What Interest Rate Can I Get with a 790 Credit Score?

Having a credit score of 790 puts you in an excellent position when it comes to getting approved for loans and credit cards. But what does this high score actually mean in terms of the interest rates you can qualify for? In this comprehensive guide, we’ll break down the benefits of a 790 credit score across different financial products.

Understanding Credit Scores

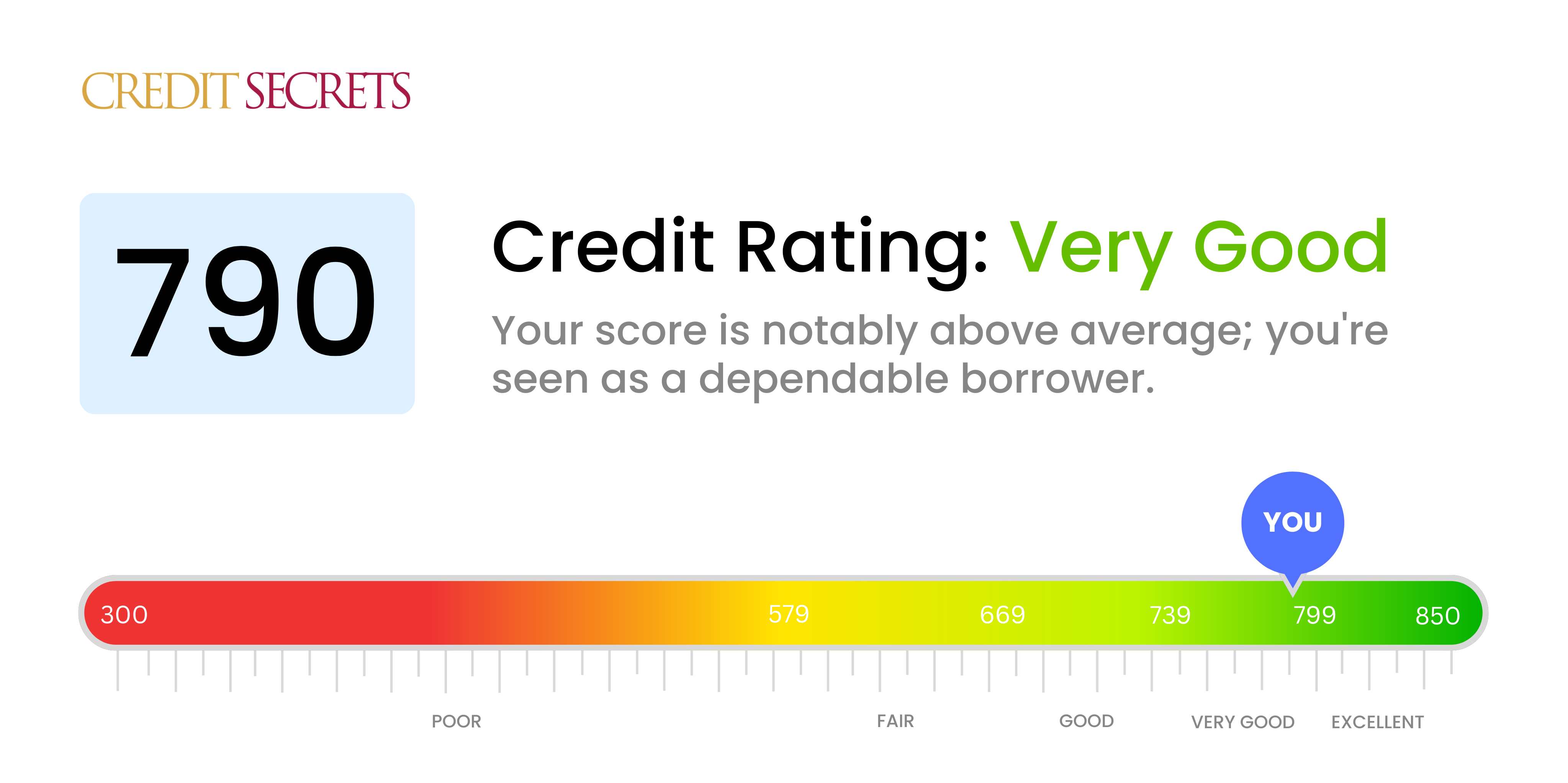

Before diving into interest rates, it’s helpful to understand what credit scores are and how they work. Your credit score is a three-digit number ranging from 300 to 850 that indicates your creditworthiness to lenders. It’s calculated based on the information in your credit report, including your payment history amounts owed length of credit history, new credit, and credit mix.

The most commonly used credit scoring model is the FICO score, with versions like FICO 8, FICO 9, and industry-specific FICO Auto and FICO Bankcard scores. VantageScore is another popular model. Scores above 700 are generally considered good, and a 790 FICO or VantageScore is in the excellent range.

The higher your credit score the lower risk you pose to lenders. As a result, you can qualify for better loan terms like lower interest rates. Now let’s look at how a 790 credit score can benefit you.

Mortgage Rates

Your credit score is one of the top factors mortgage lenders consider when determining your interest rate and eligibility. According to myFICO, someone with a 760+ credit score could expect an average rate of 6.678% on a 30-year fixed-rate conventional mortgage as of March 2024.

With a score of 790, you should have no problem qualifying for rates at or below this excellent range. Depending on other factors like your debt-to-income ratio, down payment amount, and the lender, you may even secure a rate that’s lower than the average. This can equal major savings over the life of your mortgage loan.

For example, on a $300,000 30-year mortgage, a 790 credit score could mean paying $1,897 per month at a 6.678% interest rate. But if you qualify for just a slightly lower rate of 6.528%, your monthly payment would be $1,862, saving you $35 per month or $12,558 over the full 30-year term.

Auto Loan Rates

Your credit score affects auto loan rates similarly to mortgages. According to Experian, as of November 2022, borrowers with FICO scores of 720 or above averaged 5.59% APR on 60-month new car loans. With your score of 790, you should have no problem securing close to this excellent rate.

The savings versus someone with a lower score are significant. For example, a borrower with a score between 660 and 689 would pay an average 9.16% APR. On a $30,000 5-year car loan, that higher rate costs over $135 more per month and $8,082 more in interest compared to the 5.59% excellent rate.

Credit Card Interest Rates and Rewards

A 790 credit score also opens up access to the top rewards credit cards and lowest interest rates. Issuers compete heavily for borrowers with excellent credit, offering lucrative sign-up bonuses, 0% intro APR periods, travel perks, and generous rewards programs.

For example, the Chase Sapphire Preferred Card offers 60,000 bonus points after spending $4,000 in the first 3 months from account opening. That’s worth $750 in travel booked through Chase. You’ll also earn 5x points on travel purchased through Chase and 3x points on dining, streaming services, and online grocery purchases.

If you carry a balance, look for cards like the Citi Simplicity that offer 0% intro APR for 12-21 months on purchases and balance transfers. This gives you over a year to pay off your balance interest-free.

Personal Loan Rates

Personal loan rates also correspond strongly with your credit score. According to Credible, as of February 2023 borrowers with credit scores of 780-850 qualified for average personal loan rates between 5.99% and 15.29% APR.

With your 790 score, you should have no problem getting approved and likely will qualify for rates on the lower end of this range from the most competitive lenders like Lightstream and SoFi. This allows affordable financing for expenses like home renovations, medical bills, or credit card consolidation.

The Takeaway

A credit score of 790 unlocks access to the top tier of financial products and interest rates. You can expect low rates for mortgages, auto loans, credit cards, and personal loans. This saves you money over the life of the loan through lower interest costs.

Maximizing and protecting your 790 score through responsible credit habits will ensure you continue benefiting from the score’s advantages. Monitor your credit with free services, maintain low balances, and pay all bills on time. With your excellent 790 score, the financial world is wide open to you.

Mortgage rates by credit score

Mortgage interest rates can vary significantly based on credit scores, leading to substantial differences in monthly mortgage payments and long-term interest costs for homeowners.

FICO, the biggest credit scoring company in American real estate, provides a helpful online calculator that illustrates how much mortgage rates can differ based on credit scores. Here’s an example of how average annual percentage rates (APRs) varied by credit score in early 2025:

| FICO Score | Mortgage APR* |

| 760-850 | 7.242% |

| 700-759 | 7.449% |

| 680-699 | 7.555% |

| 660-679 | 7.609% |

| 640-659 | 7.711% |

| 620-639 | 7.838% |

*Average APR from myFICO.com is for sample purposes only and based on a 30-year fixed-rate mortgage. Your own interest rate will be different..

What mortgage rate will I get with my credit score?

Mortgage rates by credit score are not one-size-fits-all.

While a credit score of 740 typically secures the lowest rates, borrowers with moderate credit may still find competitive options through specific loan types.

Remember, your credit score is just one piece of the puzzle. So let’s explore all of your options to make sure you’re getting the lowest rate possible for your credit score.

In this article (Skip to…)

What Can I Do With a 790 Credit Score? – CreditGuide360.com

FAQ

What can a 790 credit score get you?

What interest rate can I get with a 790 credit score for a car?

| Credit score | Average APR, new car | Average APR, used car |

|---|---|---|

| Superprime: 781-850. | 5.18%. | 6.82%. |

| Prime: 661-780. | 6.70%. | 9.06%. |

| Nonprime: 601-660. | 9.83%. | 13.74%. |

| Subprime: 501-600. | 13.22%. | 18.99%. |

Can I get a loan with a 790 credit score?

10 May, 2025 | 11:00 IST. Your CIBIL score — usually ranging from 300 to 900 — is a major factor when applying for a personal loan in India. Most lenders consider a score of 750 and above as ideal for approving loans.

What credit score is needed to buy a $300K house?