A 700 credit score is a solid starting point for homebuyers, offering a range of loan options. While it’s not the top-tier score, it’s good enough to get you a good rate on conventional, FHA, VA, and USDA loans.

The higher your credit score, the better your mortgage terms, so it’s worth understanding how your score affects your options.

If you’re ready to buy, Rate’s Same Day Mortgage can help streamline your home-buying process, getting you pre-approved quickly.

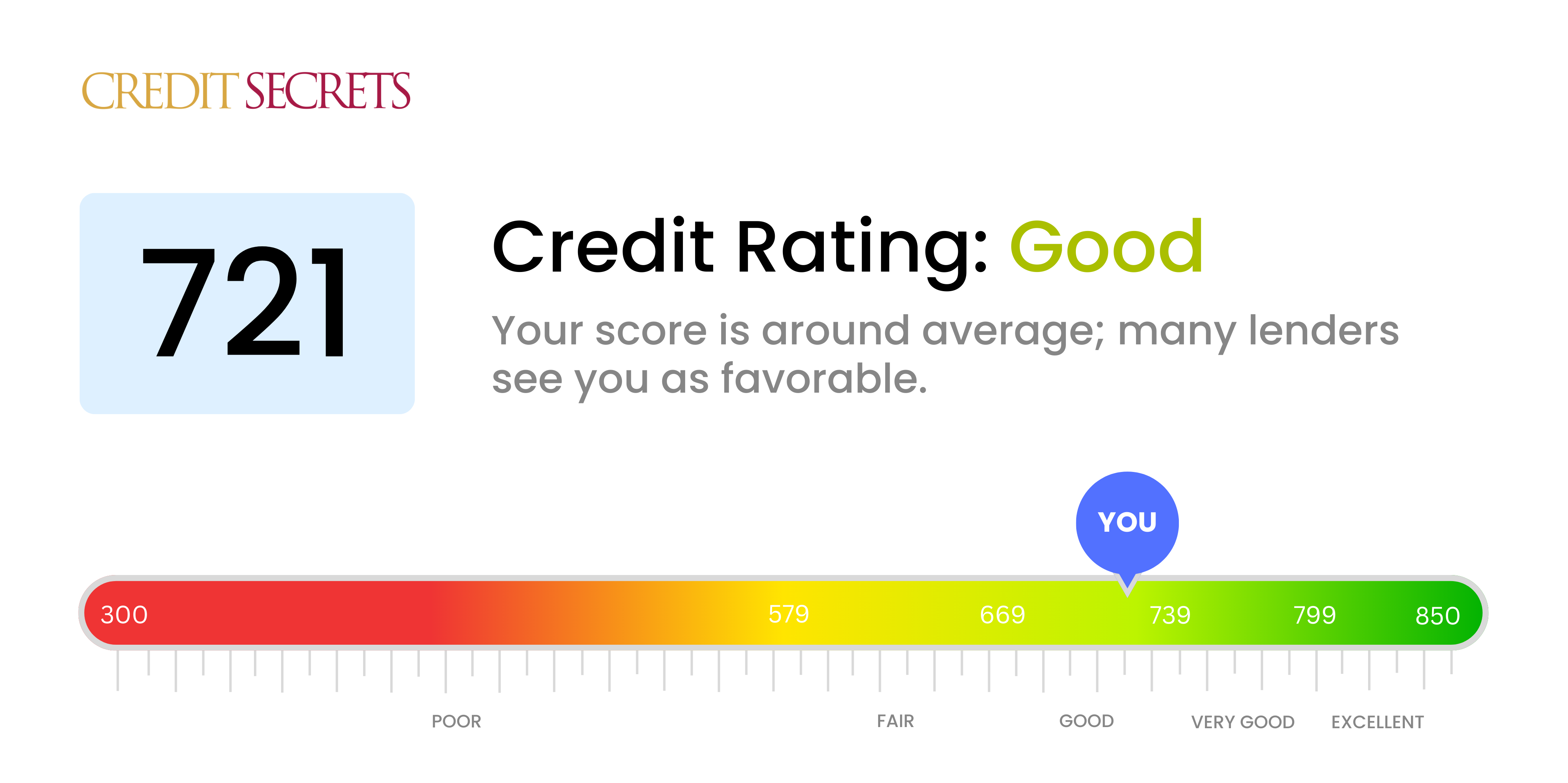

A 721 credit score falls right in the middle of the “good” credit score range. But is it good enough to get approved for a mortgage? The short answer is yes, you can likely qualify for a home loan with a credit score of 721. However, there are some important factors to keep in mind.

What is a Good Credit Score?

First, let’s define what makes a credit score “good.” FICO credit scores, the most commonly used model, range from 300 to 850. In general, scores are grouped into the following ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- Below 579: Poor

So with a score of 721, you fall within the “good” credit group The average FICO score nationwide is currently 714, so you are slightly above average.

What Does a 721 Credit Score Mean?

A 721 credit score indicates you have a pretty solid credit history. You likely pay your bills on time most months and keep your credit utilization (the amount you owe compared to your total credit limits) at a reasonable level.

Lenders see borrowers with scores in the low 700s as relatively low-risk According to FICO, only 19% of borrowers with scores between 720-739 default on their loans. So you look like a dependable borrower in the eyes of most lenders.

That said, a 721 credit score doesn’t put you in the “very good” or “exceptional” tiers who tend to get the very best rates and terms. Lenders will still examine factors like your income, assets, debts, and down payment amount very closely.

Minimum Credit Scores for Home Loans

Here are the typical minimum credit scores for popular mortgage types:

- Conventional loans – 620 minimum

- FHA loans – 580 minimum

- VA loans – No official minimum but lenders usually want 620+

- USDA loans – 640 minimum

- Jumbo loans – 700 minimum

So with your 721 score, you exceed the minimum requirements for any mainstream mortgage. However, jumbo loans may be out of reach unless you have very strong financial qualifications otherwise.

Interest Rates With a 721 Credit Score

While a 721 FICO score meets the basic requirements for most mortgages, your interest rate can vary a lot depending on your exact credit profile.

According to data from myFICO, here are the average mortgage rates for borrowers with different credit scores:

- 780-850 – 2.66% APR

- 740-779 – 2.86% APR

- 720-739 – 3.02% APR

- 700-719 – 3.45% APR

- 680-699 – 3.99% APR

- 660-679 – 4.77% APR

So you can expect to pay an APR somewhere around 3.0% – 3.5% with a 721 credit score. That’s not bad, but borrowers with scores of 740+ will qualify for at least 0.25% – 0.5% lower rates.

Over a 30 year mortgage, that can equate to thousands of dollars in interest savings. So it pays to push your score higher if your goal is the lowest rate.

Tips for Improving Your Credit Score

Here are some tips to improve your credit and reach that “very good” score tier:

- Lower credit utilization – Get balances below 10% of your limits

- Pay all bills on time – Payment history is a big factor

- Don’t apply for new credit needlessly – New inquiries hurt scores short-term

- Have a good mix of credit types – Mortgages, credit cards, installment loans, etc

- Let your credit history age – Longer history helps a lot

With diligent credit management, you may be able to boost your score 50 points or more within 6-12 months.

Other Mortgage Qualification Factors

While your credit score is important, lenders look at your entire financial picture when approving a mortgage. Some other key factors include:

- Down payment amount – The more you put down, the better

- Income and assets – Lenders want to see you can afford the payments

- Debt-to-income ratio – Should generally be below 45%

- Employment history – At least 2 years at the same job is ideal

The “stronger” these other factors are, the more flexible lenders may be with your credit score. For example, putting down 20% or more gives you a big advantage over a minimal 3.5% down FHA loan.

When Shopping for a Mortgage…

When applying for a home loan, it’s smart to get pre-qualified with multiple lenders. All lenders weigh credit scores and other factors a little differently in their underwriting algorithms. The differences between lenders can mean getting approved or denied, regardless of your credit score.

Also, don’t forget to look at total loan costs, not just interest rates. Points, origination fees, and other closing costs vary widely between lenders and can cost several thousand dollars.

Most importantly, be completely truthful when applying for a mortgage. Any inaccurate or unverifiable information is grounds for your loan to be denied, even after initial approval.

The Bottom Line

A 721 credit score is considered good and will meet the minimum requirements for most mortgages. However, you may get lower interest rates and better loan terms by improving your score to 740 or above before applying.

In addition to your credit, lenders will look closely at your income, assets, debts, and down payment amount when deciding whether or not to approve your loan. The stronger your overall financial profile, the better your chances with a 721 credit score.

Interest Rates for a 700 Credit Score

Interest rates are heavily influenced by your credit score. A higher credit score helps you secure a lower interest rate, which reduces your monthly mortgage payment and long-term costs.

While a 700 score might not get you the lowest rate available, it’s still good enough to get competitive mortgage rates from many lenders.

To boost your chances of getting a lower interest rate, focus on maintaining a solid credit history and avoiding late payments.

If you’re able to raise your credit score to 740 or higher, you could qualify for an even better interest rate.

A lower rate could save you thousands of dollars over the life of your loan, making it worthwhile to improve your score by paying down credit card balances or limiting new credit applications before applying.*

While a 700 credit score is good, it may be worth waiting a bit longer and improving your score to qualify for better rates. Consider reviewing your credit report and focusing on making timely payments to boost your score before applying for a mortgage loan.

Can I Get a Conventional Loan with a 700 Credit Score?

Absolutely! A conventional loan is often a good fit for borrowers with a 700 credit score. Conventional loans typically require a minimum credit score of 620, so you’re well above that threshold.

This puts you in a favorable position, especially since most mortgage lenders consider a 700 score to be a solid indicator of creditworthiness.

While you may not have “excellent credit,” a 700 credit score still falls within the “good” range, giving you access to competitive mortgage rates and terms.

You’ll need to meet specific income and credit requirements, but a 700 score should make the qualifying process smoother.

Conventional loans are backed by Fannie Mae and Freddie Mac, which use their own scoring models, including FICO and VantageScore, to determine creditworthiness.

With a good credit score, you can secure a lower interest rate compared to FHA loans, which often cater to borrowers with low credit scores or bad credit.

A conventional loan usually requires a down payment of at least 5% of the home’s purchase price.

However, if you can put down 20%, you’ll avoid paying Private Mortgage Insurance (PMI), significantly lowering your monthly payments.

This option is ideal for borrowers with available credit and solid personal finance habits, as it reduces long-term costs and closing costs.

What Credit Score Is Needed For A Mortgage?

FAQ

Is 721 a good credit score to buy a house?

A 721 credit score, which is above the national average, should qualify a person for credit cards, car loans, mortgages, and personal loans.

What can I do with a 721 credit score?

A FICO® Score of 721 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025

What is the minimum credit score to buy a house?

You generally need a credit score of at least 620 to qualify for a conventional mortgage, though every lender is different. It’s possible to qualify for an FHA loan, which is backed by the federal government, with a credit score as low as 500.

Is 721 a good credit score?

A 721 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things. Credit Rating: 721 is a good credit score.

What percentage of people with a 721 FICO ® score have a mortgage?

39% Individuals with a 721 FICO ® Score have credit portfolios that include auto loan and 31% have a mortgage loan. Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms.

Can you get a student loan with a 721 credit score?

Student loans are some of the easiest loans to get with a 721 credit score, seeing as more than 70% of them are given to applicants with a credit score below 740. A new degree may also make it easier to repay the loan if it leads to more income.

Can you get a car loan with a 721 credit score?

If you’re planning big-ticket purchases or a balance transfer that will take months to pay down, compare credit cards with 0% introductory APR offers. You should be able to get approved for a decent car loan with a 721 credit score, considering that more than 60% of all auto loans go to people with credit scores below 740.

Can a 740 credit score secure the lowest loan rates?

While a credit score of 740 typically secures the lowest rates, borrowers with moderate credit may still find competitive options through specific loan types. Remember, your credit score is just one piece of the puzzle. So let’s explore all of your options to make sure you’re getting the lowest rate possible for your credit score.

Can I get a mortgage if I don’t have a credit score?

If you’re just starting to consider a mortgage loan, you may not have talked to a lender yet, which means you may not have access to your official home buying credit report, which includes your individual credit score, or FICO score. Lenders are required to use a FICO score to meet loan qualifications for Fannie Mae, Freddie Mac, VA, FHA and USDA.