If you have no credit history, you have no credit score — but not a zero credit score.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The most frustrating thing about credit might be the chicken-and-egg problem of establishing it: Nobody wants to give you credit when you don’t have a track record of using credit.

But if you’ve never had credit and don’t have a credit score, that doesn’t mean you have a zero credit score. You have the absence of a score: You’re “credit invisible.”

Having no credit history can be frustrating when trying to access credit. Without a credit score, lenders have no way to judge your creditworthiness. But what exactly does it mean to have no credit score? And what can you do build credit from scratch? This article will explain what no credit score means and provide tips for establishing credit history.

What Does Having No Credit Score Mean?

Having no credit score simply means that the three major credit bureaus – Equifax Experian, and TransUnion – do not have enough information to calculate a credit score for you. This typically happens for a few key reasons

-

You’ve never had a credit account. If you’ve never had a credit card, loan, or other line of credit, you won’t have a credit history for the bureaus to evaluate

-

You’re new to the US Recent immigrants often don’t have U.S. credit histories, so no score can be calculated.

-

You have no recent credit activity. Even if you’ve had credit in the past, you need recent activity within the last 6-24 months to have a score.

-

You have a “thin” credit file. This means you have too little credit history for the bureaus to assess.

Having no credit score doesn’t mean your credit is bad. It simply means you don’t have enough credit information yet to generate a score. You have a blank slate to build good credit habits.

How Having No Credit Score Affects You

Not having a credit score can make it harder to get approved for new credit since lenders prefer to see a proven history of responsible borrowing. Effects include:

-

Reduced credit options: With no score, lenders see you as riskier and may deny applications. You’ll have fewer credit products available.

-

Higher rates and fees: If approved without a score, you’ll likely pay more in interest and fees due to the perceived risk.

-

Difficulty renting: Landlords often check credit scores, so no score may mean you need a co-signer.

-

Paying deposits: Utilities, cell providers, and other services may require deposits if you lack credit history.

So while no score doesn’t mean you have bad credit, it does limit your access to credit. Building a score opens doors to more affordable loan options.

How Long It Takes to Build Credit

There’s no set timeframe for building credit. It depends on your specific credit situation and activities. However, here are some general guidelines:

-

6 months: The minimum time to potentially get a FICO score is 6 months of credit history.

-

6-12 months: You may see a VantageScore in as little as 6 months. Allow 12 months of building credit to be considered for more credit products.

-

24 months: Two years of credit history unlocks broader approval odds and better loan terms. But keep building history beyond that.

-

10+ years: A decade of responsible borrowing will typically mean great credit and prime interest rates.

The key is to be patient, make all payments on time, keep balances low, and continue using credit responsibly over years. Checking your credit reports along the way lets you monitor your progress.

5 Tips for Building Credit from Scratch

If you currently have no credit score, here are some smart ways to start establishing a credit history:

-

Become an authorized user – Being added as an authorized user on someone else’s credit card can build your score if they report your activity to bureaus.

-

Open a secured card – Secured cards require a refundable deposit that becomes your credit limit but reports like a regular card.

-

Use credit builder loans – These loans let you pay into a savings account and report payments to bureaus to build history.

-

Ask bill providers to report – Some bill payments like rent and utilities can be reported to help build your score.

-

Review credit reports – Checking your reports lets you monitor your progress even before your score appears.

Building credit takes diligent, long-term effort. But establishing healthy credit habits now pays dividends for years to come in the form of better loan rates and more choices. Be patient and let your good money management shine through with each on-time payment.

The Takeaway

Having no credit score simply reflects a lack of enough credit history to calculate a score. It doesn’t mean your credit is damaged. While no score does limit your lending options now, you have the chance to build great credit over time. With smart credit-building tactics and consistently responsible usage, your credit score will rise and open up brighter financial opportunities.

What’s the starting point for your score?

Just as being new to credit doesn’t mean you start at zero, it also doesn’t mean you begin in the basement at 300. After all, if you’ve never had credit, you’ve never made score-devastating mistakes.

When you have no credit history, the credit bureaus just don’t know enough about you to guess whether you’ll pay back borrowed money. And that’s all a credit score is — an estimate of the likelihood you’ll pay back the next credit you’re granted, based on the data in your credit reports.

Once you begin using credit, scores can be calculated. You likely wont start with a good credit score but you won’t be at the bottom of the scale, either.

Why you don’t have a credit score

No one has a credit score of zero, no matter how badly they have mishandled credit in the past.

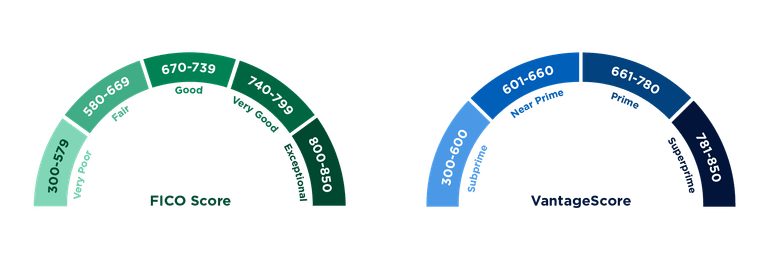

The most widely used credit scores, FICO and VantageScore, are on a range from 300 to 850.

Tommy Lee, a senior director at FICO, said scores of 300 are “extremely rare.”

Reasons you might not have a score are:

- You’ve never been listed on a credit account.

- You haven’t used credit in at least six months.

- You have only recently applied for credit or been added to an account.

How To Start Building Your Credit Score With No Credit History

FAQ

What is your score if you have no credit?

Having no or minimal credit history means you don’t have a credit score at all. This is different from having a low credit score, which can stem from having negative information on your credit reports.

Can you have a 0 credit score?

What credit score does an 18 year old start with?

A 600 FICO score, which is considered “fair,” is below the average credit score of individuals ages 18 to 26. The average 18-year-old has a 681 score.Dec 2, 2024

What is my credit score if I only have a debit card?

Debit cards do not appear on your credit history or affect your credit score. When you use a debit card, the money is immediately taken out of your banking account. You are not borrowing money like you would with a credit card.