Having a poor credit history can make many aspects of life more difficult. From getting approved for loans and credit cards to renting an apartment, your credit history plays an important role. In this article, we’ll explain what poor credit is, what causes it, and how it can impact your finances.

What is Considered a Poor Credit History?

Your credit history refers to your track record of repaying debts and other financial obligations This information is compiled in your credit report, which is maintained by the three major credit bureaus – Equifax, Experian, and TransUnion.

Your credit report contains details on all your credit accounts, such as credit cards, loans, and mortgages. It shows your payment history, how much you owe, and other key factors. This information is used to calculate your credit score, which is a three-digit number summarizing your creditworthiness.

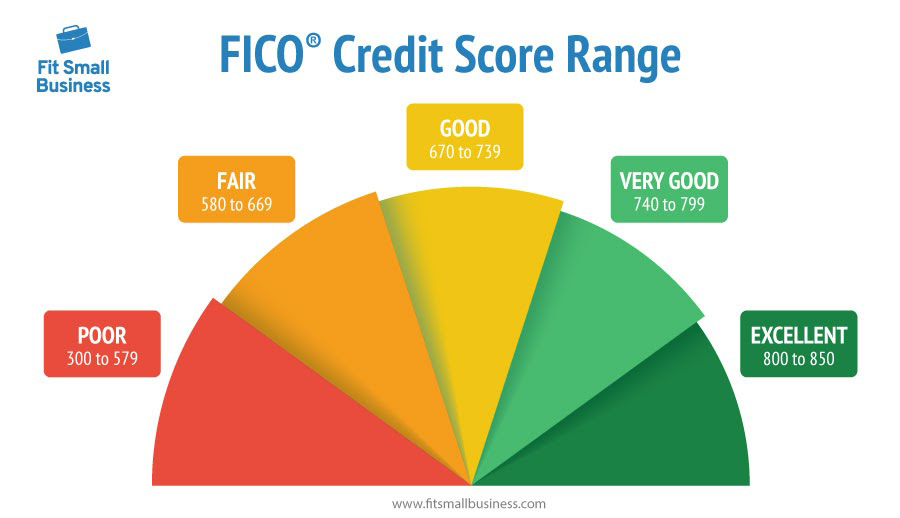

Credit scores range from 300 to 850. In general, scores below 580 are considered poor. This range 300 to 579, is categorized as “poor” or “bad credit” by most lenders. A poor credit score can result in

- Denials for credit cards or loans

- Higher interest rates if approved

- Difficulty renting an apartment

- Paying deposits for utilities

So what causes someone to have bad credit in the first place? There are a few key factors that can tank your credit score.

What Causes Poor Credit?

Several financial behaviors or situations can cause you to develop poor credit

-

Missed payments: Payment history is the biggest factor impacting your score. If you frequently miss credit card or loan payments, it will quickly lower your credit score. Even being just a few days late can get reported.

-

High balances: Carrying high balances on your credit cards leads to a high credit utilization ratio, another key factor in your score calculation. Maxing out cards hurts your credit.

-

Too many credit inquiries: Every time you apply for new credit, the credit bureau logs a “hard inquiry” on your report. Too many in a short period raises red flags and can reduce your score.

-

Short credit history: If you have limited accounts or a short history using credit, you won’t have a robust profile. Lenders prefer to see a longer track record of responsible borrowing.

-

Inaccuracies: Sometimes errors or fraudulent accounts end up on your report, dragging down your score through no fault of your own. This is why checking your credit reports is so important.

-

Financial difficulties: Major events like bankruptcy, foreclosure, or debt settlement programs can devastate your credit scores for years. It takes time to rebuild credit after these occurrences.

How Does Poor Credit Affect You?

Now that you know what causes bad credit, let’s explore the consequences of having a low credit score. Poor credit can impact many areas of your financial life:

-

Credit denials: With bad credit, you may struggle to get approved for new credit cards and loans. Lenders view you as high risk, so you’ll have limited options.

-

Higher interest rates: If approved for credit with a low score, expect to pay higher APRs, annual fees, and interest rates. This makes borrowing more expensive.

-

Difficulty renting: Many landlords check credit reports before approving tenants. You may have a hard time finding a rental with poor credit.

-

Utilities deposits: Utility companies often require security deposits from customers with poor credit to offset their risk. This ties up your money.

-

Auto insurance premiums: In most states, insurers can use your credit report to set rates. Bad credit often leads to higher premiums.

-

Difficulty getting a job: Employers are allowed to check your credit in many states during background checks. Poor credit could limit job prospects.

As you can see, bad credit impacts nearly every area of your financial life. The good news is your credit is fixable with some effort and discipline.

Tips for Improving Your Credit Score

Repairing poor credit takes time, but it’s doable with the right strategies. Here are some effective ways to improve your credit score:

-

Pay all bills on time. Set up autopay or reminders to avoid missed payments. Payment history has the biggest impact on your scores.

-

Pay down balances. Getting balances below 30% of your credit limits will help reduce your credit utilization ratio.

-

Check for errors. Review your credit reports for any incorrect information dragging down your scores. Dispute errors with the bureaus.

-

Limit new accounts. Apply for new credit only when absolutely necessary. Too many inquiries will lower your scores temporarily.

-

Become an authorized user. Ask a friend with good credit to add you as a user to help build your history.

-

Open a secured card. Secured cards require a deposit but are easier to qualify for. They can help build or rebuild credit.

-

Utilize credit builder loans. These loans place the funds into a savings account while you make fixed payments. The money is released once the loan is paid off.

With some time and effort, you can turn around a poor credit history. Monitor your credit scores so you can track your progress. Be patient – consistently making smart financial decisions will gradually improve your creditworthiness.

The Bottom Line

Having poor credit can negatively impact many areas of your life and make it harder to access credit. If you have bad credit, don’t panic. The most important thing is taking action to change your financial habits and start rebuilding your credit profile. It may take months or years depending on your situation, but with responsible money management, you can work your way back to good credit.

Factors that influence your credit score

Credit scores are calculated differently depending on the credit scoring model. Here are the key factors FICO and VantageScore consider.

- Payment history (35% of your score): Whether youve paid past credit accounts on time

- Amounts owed (30%): The total amount of credit and loans youre using compared to your total credit limit, also known as your utilization rate

- Length of credit history (15%): The length of time youve had credit

- New credit (10%): How often you apply for and open new accounts

- Credit mix (10%): The variety of credit products you have, including credit cards, installment loans, finance company accounts, mortgage loans and so on

- Extremely influential: Payment history

- Highly influential: Type and duration of credit and percent of credit limit used

- Moderately influential: Total balances/debt

- Less influential: Available credit and recent credit behavior and inquiries

Remove inaccurate, negative information on your credit report with a credit repair company.

Offers in this section are from affiliate partners and selected based on a combination of engagement, product relevance, compensation, and consistent availability.

Credit Saint offers three packages for credit repair services and a 90-day money-back guarantee for services. It has received an A rating and is accredited by the Better Business Bureau.

The Credit Peoples Credit Report Repair service is relatively affordable compared to other programs in the space. Even the most basic package (the standard package) includes unlimited challenges to all three credit bureaus. Upgrading to the premium package includes escalated disputes and monthly credit score reports and score refreshes.

What is a bad credit score?

Credit score ranges vary based on the scoring model used (FICO versus VantageScore) and the credit bureau that pulls the score (Experian, Equifax or TransUnion). These are estimates from Experian.

FICO Score:

- Very poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very good: 740 to 799

- Excellent: 800 to 850

VantageScore

- Very poor: 300 to 499

- Poor: 500 to 600

- Fair: 601 to 660

- Good: 661 to 780

- Excellent: 781 to 850

How To Fix A BAD Credit Score ASAP

FAQ

What is classed as poor credit history?

| Excellent | Very good | Poor |

|---|---|---|

| Excellent 811 – 1000 | Very good 671 – 810 | Poor 439 – 530 |

What credit score is considered poor?

Within the FICO model, a credit score between 300 and 660 may fall into two separate categories: Poor: 300–579. Fair: 500–669.

How do I know if I have bad credit history?

If your credit score lands in the range of 300 and 579, it is considered poor, and lenders are more likely to see you as a risk.

How do I fix my poor credit history?

- Paying your loans on time.

- Not getting too close to your credit limit.

- Having a long credit history.

- Making sure your credit report doesn’t have errors.