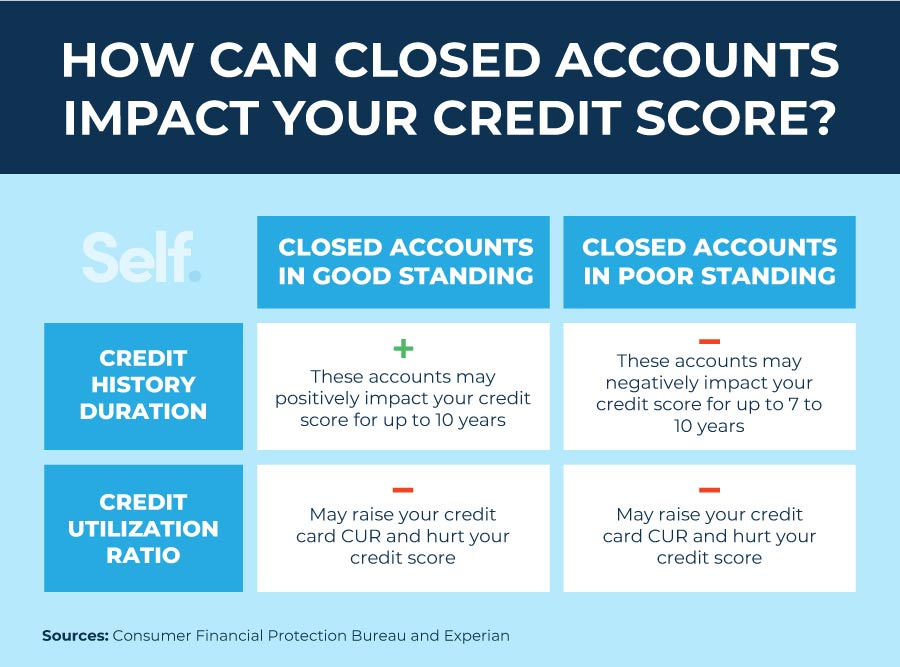

A credit card account can affect your credit for years after you close the account. Its effect on your credit score, however, isn’t always straightforward. Read on to learn when closed accounts are negatively impacting your credit score on your credit report, and how you might address them when necessary.

Having a closed account with an outstanding balance on your credit report can definitely impact your credit score But how much it affects you depends on several factors In this article, we’ll explain what a closed account means, how long it remains on your report, and most importantly – how it can alter your credit scores.

What is a Closed Account?

First, let’s clarify what a “closed account” refers to A closed account on your credit report is generally a credit card, loan, line of credit or other revolving credit that can no longer be used to make new charges There are a few reasons an account may become closed

- You decided to close the account yourself.

- The credit card issuer closed the account due to inactivity, risk factors, or failure to make payments.

- Your credit score dropped significantly, prompting the lender to close the account.

Closing an account does not erase the history or outstanding balance – it simply means the account is invalid for new transactions. The account and all related information remains on your credit report.

How Long Do Closed Accounts Stay on Your Credit Report?

Closed accounts typically stay on your credit report for up to 10 years after being closed. However, any negative marks like late payments fall off your report after 7 years.

So while the closed account itself may remain for a decade, missed or late payments won’t continue dragging down your credit score for that entire time. The impact lessens as time passes.

Can a Closed Account With a Balance Hurt Your Credit?

The short answer is yes – having a closed account with a remaining balance can potentially hurt your credit score. Here are some of the ways it can impact your credit:

-

Increased Credit Utilization Ratio – This measures how much of your total available credit you’re using. If closing an account lowers your overall credit limit, your utilization ratio goes up. A high ratio signals credit risk and drags down your score.

-

Lost Credit History – The older your credit accounts, the better for your credit score. Closing your oldest card means you have a shorter credit history, which can lower your scores.

-

Credit Mix – Lenders like to see you manage both revolving (credit cards) and installment (fixed loans) credit. Closing a card account could alter your mix in a negative way.

-

New Credit Applications – If you apply for new credit to replace closed accounts, you’ll get hard inquiries on your report and dings for opening new accounts. Both can hurt your credit score temporarily.

-

Negative Records – Any late payments or defaults on the closed account remain on your report for up to 7 years. These can significantly damage your credit, especially if the account has been closed due to non-payment.

Tips to Minimize Damage from Closed Accounts

If you have outstanding balances on closed accounts, it will likely impact your credit to some degree. But here are some tips to help minimize the damage:

-

Pay down balances – Reducing or eliminating balances on closed accounts will help decrease your credit utilization and debt-to-income ratios.

-

Avoid new applications – Don’t apply for new credit right away to replace closed accounts. Too many hard inquiries and new accounts at once can temporarily lower your score.

-

Let time pass – As time goes on, the effects on your credit age and history will be reduced. The old account will eventually fall off your report.

-

Dispute errors – If you find incorrect information on your credit report, file disputes to get errors corrected. This can help improve your score.

-

Monitor credit – Stay on top of your credit by checking your reports regularly so you understand how closed accounts are impacting your scores.

The Bottom Line

Having a closed credit account with a lingering balance on your credit report can negatively influence your credit scores. The impact depends on the status, history, age, and limits of the closed account. A high balance on a recently closed card could hurt much more than a small balance on an older, inactive account.

The key is keeping balances low, allowing time to pass, monitoring your credit, and avoiding applying for new credit too quickly. With some patience and diligent credit management, the effects of a closed account on your credit can be minimized.

How to dispute errors on your credit report

Just like with open accounts, checking each closed credit account for incorrect information is crucial since even minor errors, like a single late payment, could hurt your credit score.

Does a closed account affect your credit score?

A closed account can affect your credit score for as long as the account appears on your credit report. Your credit score is calculated based on the following factors from your credit report: payment history, amounts owed, length of credit history, credit mix, and new credit. Closing an account may affect your credit score by affecting those factors.

How Does Closed Account Affect Credit Score? – CreditGuide360.com

FAQ

Does a closed credit card with a balance affect credit score?

Closing a credit card with a balance can also hurt your credit score — even though you’re not adding more debt.

Should I pay off closed accounts?

What happens when you close an account with a balance?

If you still have a balance when you close your account, you are required to pay off any balance on schedule.Jan 22, 2025

Does your credit score go down when an account is closed?

Closing an account doesn’t hurt your credit, but there are steps you should take to ensure your credit stays unaffected when you do so.