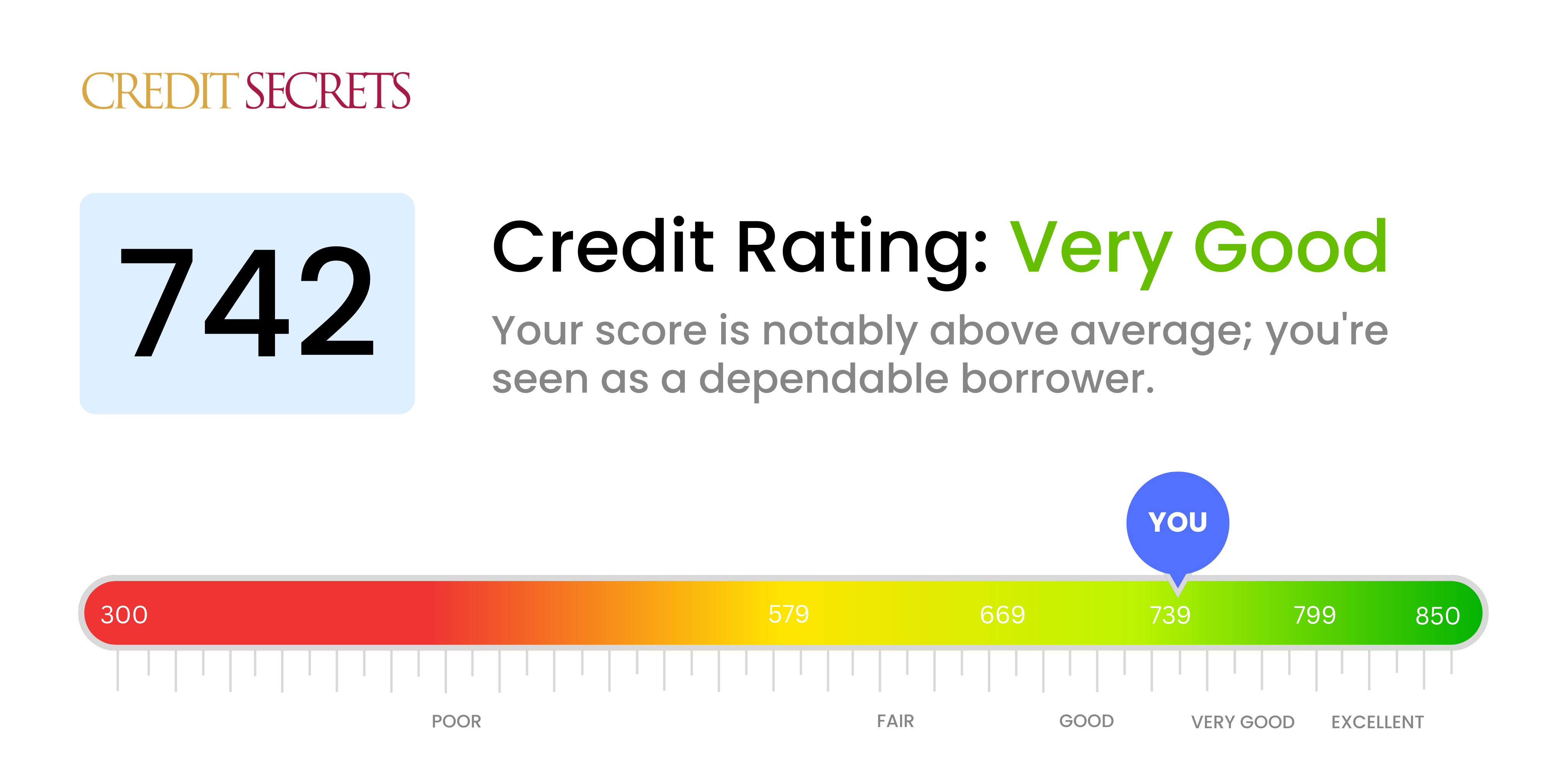

A credit score of 742 is considered good and even very good by many lenders. But is it good enough? The answer depends on your financial goals and credit needs.

What Credit Scores Mean

Credit scores provide a snapshot of your creditworthiness They are calculated based on information in your credit reports, which list your borrowing and payment history. Scores range from 300 to 850

Higher scores signal lower credit risk. This allows you to qualify for better loan terms Lenders view borrowers with scores above 700 as good credit risks. Those with scores of 750 or higher are seen as excellent

The most widely used credit scoring model is the FICO Score. FICO Scores have several versions, with the FICO Score 8 being most common.

VantageScore is another scoring model. It also uses a scale of 300 to 850. VantageScores and FICO Scores may differ, but both consider the same types of credit information to assess your creditworthiness.

Key Facts About a 742 Credit Score

-

A 742 FICO Score is in the “very good” range of 740-799.

-

It is above the average FICO Score of 714.

-

A 742 VantageScore would also be classified as “very good” on its scale.

-

About 25% of consumers have FICO Scores in the very good range.

-

People with scores of 742 have a low 1% risk of becoming seriously delinquent on credit obligations.

So in the context of credit scores, a 742 is definitively good. It demonstrates responsible credit management. If your score is 742, lenders will likely view you as a trustworthy borrower who deserves competitive rates.

Is 742 Good Enough for Approval?

While a score of 742 is good, it doesn’t guarantee approval. Lending decisions depend on your entire credit profile, your income, and the lender’s policies.

Here are general credit score guidelines for major types of credit:

-

Mortgages – Scores of 740 or higher have the best approval odds for conventional mortgages. 620 is often the minimum for approval.

-

Credit cards – 700 is usually recommended for good approval odds for mainstream cards. But scores around 740 typically qualify you for the best rewards card offers.

-

Auto loans – 700 is considered good. Interest rates are lowest for borrowers with scores in the 740-850 range.

-

Personal loans – The minimum score for approval varies by lender. But you can likely find offers with a 742 FICO or VantageScore.

So while a 742 credit score isn’t a guarantee, it indicates positive approval odds for many types of credit. Lenders make exceptions, though. And they may require other qualifications too, like a certain income level.

Does a 742 Credit Score Qualify for the Lowest Rates?

In most cases, a score of 742 will qualify you for competitive interest rates from lenders. However, you usually need higher scores for the very lowest rates.

Here are the credit score ranges that generally offer the best rates:

-

Mortgages – 760+ for conventional loans, 700+ for FHA, VA, and USDA loans

-

Auto loans – 740+

-

Personal loans – 670+ from online lenders, 700+ from banks and credit unions

-

Credit cards – 760+ for lowest APRs on new card offers

So while a 742 credit score will qualify you for below-average interest on new credit, it’s shy of the range for the rock-bottom rates. Boosting your score higher — into the 760s or 770s — can help you lock in the most favorable lending terms.

Is a Credit Score of 742 Good Enough for Rewards Cards?

A 742 credit score meets the approval threshold for most rewards credit cards, including popular options from issuers like Chase and American Express. But the market’s most exclusive cards will likely remain out of reach without higher scores.

For example, the average approved score for the Chase Sapphire Reserve is 785. To qualify for the highest-level Amex Platinum card perks, you typically need a score around 790.

Citi’s Prestige card looks for scores in the high 700s. Capital One requires scores of at least 750 for its Venture and Savor cards.

The good news is that with less elite rewards cards, you can still earn lucrative signup bonuses, points on purchases, and benefits like airport lounge access. Consider cards like the Wells Fargo Propel and Bank of America Cash Rewards for starters.

How to Raise Your Credit Score from 742

While a 742 credit score is admirable, boosting it higher can help you land even better loan terms and elite credit card offers. Try these tips to give your score a lift:

-

Lower credit utilization – Keep balances low on revolving accounts like credit cards. below 30% of your limit is ideal.

-

Pay bills early – Set payment reminders to avoid late payments. Paying before the due date can also help.

-

Limit hard inquiries – Apply conservatively for new credit to limit score-lowering hard inquiries. Shop for a mortgage or auto loan within a focused time period as the credit bureaus count these as a single inquiry.

-

Don’t close old accounts – Keep your longest-open credit accounts open to preserve the depth of your credit history.

-

Review reports closely – Dispute any errors with the credit bureaus to keep your reports accurate.

The Takeaway

A FICO or VantageScore of 742 is in the “very good” range and signals to lenders that you are a low-risk borrower. Credit approval is likely with this score, though not guaranteed. Interest rates will be below average but not the absolute lowest.

With excellent financial habits, you can improve your 742 score over time and access the most competitive lending opportunities. Monitoring your credit reports and scores is key to managing what impacts your rating.

So while a 742 credit score is good, it still offers room for improvement. With some work, you can level up your credit and reap the rewards.

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

Is 742 A Good Credit Score? – CreditGuide360.com

FAQ

How rare is a 742 credit score?

| Credit Score | Tier | Percentage of Americans |

|---|---|---|

| 720 – 850 | Excellent | 38.12% |

| 660 – 719 | Good | 17.33% |

| 620 – 659 | Fair/Limited | 13.47% |

| 300 – 619 | Bad | 31.08% |

Can I buy a house with a 742 credit score?

What is a respectable credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

How rare is a 750 credit score?

A credit score of 750 is considered “very good” and is above the average credit score in the United States. While it’s not as rare as an exceptional score of 800 or higher, it still places you in a relatively strong position with lenders.