Having a good CIBIL score is essential for availing loans and credit cards in India. But have you ever wondered what the highest CIBIL score in India is? Let’s find out!

What is CIBIL Score?

CIBIL or Credit Information Bureau (India) Limited is India’s premier credit information company. It collects and maintains records of an individual’s payments pertaining to loans and credit cards.

CIBIL then generates a three-digit numeric summary known as the CIBIL score or credit score It ranges between 300 to 900, with 900 being the highest score

Lenders use the CIBIL score to gauge a borrower’s creditworthiness and likelihood of loan repayment. The higher your CIBIL score, the better are your chances of getting a loan approval.

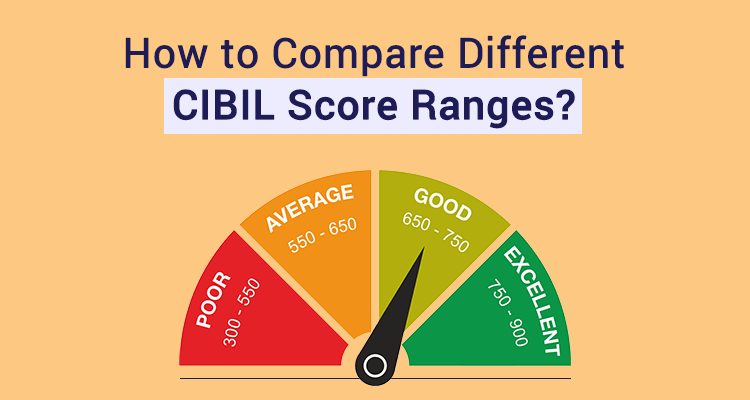

CIBIL Score Range

Although the score range is 300 to 900, what is considered a good CIBIL score in India?

- A score above 750 is excellent

- 700 – 750 is good

- 650 – 699 is fair

- 600 – 649 needs improvement

- Below 600 is poor

As a thumb rule, a score above 700 helps secure loan approvals with ease Anything below 650 would mean potential rejection or stricter loan terms

What is the Highest CIBIL Score in India?

Now coming to the key question – what is the maximum CIBIL score in India?

As per CIBIL, the highest score is 900. But in reality, a score of 900 is extremely rare.

As of October 2022, the highest CIBIL score reported is 823, shared by a few individuals online.

Some key facts:

- In the last 12 months, only 0.06% of people had a score above 800.

- 99% of scores fall between 550 – 790.

- The most common score in India is 723.

This data reveals that while 900 is theoretically possible, a score above 820 is highly unusual.

Why is a 900 CIBIL Score Rare?

Achieving the maximum 900 CIBIL score is rare because it requires:

- Flawless repayment history over many years

- Zero missed or delayed payments

- Very low credit utilization ratio

- Healthy mix of loans and credits managed responsibly

Maintaining this pristine credit record over a long period is challenging. Even a single missed payment can disrupt the score.

Minor reporting delays by lenders can also impact your score. Hence, the stars need to align perfectly to reach 900.

Does CIBIL Score Increase Gradually?

Yes, CIBIL scores increase gradually as you build your credit history.

New credit card holders start at a lower score. As they use credit responsibly over months and years, the score slowly rises.

However, the speed of increase reduces once you reach very high scores:

- Reaching 700 is easier and faster

- Beyond 750, scores climb slowly

- Above 800, it crawls at a snail’s pace

The marginal effort required to go from 780 to 800 is much higher than 700 to 750.

Tips to Get a High CIBIL Score

While a 900 score may seem impossible, you can still aim to get as close to 800+ as possible. Here are some tips:

-

Pay all bills on time – This includes credit card bills, loan EMIs, utility bills etc. Even a slight delay can impact your score negatively.

-

Keep credit utilization low – Try maintaining credit card balances at less than 30% of the limit. High utilization indicates credit hunger.

-

Monitor credit report – Check for errors regularly and dispute them immediately.

-

Use credit responsibly – Avoid multiple loan inquiries in a short span. Build credit mix cautiously.

-

Give it time – Scores climb gradually. Be patient and persist with good credit behavior.

How High CIBIL Scores Benefit You

The higher your CIBIL score, the more you stand to gain:

-

Easy loan approval – Lenders prefer lending to lower credit risk individuals.

-

Higher loan eligibility– Become eligible for bigger loan amounts.

-

Lower interest rates – A high score makes you eligible for the lowest interest rates.

-

Better terms – Get longer repayment tenors and lower processing fees.

-

Increased access to credit – Qualify for premium cards and exclusive products.

How Do I Get the Highest Credit Score?

Here’s a breakdown of the steps you can take to achieve the highest possible credit score:

- Pay Like Clockwork: This is king. Timely payments on all bills are crucial. Set up auto-pay to avoid missed payments.

- Credit Usage Diet: Keep your credit card balances low. Aim for a utilisation ratio below 30%. Pay them down regularly!

- Time is Money (and Credit Score): The longer your credit history, the better. Use a credit card responsibly and avoid closing old accounts.

- Credit Buffet, Not Smorgasbord: For a well-rounded credit profile, have a mix of credit accounts, such as credit cards and loans (mortgage, auto).

- Shop Around, Don’t Apply Around: Applying for too much credit can hurt your score. Only apply when truly necessary.

- Be a Credit Report Bloodhound: Regularly check your reports for errors and dispute them quickly.

Range of Lowest to Highest Credit Score

| Score Range | Credit Quality | Description |

| 300 – 579 | Poor | This indicates a high risk to lenders and likely difficulty in obtaining credit. |

| 580 – 669 | Fair | Considered subprime, borrowing costs may be higher. |

| 670 – 739 | Good | Generally approved for credit but not at the best rates. |

| 740 – 799 | Very Good | Likely to receive better than average rates from lenders. |

| 800 – 850 | Exceptional | Qualifies for the best rates and most favourable terms. |

5 Benefits to Good CIBIL Score Holders

FAQ

Does anyone have a CIBIL score of 900?

Individuals with a perfect payment history, low credit utilisation, a long credit history, a healthy credit mix, and minimal new credit inquiries can achieve …

Is 777 a good CIBIL score in India?

According to this table, 777 CIBIL score is considered a very good score, signalling a solid credit history and trustworthiness to lenders. However, this score falls short of an excellent credit score.

Has anyone got a 900 credit score?

A 900 credit score is typically only possible when auto lenders or credit card issuers use the older industry-specific FICO® Bankcard Score model.Mar 28, 2025

Does anyone have 800 CIBIL score?

Yes, with an 800 credit score, you are highly likely to qualify for a loan. Lenders view you as an exceptionally reliable borrower, which makes you eligible for higher loan amounts and lower interest rates.

What is the highest CIBIL score in India?

The highest recorded CIBIL score in India is 900, but achieving this requires disciplined financial planning and consistent responsible credit behaviour. Here are some effective strategies to boost your current credit score: Pay EMIs and credit card bills on time to establish a track record of financial reliability.

What is a good CIBIL score?

The CIBIL score, ranging from 300 to 900, is a key indicator of your creditworthiness. It helps lenders assess your credit risk (likelihood of repaying loans). Here’s a breakdown of the CIBIL score ranges: Above 750: Excellent – This signifies a strong credit history, making it easier to secure loans and credit cards at favorable terms.

What are CIBIL score benchmarks in India?

Let’s understand the CIBIL score benchmarks in India, along with the advantages of achieving a high score and actionable steps to improve it. The CIBIL score range in India falls between 300 and 900, with 300 being the lowest and 900 being the highest.

Can someone have a 900 CIBIL score?

Yes, a 900 CIBIL score is the highest possible in India, indicating exceptional creditworthiness. It reflects a history of on-time payments, a healthy mix of credit products (secured and unsecured loans), and a low credit utilisation ratio.

What is a CIBIL credit score?

CIBIL awards score based on the credit history information provided by financial institutions from time to time. The credit score range will be 300 to 900. 300 is considered the lowest credit score, while 900 is the maximum Credit Score. A credit score of 750 is the minimum Score for loans.

What is a good CIBIL score for a home loan?

The closer you are to the CIBIL Score maximum limit, which is 900, the better your credit history will be. The maximum CIBIL score indicates great creditworthiness and a history of on-time payments. If your credit score falls within the range of 650 to 750, you will have a decent chance of getting a home loan without any problems.