Understanding the escrow process is important when refinancing your home. Since real-estate transactions include long, multifaceted steps, escrow agents are in place to help refinancers and lenders track and disburse money according to the agreements made.

However, many are unsure of the specifics of the escrow process when refinancing a home. In this article, we explain what an escrow agent does during a home refinance and what it means for your money.

Refinancing a mortgage can be a great way to lower your interest rate, reduce your monthly payments, or tap into your home equity. But one question that often comes up is whether you need to pay into an escrow account when you refinance. The short answer is – it depends. Here’s what you need to know about escrow and refinancing.

What is an Escrow Account?

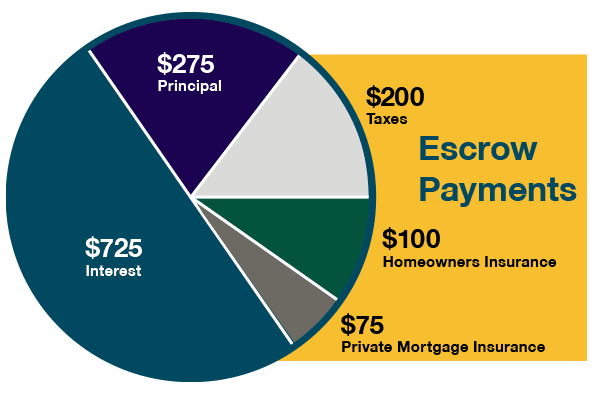

An escrow account is an account held by a third party, like your mortgage lender, to pay certain homeownership expenses on your behalf With an escrow account, your monthly mortgage payment will include an extra amount above your principal and interest This escrow payment covers things like

- Property taxes

- Homeowners insurance

- Mortgage insurance (if applicable)

The lender collects your escrow payment each month and holds it in a special account. When taxes or insurance bills come due, the lender pays them from the escrow funds. This ensures these bills are paid on time.

Escrow accounts make homeownership easier by handling these payments for you But they also mean your monthly payment is higher because you’re paying extra into escrow,

Is Escrow Required for a Refinance?

When refinancing your mortgage, your lender may require you to have an escrow account set up. However, escrow is not always mandatory. Here are some key factors that determine if you’ll need an escrow account when refinancing:

Your Current Loan-to-Value Ratio

The main factor is your loan-to-value (LTV) ratio after refinancing. This compares how much you owe on the mortgage to how much your home is worth.

If your LTV will be 80% or higher after refinancing, the lender is likely to require an escrow account. A higher LTV means less equity in your home, which equals higher risk for the lender. Requiring escrow helps lower their risk.

But if your post-refinance LTV is under 80%, your lender may not mandate escrow. More home equity provides you more financial breathing room, reducing the lender’s risk.

Your Current Escrow Status

Your current escrow setup will also play a role. If you had an escrow account with your existing mortgage, chances are your new lender will want to continue that. Maintaining escrow provides continuity for things like taxes and insurance.

However, if your current mortgage does not have an escrow account, you may be able to refinance without starting one. Your lender will be more open to this if you have a long history of directly paying your bills on time.

Your Credit Profile

In general, the stronger your credit score and financial profile, the better your case for refinancing without mandatory escrow. If you have excellent credit, steady income, and low debt, the lender has less cause for concern.

Borrowers with weaker credit or income may have a harder time qualifying for a refi without escrow, even at lower LTVs. The lender views escrow as an extra safeguard.

Loan Product Type

Certain types of refinance loans are more likely to require escrow accounts as well. FHA and VA refinance loans almost always mandate escrow, thanks to rules set by these government agencies.

Conventional refis are more flexible, though lenders will still mainly base escrow on your LTV ratio. Jumbo refinance loans may offer even more leeway to waive escrow.

Should I Choose to Pay Escrow When Refinancing?

If your lender gives you a choice, you’ll need to weigh the pros and cons of paying escrow or not. Here are some things to consider:

Pros of Paying Escrow When Refinancing

- Convenience of automatic bill pay

- Avoid penalties for late payments

- May help you qualify if you have limited reserves

- Needed to refinance with certain loan types

Cons of Paying Escrow When Refinancing

- Higher monthly mortgage payment

- Loss of control over payments

- Difficult to remove escrow later

Analyze your specific situation to decide what makes sense. If you’re very disciplined about paying bills yourself, hate fluctuating payments, and want full control, avoiding escrow may be better. But if you want the simplicity of automatic payments, escrow could be the way to go.

The Escrow Process When Refinancing

Now let’s walk through what actually happens with your escrow account when you refinance your mortgage. There are a few key steps:

1. Close Your Current Escrow Account

When your refinance closes, your existing escrow account with the old lender must be closed. Any surplus funds you may have in that account are returned to you, typically via check within 30-45 days.

You cannot transfer old escrow funds to the new mortgage and lender. The old escrow account gets closed out.

2. Open a New Escrow Account

If your refinance requires an escrow account, you’ll open a new one with the new lender. This account starts fresh – your old escrow balance does not carry over.

The lender will calculate the required escrow reserves you must have at closing. This ensures enough funds to make your next tax and insurance payments.

Reserves are based on factors like the time of year, when payments are due, and the cushion required by your lender.

3. Fund Your New Escrow Account

At your refinance closing, you’ll deposit money into the new escrow account to establish the reserves per the lender’s calculations. This funding often comes from the loan proceeds.

If loan proceeds don’t cover the full reserve amount, you may need to pay some from your own pocket. Discuss required escrow funding with your lender upfront.

4. Escrow Payments Begin

Once the refinance funds and your new escrow account is established, you’ll start making monthly escrow payments with your new mortgage payment. This replenishes the escrow reserves so your bills can be paid in the future.

Key Takeaways About Escrow When Refinancing

Refinancing into a lower rate can save you a lot over the loan term. Here are some key facts to remember about escrow accounts in a refinance:

- Escrow may be required based on your loan-to-value ratio

- You must close your old escrow account and open a new one

- Existing escrow funds don’t carry over to the new account

- You may have to fund reserves for the new escrow account

- Discuss escrow needs with lenders when shopping for rates

Knowing the escrow implications before refinancing helps prevent surprises. Be sure to ask lenders what their escrow policies are. Shopping around also gives you a better chance to avoid mandatory escrow, if desired. With the right information upfront, you can ensure your refi achieves your financial goals.

When do I use Escrow for a Home Refinance?

In a refinance, a homeowner replaces his or her current mortgage with a new mortgage. The new mortgage often comes with more favorable terms to the borrower than those of the current mortgage.

When the new mortgage has been finalized with a new lender, that lender will then make use of the escrow process to disburse money to the old lender to cover the old mortgage.

However, many want to know what the exact steps are in an escrow process during refinancing. When do you stop paying interest on your old loan and when do you start paying interest on your new loan in a home refinancing process?

Refinancing Escrow Process, Explained:

When closing a home refinance, there are steps an escrow agent needs to take to complete the refinancing process. After you have signed the final documents on your refinance and received all the disclosures and notices, you will have a 3 day rescission period to reconsider the home refinance and cancel the new mortgage. If you continue with the refinance, here are the steps to the escrow process:

Step 1: Your escrow agent will request funding from your new lender.

Step 2: The new lender will wire the money to the escrow account.

*You will start paying interest on your new loan the day your new lender wires the money to your escrow account. You will also still be paying interest on your old loan until the old loan is paid off.

Step 3: The escrow agent will then work with the title company to pay the lender on your old mortgage by wire transfer. Once money is received, you will stop paying interest on the old loan.

* If your old lender does not accept wire transfers, the title agent will overnight a check. You will have to pay interest on old loan until old lender receives check.

Step 4: The escrow agent will record the new mortgage with the county recorder’s office and your new mortgage is now official!

What happens to your escrow balance when you refinance?

FAQ

What happens to my escrow when I refinance?

Once mortgage payoff funds are posted, money held in escrow with your current lender will be returned to you from that lender.

Who pays closing costs when refinancing?

You pay closing costs and fees when you close on a refinance – just like when you signed on your original loan. You might see appraisal fees, attorney fees and title insurance fees all rolled up into closing costs. Generally, you’ll pay about 2% – 6% of your refinance loan’s value in closing costs.

Can I refinance without escrow?

Yes. You typically can’t waive just one. Waiving escrow means you’re responsible for both property taxes and insurance payments.May 22, 2025

Do you get the escrow money back?