The 28/36 rule is an important guideline that potential homebuyers should understand when applying for a mortgage loan. This rule of thumb helps determine how much house you can comfortably afford based on your income, debts, and lifestyle.

What Does 28/36 Mean?

The 28/36 rule recommends that your total monthly housing costs should not exceed 28% of your gross monthly income. Additionally your total monthly debt payments including housing, should not exceed 36% of your gross monthly income. Here’s a breakdown of what the numbers mean

-

28 – Your total monthly housing costs (mortgage, insurance, property taxes, etc) should not exceed 28% of your gross monthly income. This is known as the front-end ratio.

-

36 – Your total monthly debt payments including housing should not exceed 36% of your gross monthly income. This is known as the back-end ratio or debt-to-income (DTI) ratio.

So in simple terms, 28% goes toward housing costs and 36% goes toward total debt obligations. The remaining 64% of your income is available for other expenses like food, transportation, healthcare, savings, etc.

Why Do Mortgage Lenders Use This Rule?

Mortgage lenders utilize the 28/36 rule to determine if you can comfortably afford the monthly payments on the loan amount you are requesting. By limiting housing costs to 28% of your income, there is a buffer so you can still afford other necessities after making your mortgage payment each month.

The 36% back-end ratio further examines your total debts to ensure you aren’t overextended. Lenders want to avoid lending to borrowers who are likely to default on their loans. The 28/36 guideline helps them screen applicants and make smart lending decisions.

So in short, the 28/36 rule protects both you as the borrower and the lender providing the mortgage loan. It aims to ensure loans are affordable for the long-term.

Is the 28/36 Rule a Hard Requirement?

The 28/36 rule is not a hard requirement or law but rather a general guideline used by most mortgage lenders. Here are a few key points about the flexibility of the 28/36 rule

-

Your credit – If you have an excellent credit score, lenders may approve a higher DTI ratio. Your strong credit helps offset the increased risk.

-

Down payment – A larger down payment reduces risk for the lender, so they may allow a higher DTI.

-

Income stability – Steady income sources can allow for a higher DTI as well.

-

Compensating factors – Strong reserves, low loan-to-value ratio and other positives may compensate for a higher DTI.

So in reality, many lenders allow DTIs higher than 36%, with some going up to 45% or more. The 28/36 rule is best viewed as a caution light that you may be taking on too much debt. Work to lower your ratios if possible before applying.

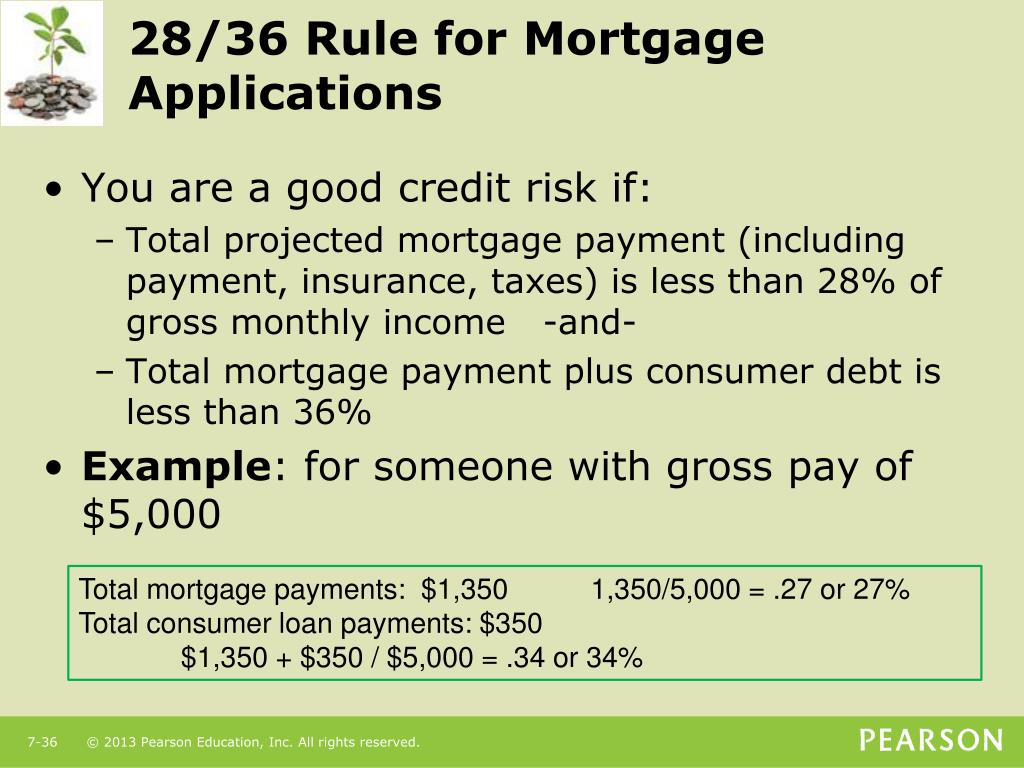

Example of the 28/36 Mortgage Rule

Let’s look at an example to see the 28/36 rule in action:

- Gross monthly income: $6,000

- Total monthly housing costs: $1,680 (28% of $6,000)

- Total monthly debt payments: $2,160 (36% of $6,000)

Based on these numbers, you should limit your monthly housing costs like mortgage, insurance and taxes to $1,680 if you want to follow the 28% recommendation.

And your total monthly debt payments including your housing costs should not exceed $2,160 (36% of your $6,000 gross monthly income).

This leaves $3,840 per month for other expenses like food, transportation, utilities, and savings.

Tips for Meeting the 28/36 Ratios

Here are some tips if your current income and debts make it difficult to meet the 28/36 qualifications:

-

Pay down debts to reduce your monthly obligations before applying for a mortgage.

-

Increase your down payment – This lowers the loan amount so your monthly mortgage costs fit within 28%.

-

Boost income with a promotion, second job or other means. Higher income makes it easier to fit within the ratios.

-

Lower expectations – Consider a less expensive home or more affordable neighborhood.

-

Improve credit – A score over 740 gives you the best shot at approval and better mortgage rates.

With some practical steps, you can potentially adjust your finances to align with the 28/36 rule. This helps set yourself up for mortgage approval.

The Bottom Line

While not an absolute requirement, the 28/36 guideline gives you a target to aim for when budgeting for a home purchase. Sticking close to 28% housing and 36% total debts shows lenders you can afford the mortgage long-term.

Aim to reduce your ratios as much as possible before applying. But know that there is flexibility, especially if you have strong compensating factors like an excellent credit score. The 28/36 mortgage rule helps set expectations, but isn’t the only deciding factor for loan approval.

Can I get a loan if I exceed the 28/36 rule?

When you apply for a mortgage, the lender tries to answer one question: Are you likely to repay the loan? Your debt-to-income ratio (DTI) is one piece of information lenders use to reach their decision, and the 28/36 rules value lies in making sure you have a DTI that most lenders would consider acceptable.

That being said, its possible to get a mortgage even if you exceed the 28/36 framework. “Its certainly not a hard and fast rule and not even a guideline,” says Laurie Goodman, an Institute Fellow at the Urban Institute and Founder of the Housing Finance Policy Center. “If your credit score is high and youre putting down a lot of money, you might be able to get away with having a higher DTI,” she says.

Each lender has its own system for evaluating your risk as a borrower, and your DTI tends to lag in importance compared to your credit score and the size of the mortgage compared to the homes value, for example. “The takeaway here would be that there are no absolute cutoffs in the mortgage market,” Goodman says.

Some lenders are more flexible with their requirements. Navy Federal Credit Union doesnt require a minimum credit score, for example. Instead, it works with applicants to find a mortgage thats right for them.

-

Annual Percentage Rate (APR)

Apply online for personalized rates

-

Types of loans

Conventional loans, VA loans, Military Choice loans, Homebuyers Choice loans, adjustable-rate mortgage

-

Terms

10 – 30 years

-

Credit needed

Not disclosed but lender is flexible

-

Minimum down payment

0%; 5% for conventional loan option

Citi Banks HomeRun program allows borrowers to apply with as little as 3% down. Normally a down payment that low would require private mortgage insurance, but Citi waives the insurance (which can cost up to 2% of your loan amount) for HomeRun borrowers. That could shave hundreds off your housing costs every year.

-

Annual Percentage Rate (APR)

Apply online for personalized rates

-

Types of loans

Conventional loans, FHA loans, VA loans and Jumbo loans

-

Terms

15 – 30 years

-

Credit needed

Not disclosed

-

Minimum down payment

3%

Is this homebuying rule of thumb still realistic?Updated Wed, Jun 5 2024

When applying for a mortgage, homebuyers need to figure out how much they can afford. If you have no idea where to start, the “28/36” rule can help you (and lenders) arrive at a ballpark figure. Below, CNBC Select looks into this real estate rule of thumb to see how it can help you settle on the right mortgage.

Can You ACTUALLY Afford That House? 28 – 36 Rule Explained

FAQ

How do you calculate the 28 36 rule?

Once you have your gross income, multiply that by 0.28 to find the maximum amount you should spend on housing, including your mortgage, taxes, and insurance. You’ll also multiply your gross income by 0.36 to find the maximum amount you should spend on debt.

Is the 28/36 rule good?

Following the 28/36 rule can help to improve your chances of credit approval even if a consumer isn’t immediately applying for credit. Many underwriters vary their parameters around the 28/36 rule, with some requiring lower percentages and some requiring higher percentages.

Does the 28-36 rule include taxes and insurance?

The 28/36 rule helps determine how much of your income should ideally be allocated to housing expenses and overall debt. Specifically, the 28/36 rule suggests that no more than 28% of your gross monthly income should be spent on housing costs, which include your mortgage payment, property taxes, and insurance.

What is the 28 36 rule in evaluating mortgage applications?

The 28/36 rule is a tool lenders could use to assess an applicant’s potential risk for a new loan, specifically a mortgage. The rule suggests that a borrower use no more than 28% of their income on housing, and no more than 36% of their income on overall debts.

What is the 28/36 rule?

The 28/36 rule helps determine how much debt a household can safely take on based on their income, other debts, and lifestyle. Some consumers may use the 28/36 rule when planning their monthly budgets. Following the 28/36 rule can help to improve your chances of credit approval even if a consumer isn’t immediately applying for credit.

What is the 28/36 mortgage rule?

The 28/36 mortgage rule is meant to help families decide when further debt or housing cost obligations would put them in danger of incurring financial risk. Even if you can technically afford a particular home now, if it commands a high percentage of your budget, you don’t have much room for error.

What is a 28/36 ratio?

This is the ratio of your monthly housing expenses versus your monthly gross income, and according to the 28/36 rule, the ratio should ideally be 28% or less. The front-end ratio doesn’t just refer to your mortgage payments. It refers to all of the following: Principal: This is the amount you borrow for your mortgage.

What is a 28/36 mortgage ratio?

The front-end ratio of the 28/36 rule is the percentage of your income that would be spent on your monthly mortgage payment and other housing expenses, including taxes, insurance, and HOA fees. The back-end ratio is the percentage of your income spent on total debts, including your housing payment and other bills.

What is the 28/36 rule of thumb for mortgage debt?

The 28/36 rule of thumb for mortgages suggests that your mortgage, taxes, and insurance payments should not exceed $1,960 per month, and your total monthly debt payments—including that $1,960—should be no more than $2,520.

What is the 28/36 rule when buying a home?

The 28/36 rule is a practical guide when buying a home. Keeping your percentages within these ranges ensures that you don’t commit too much of your income to housing costs or debt payments. Thus, you’re able to maintain a healthy balance between affordability and overall stability.