If you’ve been paying your federal loans for decades, you might be closer to student loan forgiveness after 25 years than you think. Forgiveness isn’t automatic, though—you need to make income-based payments during that time.

Typically, months spent in deferment, grace periods, or forbearance don’t count toward those 25 years. But a temporary program introduced during the pandemic—sometimes called the IDR Waiver or payment count adjustment—may have given you extra credit toward forgiveness for some of that time.

Here’s what you need to know about the 25-year forgiveness rule, what qualifies, and what happens if you have private loans.

Student loans can feel like a lifelong burden. The average student loan debt for a bachelor’s degree is over $28,000. With 10-year standard repayment plans, monthly payments can take a big bite out of your paycheck. It may seem like you’ll be stuck paying these loans forever.

But there is hope – student loans can actually be forgiven after 25 years through income-driven repayment plans This article will explain how 25-year student loan forgiveness works, who qualifies, and what you need to do to take advantage of this program

What is Student Loan Forgiveness After 25 Years?

The federal government offers four income-driven repayment (IDR) plans that base your monthly student loan payment on your income and family size These plans can provide relief by lowering payments. And after 25 years of payments, any remaining balance is forgiven

The four IDR plans are:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Income-Contingent Repayment (ICR)

- Income-Sensitive Repayment

So if you make payments for 25 years under one of these plans, the Department of Education will forgive whatever amount remains. This is known as “IDR forgiveness” or the “25-year rule”.

It’s important to note that only payments made under an IDR plan qualify. Time spent in other repayment plans like standard or graduated repayment does not count.

The One-Time Adjustment to Fix IDR Loan Forgiveness

Historically, 25-year forgiveness has been nearly impossible to obtain. Strict rules disqualified payments made during deferment or forbearance periods. Even small errors could reset the clock. Out of millions of borrowers, only a handful saw forgiveness.

But in April 2022, the Department of Education announced a one-time adjustment to count previously ineligible periods toward IDR forgiveness. This includes:

- 12+ months of consecutive forbearance

- 36+ months of cumulative forbearance

- Months in deferment (except in-school)

They will also count any months spent in repayment, regardless of payment amount or loan types.

The adjustment is automatic. Any borrower who hits 240 months will see immediate forgiveness. Others will see accounts updated in 2024.

What Types of Loans Are Eligible for 25-Year Forgiveness?

Only federal student loans qualify for IDR forgiveness after 25 years:

- Direct Loans automatically qualify

- Older FFEL and Perkins loans must be consolidated into a Direct Loan first

Private student loans are not eligible.

Parents who borrowed PLUS Loans can qualify by consolidating into a Direct Loan and entering an IDR plan. Although Parent PLUS loans themselves don’t qualify, payments made on a consolidated Direct Loan do.

How to Apply for 25-Year Student Loan Forgiveness

The good news is there’s no special application for 25-year forgiveness. The Department of Education and your servicer track your progress automatically.

Here are the steps to take advantage of this program:

-

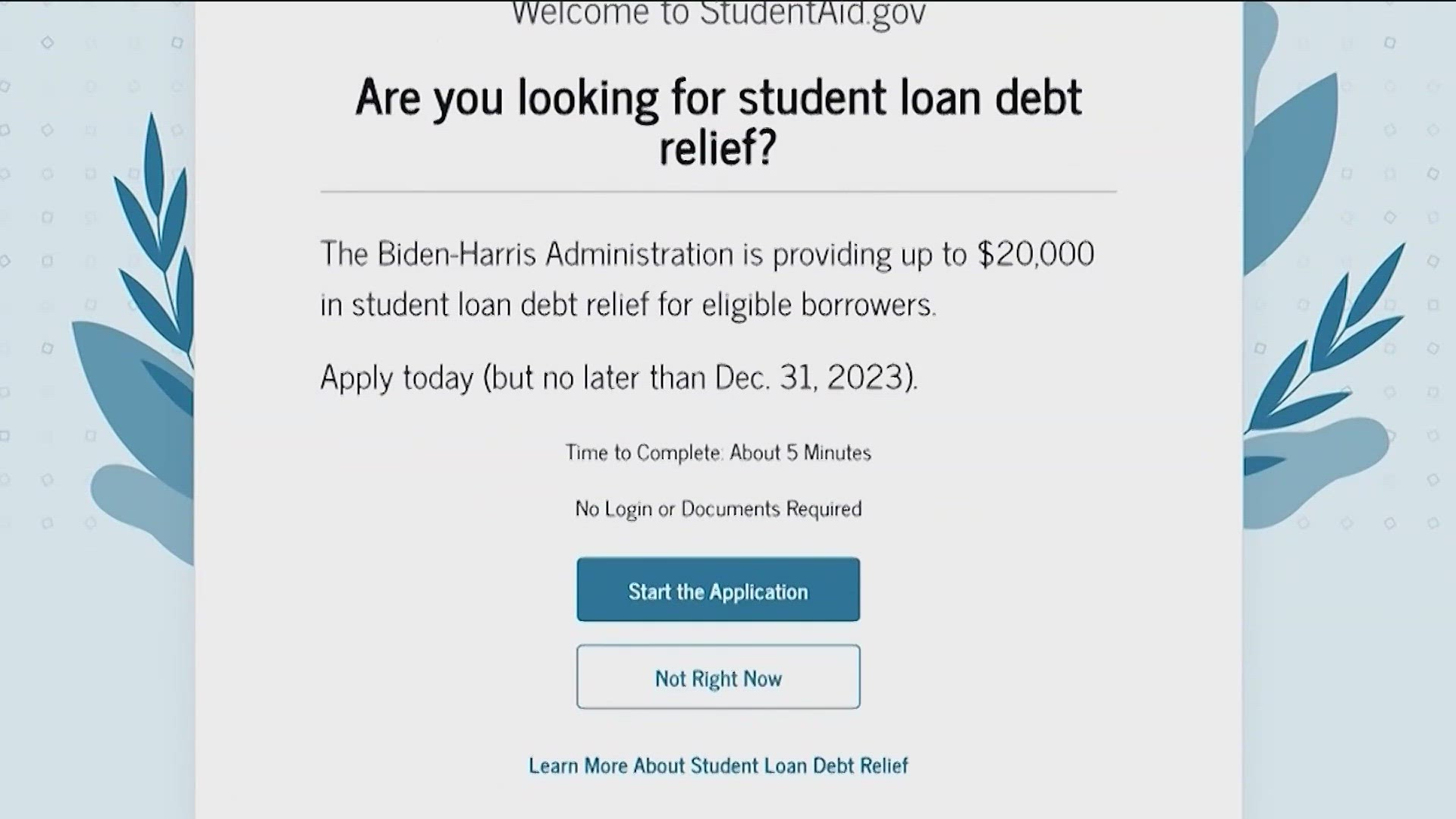

Enroll in an IDR plan – apply online at StudentAid.gov

-

Recertify income and family size each year to recalculate payment

-

Make monthly payments under the IDR plan for 25 years

-

After 300 payments, your servicer will forgive any remaining balance

You can monitor your payment count using the IDR tracking tool on StudentAid.gov. Once you hit 300 payments, you’ll be notified forgiveness is on the way.

The Tax Bomb on Forgiven Debt

One catch of 25-year forgiveness is the potential tax bill. Under current tax law, forgiven debt is treated as taxable income. This means if $50,000 is forgiven after 2025, you may owe taxes on that $50,000.

Temporary relief is in place through 2025 due to the American Rescue Plan Act. But unless Congress extends this, borrowers will need to plan for a hefty tax bill down the road.

Is Student Loan Forgiveness After 25 Years a Good Idea?

IDR forgiveness opens doors for more borrowers to see their loans discharged. But there are pros and cons to consider:

Pros

- Payments are affordable based on income

- You can qualify regardless of career or loan types

- Tax bomb is avoided until 2026

Cons

- You may pay more interest over the long run

- Tax bill could be thousands depending on forgiven amount

- Few protections if income increases substantially

Overall, IDR forgiveness is a lifeline for struggling borrowers. But enrolling is a long-term commitment. Have a plan for handling larger monthly payments if your income rises. And set aside savings for taxes just in case relief isn’t extended.

What if You Have Private Student Loans?

Unfortunately private student loans are not eligible for forgiveness, even after 25 years. These loans are handled by private lenders and don’t qualify for federal repayment programs.

If you have private loans, here are some options to look into:

- Refinancing to a lower rate

- Extended repayment term to lower monthly payments

- Settlement – paying a lump sum less than what you owe

Refinancing with a private lender may help lower payments but also eliminates access to federal protections. Weigh the pros and cons carefully based on your situation.

Find Relief from Student Loan Debt

Student loans can feel overwhelming but relief is possible. IDR plans and 25-year forgiveness open doors if you qualify. Be sure to recertify income annually and monitor your payment count.

Most importantly, stay positive. With commitment and smart planning, you can minimize interest costs and work toward the day your student loans are forgiven. The light at the end of the tunnel makes the long journey worthwhile.

What Happens If You Don’t Pay Off Student Loans in 25 Years?

If you don’t pay off your student loans in 25 years, you still owe the balance—period. You’ll keep paying until you either pay it off in full or qualify for forgiveness under an income-driven repayment plan. But forgiveness after 25 years isn’t automatic. Here’s why borrowers still owe after all this time:

- Not enrolled in an IDR plan. Only payments made under IDR plans count toward the 25-year rule. Time in other plans, like standard or graduated repayment, doesn’t qualify.

- Time in deferment or forbearance. Months in deferment (except during certain economic hardships) or forbearance don’t count. For some borrowers, this added years to their timeline.

- Default or bankruptcy. These stop the forgiveness clock entirely. Even if you rehabilitate or consolidate, you lose credit for time spent in default or bankruptcy.

- Incomplete payment history. Errors or missing records mean some borrowers’ qualifying time hasn’t been counted accurately.

If you’ve had loans for decades but haven’t seen forgiveness, this is likely why. Understanding where you stand now can help you figure out your next steps—and whether recent changes, like the one-time account adjustment (more on that later) might help.

How to Get Into an Income-Driven Repayment Plan

For weeks, partisan politics blocked access to income-driven repayment plans, leaving borrowers in limbo. And with the Trump administration preparing to take office, many are left wondering what’s next for student loan forgiveness.

The good news is that IDR applications have reopened. You can apply online through the Federal Student Aid website or by contacting your loan servicer. Choosing the right plan is critical—especially with the SAVE plan’s future uncertain.

For most borrowers working toward forgiveness, the IBR or PAYE plans are the safest choices. If you’re a parent with Parent PLUS loans, the ICR plan makes the most sense—unless you’re pursuing the double consolidation loophole. Doing that will give you access to the other IDR plans.

If you’re not sure which plan is right for you or how to get started, check out our guide to student loan repayment plans. It breaks down who to talk to, what questions to ask, and how to make the best decision for your situation.

Are student loans forgiven at age 65?

FAQ

Does student loan debt go away after 25 years?

No, student loans are not automatically forgiven after 25 years. If you are in one of the programs that allow you to repay based on your income, any debt that remains after 20 years is forgiven. However, the amount of debt that is discharged is co…

How many years before student loans were forgiven?

If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness.Dec 12, 2024

What happens if you never pay off your student loans?

How do I know if my student loans are forgiven?