You may be able to get an auto loan with a very low, or even no, credit score. However, good credit can help you qualify for loans with better terms, including low rates and promotional offers.

You can get a car loan with a low credit score, and some lenders may offer you a car loan even if you dont have a credit history or score. However, applicants with good or excellent credit generally qualify for better interest rates and offers. If you need to buy a car right away and dont have a great score, you could try to get the best loan possible and then refinance it after improving your credit.

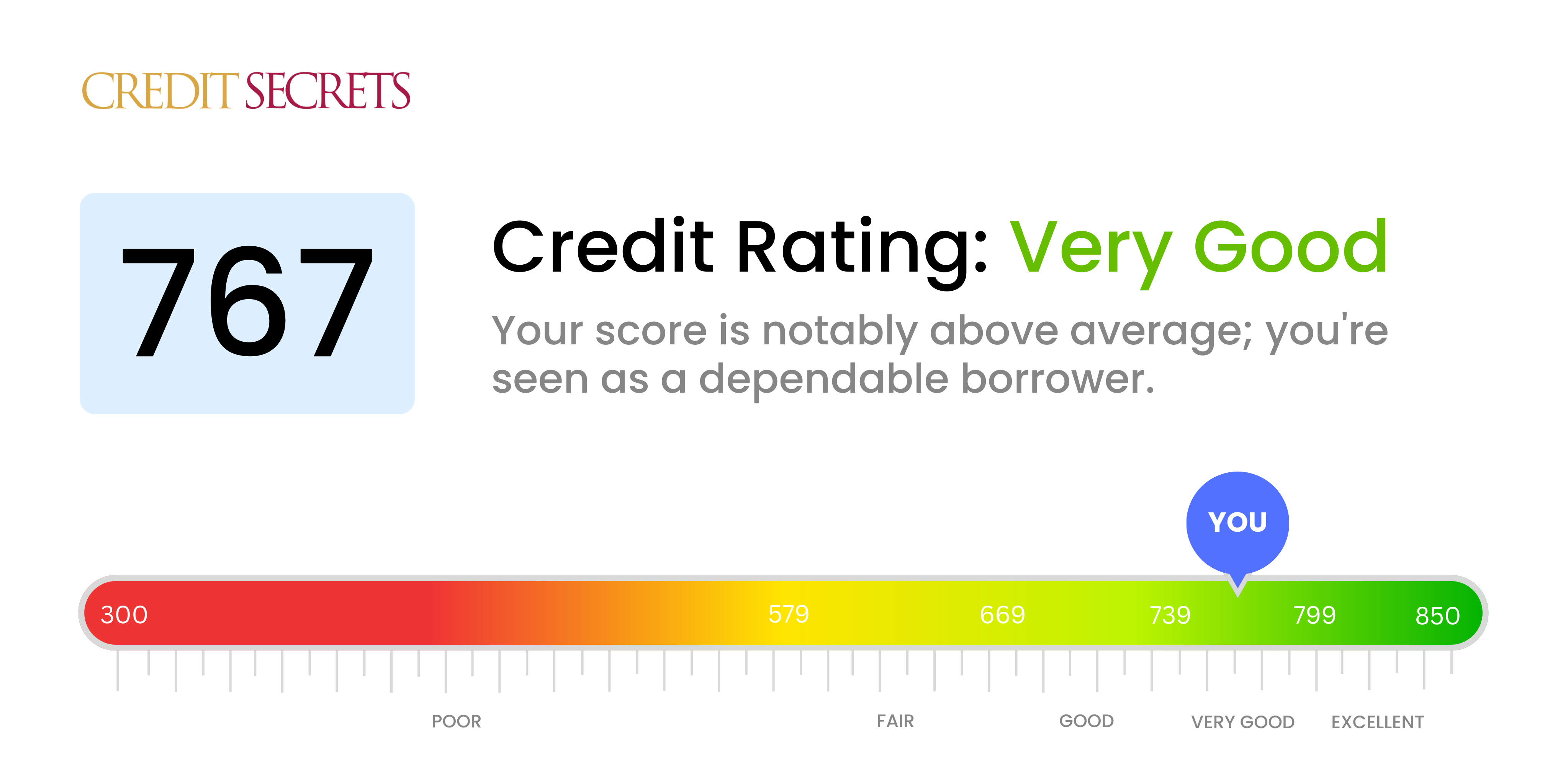

A 767 credit score is considered very good, and will likely qualify you for favorable auto loan terms. Here’s a breakdown of what your 767 credit score means for buying a car, along with tips for getting the best deal.

What is a 767 Credit Score?

-

A credit score is a three-digit number that lenders use to evaluate your creditworthiness.

-

Scores range from 300 to 850.

-

A 767 falls in the “very good” range between 740-799 according to FICO.

-

Only 1% of people with scores in this range are expected to become seriously delinquent on credit obligations

-

A 767 is well above the average credit score of 714.

What a 767 Credit Score Means for Car Buying

-

Interest rates – You’ll likely qualify for competitive interest rates from most lenders, saving potentially thousands over the loan term.

-

Loan eligibility – High approval odds for auto loans from a wide range of lenders,

-

Down payment – May be able to get a loan with little to no down payment.

-

Loan terms – Probably eligible for longer repayment terms, keeping monthly payments low.

-

Special offers – May qualify for special low APR promotions from dealers/manufacturers.

How Your Credit Score Affects Your Loan

Higher scores generally lead to better loan terms:

-

Interest rates decrease as credit scores increase. According to Experian data, average used car loan rates are:

-

741+ credit: 7.41%

-

661-740 credit: 9.63%

-

601-660 credit: 14.07%

-

501-600 credit: 18.95%

-

-

Loan eligibility goes up with higher scores. Lenders view you as less risky.

-

You may qualify for a lower down payment and longer repayment term.

-

Better chances for special offers like 0% APR promotions.

Tips for Buying a Car with a 767 Credit Score

Follow these tips to get the best possible deal:

-

Shop around for rates. Compare offers from banks, credit unions, and dealers.

-

Consider bringing a co-signer if you have a limited credit history. This can improve your rate.

-

Negotiate! Don’t be afraid to negotiate the vehicle price and loan terms.

-

Read the fine print before signing anything. Understand all terms and conditions.

-

Make a sizable down payment if possible. This shows lenders you’re financially committed.

-

Apply for financing from your own bank or credit union first. Then negotiate with the dealer.

How to Boost Your Credit Score Even Higher

To improve your already strong 767 score:

-

Maintain low credit card balances. Keep utilization below 30% of your limits.

-

Make timely payments each month for all bills and debts. Even one late payment can hurt.

-

Be cautious about opening many new credit accounts close together. Too many inquiries can lower your score temporarily.

-

Check your credit report regularly and dispute any errors that could be dragging your score down.

-

Become an authorized user on a longstanding credit card account to build your history if needed.

The Bottom Line

A 767 credit score puts you in an excellent position to qualify for a competitive auto loan. Shop around, negotiate the best deal possible, and maintain responsible credit habits. With some research and preparation, you can leverage your 767 score to end up with favorable financing that fits your budget.

How to Get a Car Loan With Bad Credit

Here are several steps you can take to get an auto loan with bad credit:

- Set your budget and save for a down payment. Figure out approximately how much you can afford to pay each month for an auto loan, the related costs of owning a car and your down payment. If you have a car, consider whether trading it in or selling it directly to a buyer and using the money for a down payment makes more sense.

- Learn about different types of lenders. Knowing where to look for an auto loan can be important. Banks, credit unions and some online lenders might have options. Some dealerships can also help you shop for a loan, although the interest rate might be higher than if you went directly to the lender yourself. There are also buy here, pay here (BHPH) lenders that work with borrowers who have bad or no credit. But treat them as a last resort because the loans tend to have high interest rates and fees.

- Try to get prequalified for several car loans. See if you can get preapproved or prequalified for auto loans from multiple lenders. Lenders sometimes use the terms interchangeably, but start with options that only require a soft credit checkâthe type that doesnt affect your credit scores. Once you find a loan that works for your needs, get a preapproval letter from the lender that you can then take to the dealer to show youre ready to buy (they may try to match or even improve your terms).

- Choose a rate-shopping window. Preapprovals and applications that result in a hard inquiry may hurt your credit scores a small amount. However, multiple hard inquiries for auto loans that occur within a 14-day window will only count as one inquiry for scoring. With this in mind, wait until youre ready to buy to seek loan preapprovals.

- Consider a cosigner. You might qualify for more loans and better terms if you can get someone with good credit to cosign your auto loan. But consider the impact on your relationship first. They will be legally responsible for the debt, it could impact their DTI and missing a payment could hurt their credit.

- Go with the best offer. Review your auto loan offers to see which one works best with your budget. If you didnt get a good offer, you could try to get preapproved with more lenders or dealerships. Or, see if you can get preapproved for a smaller loan and buy a different vehicle.

Your auto loan will likely have a high APR, but you may be able to refinance with a lower-rate loan as your credit score improves. If this is your plan, review your loans terms for a prepayment penaltyâan extra fee that you may need to pay if you want to pay off your auto loan early.

Is There a Minimum Credit Score to Get a Car Loan?

Some auto lenders have a minimum credit score, but there isnt an overall minimum score to get a car loan. There are lenders that offer loans to applicants with low scoresâand to borrowers who dont have any credit history or score.

Car loans tend to have higher interest rates and fees if you have poor credit. But no matter your credit score, youll generally receive a lower interest rate with an auto loan than an unsecured personal loan because the vehicle youre buying secures the auto loan. If you miss a payment, the lender can repossess and sell the car, which limits its potential losses.

Learn more: What is a Good Credit Score for an Auto Loan

Buying A Car with Bad Credit – Exposing Dealership – secrets to buying a car

FAQ

Is 767 a good credit score to buy a car?

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850. 5.18%. 6.82%.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

What can a 767 credit score do for you?

People with credit scores of 767 typically pay their bills on time; in fact, late payments appear on just 18% of their credit reports. People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms.

Is a 700 credit score good enough to buy a car?

What does a 767 credit score mean?

A 767 credit score is often considered very good — or even excellent. A very good or excellent credit score can mean you’re more likely to be approved for good offers and rates when it comes to mortgages, auto loans and credit cards with rewards and other perks. This is because a high credit score may indicate that you’re less risky to lend to.

Do you need a good credit score to buy a car?

That’s why most people who end up taking out an auto loan have a good or excellent credit score. The lower your credit score, the lower your chances of you being able to buy a car. If your credit score needs a lot of work, it may be hard to find a lender who will approve you for a car loan.

Can you buy a car with poor credit?

Despite these car loan statistics, buying a car with poor credit is possible, especially if you can provide a generous down payment (at least 20% on a new car, 10% for used). With that said, having a very good to an excellent score will increase your chances of approval and help you secure the most competitive rates and terms.

Can you get a car loan with a 660 credit score?

Most approved borrowers have credit scores of 661 or higher, but there is no set score to get an auto loan. Having a credit score below 660 could make it harder and more expensive — though not impossible — to finance your car. Here is what you need to know about auto loan credit scores and how to increase your score to get a better rate.

Is it easier to get a car loan with a good credit score?

That said, it’s definitely easier to get approved for a car loan if you have a good credit score. The lower your credit score, the harder it may be to find a lender, and if you do, you’ll usually pay a lot more for financing.

What credit score do you need to get a car loan?

Still, you typically need a good credit score of 661 or higher to qualify for an auto loan. About 71% of vehicle financing is for borrowers with credit scores of 661 or higher, according to Experian. Meanwhile, low-credit borrowers with scores of 600 or lower account for only 14% of auto loans.