A house is one of the biggest purchases you can make, so figuring out how much you can afford is a key step in the home-buying process. You’ll need to start by weighing how much money you have coming in — your monthly earnings from your job, investments and any other streams of income — versus how much you have going out to cover costs like student loans, credit card balances and car payments.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Buying a house is an exciting milestone, but determining your budget is crucial before starting the home search. If your annual salary is around $30k, you may be wondering how much house you can realistically afford As tempting as it may be to stretch your budget to the max, being realistic about affordability will ensure you don’t end up house poor.

When calculating affordability, there are several key factors to consider:

Calculate Your Monthly Income

The first step is to calculate your gross monthly income. Based on a $30k annual salary, your monthly pre-tax income would be approximately $2,500. This is the starting point for determining your price range. Be sure to account for any additional sources of stable income, such as a spouse’s earnings, investment income, freelance work, etc. The more income you can verify, the higher mortgage amount you may qualify for.

Account For Existing Debt

Next, you need to have a clear picture of existing debt obligations like credit card, student loan, auto loan, and personal loan payments. Your total monthly debt payments will directly impact how much you can afford to spend on a mortgage payment. As a general guideline, your total debt-to-income ratio (DTI) should remain below 36% to qualify for a mortgage.

Factor In Down Payment Amount

The size of your down payment is a major affordability factor The more you can put down upfront, the lower your monthly mortgage payments will be. Saving up a 20% down payment is ideal, but programs like FHA loans allow down payments as low as 35%. Just keep in mind that a lower down payment results in higher monthly costs and mortgage insurance.

Consider Local Real Estate Markets

Housing costs can vary drastically depending on location. Make sure to research median home values in the areas where you hope to buy to get an accurate sense of what’s affordable In high-cost urban areas, managing expectations on size and amenities is key

Account For Other Living Costs

Your monthly mortgage payment is just one piece of your overall budget. Be realistic about costs like transportation, groceries, utilities, entertainment, clothing, and retirement savings goals. You need to strike a balance between housing costs and maintaining your lifestyle.

Use Mortgage Calculators

Online mortgage calculators allow you to input different down payment amounts, mortgage rates, and loan terms to determine estimated monthly payments. This gives you a rough idea of how different factors impact affordability. Be sure to get pre-approved from a lender to confirm your actual purchasing power.

Follow The 28/36 Rule

As a general guideline, your monthly housing payment (including mortgage, taxes, and insurance) shouldn’t exceed 28% of your gross monthly income. And your total monthly debt obligations shouldn’t exceed 36% of income. For a $30k salary with $2,500 in monthly income, aim to keep housing costs below $700 per month.

Consider 30-Year Mortgage

Opting for a 30-year mortgage instead of a 15-year mortgage will mean higher interest paid over time, but lower monthly payments. This may allow you to afford more house while staying within a comfortable monthly budget. Just be cautious of overextending.

Explore Low Down Payment Programs

Government-backed loans like FHA, VA, and USDA loans can offer down payments as low as 3.5% for qualified buyers. This provides more flexibility compared to conventional 20% down mortgages. Just be aware of mortgage insurance costs.

Shop Around For The Best Rates

Today’s mortgage rates are near historic lows, but can vary by more than 1% between lenders. Working with an experienced mortgage broker to source the lowest rate for your scenario could potentially save you thousands over a mortgage term.

Make A Higher Down Payment If Possible

While low down payment programs provide an option for buying sooner, putting down more upfront if you can will reduce your monthly costs and overall interest paid. Building up to a 10-20% down payment should be a priority before buying.

Consider A Modest Starter Home

Resist the temptation to overextend your budget to purchase a dream home right away. Consider a more modest starter home that allows you to comfortably afford monthly payments and other costs. You can always upgrade later as your income grows.

Boost Your Down Payment Savings

If you’re light on down payment funds, look for ways to boost savings, like trimming discretionary costs, taking on a side gig, earning cashback rewards, or negotiating with sellers for closing cost assistance.

Prioritize Paying Down Debts

Reducing existing debts improves your DTI ratio, allowing you to qualify for a higher mortgage amount. Create a plan to aggressively pay down credit cards, auto loans, and student loans.

Add A Co-Borrower If Possible

Combining incomes with a spouse, partner, or family member as a co-borrower on the mortgage can significantly increase purchasing power. Just make sure both parties have good credit.

The bottom line is to be realistic. Take a close look at your full financial picture and employ the 28/36 rule as a guideline. This will help ensure you don’t end up house poor but can still comfortably achieve homeownership, even on a $30k annual salary with proper planning.

How much can I afford on my salary?

Let’s say you earn $100,000 a year, which is $8,333 per month. By using the 28 percent rule, your mortgage payments should add up to no more than 28 percent of $8,333, or $2,333 per month.

However, there are a lot of factors that can impact your monthly mortgage outlay, including what kind of loan you have, your interest rate, the cost of property taxes and homeowners insurance in your area, and whether or not you’ll have HOA fees to pay. And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise.

Why it’s smart to follow the 28/36% rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month. For example, let’s say you earn $4,000 each month. That means your mortgage payment should be a maximum of $1,120 (28 percent of $4,000), and all of your other debts should add up to no more than $1,440 each month (36 percent of $4,000, which includes your housing payment). What do you do with what’s left? You’ll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

How To Know How Much House You Can Afford

FAQ

Can I buy a house if I make 30k a year?

Buying a house on a 30k salary is feasible, as long as you don’t live in an area with a really high cost of living.

What can you afford with a 30k salary?

- Monthly take-home pay: $2,500 ($30,000 a year)

- Monthly rent: $881.

- Monthly food bill: $313.

- Monthly health care expenses: $206.

- Monthly transportation costs: $313.

- Monthly utilities: $225.

- Monthly entertainment and recreation: $188.

What apartment can I afford making 30k a year?

Once you’ve determined your gross income, you can then use the 30% or 50/30/20 rules to determine how much rent you can afford. Here’s an idea of the ideal rent for different salaries based on the 30% rule: If you make $30,000 a year, you can afford to spend $750 a month on rent.

How much mortgage can I afford making $35,000 a year?

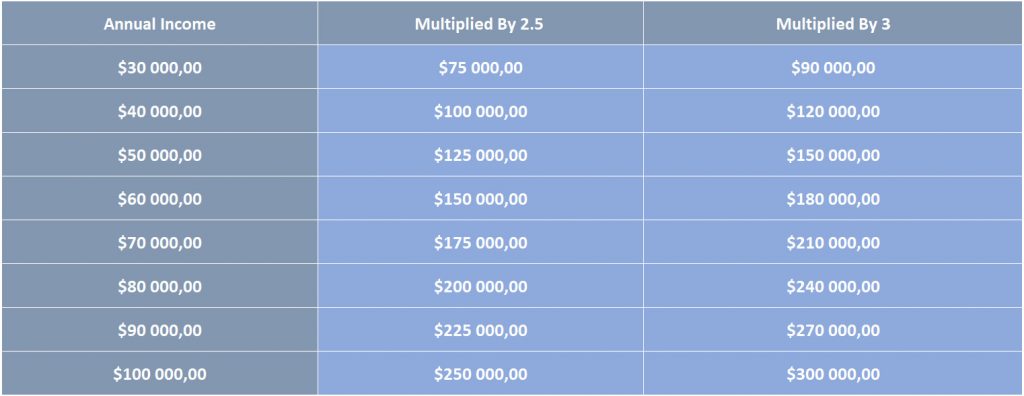

So if you’re making $35,000 a year, this rule would put your max home price around $105,000.

How much house can I afford with 30K income?

With a monthly payment of $300.00 and an income of $30,000, you can afford a house worth $38,871.02 based on a mortgage rate of 6.79%.

How much mortgage can you afford with 30K salary?

With a $30,000 salary, you can afford a mortgage anywhere from $67,500 to $108,000 assuming you have at least 10% saved for a down payment. It is recommended that all your debt added together should not exceed 36% of your gross monthly income.

Can you buy a house if you earn $30,000 a year?

Buying a house is possible if you earn $30,000 a year, but you’ll typically need to enter into a mortgage and make a reasonable down payment or deposit. However, there are a few more circumstances and scenarios to consider – let’s take a closer look! 1 How much house can I afford if I make $30,000 a year?

How much house can you afford?

How much house you can afford is also dependent on the interest rate you get, because a lower interest rate could significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability, getting pre-qualified for a home loan can help you determine a sensible housing budget.

How much house can you afford with an FHA loan?

For example, if you make $3,000 a month ($36,000 a year), you can afford a mortgage with a monthly payment no higher than $1,080 ($3,000 x 0.36). Your total household expense should not exceed $1,290 a month ($3,000 x 0.43). How much house can I afford with an FHA loan?

Can I buy a house if I make 30K a year?

“If I make $30k a year, can I buy a house?” “What sort of a house can I buy on my first paycheck?” The questions go on – but what could you get for $30k, on average, in the US? Buying a house is possible if you earn $30,000 a year, but you’ll typically need to enter into a mortgage and make a reasonable down payment or deposit.