For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent.

For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U.S. was 715.

Lenders use their own criteria for deciding whom to lend to and at what rates. But a higher credit score can generally help you qualify for a credit card or loan with a lower interest rate and better terms. The two main types of credit scores, the FICO® Score and VantageScore® credit scores, vary slightly in their ranges but have similar scoring factors.

Your credit score is one of the most important factors that lenders consider when reviewing your application for a loan, credit card, or other line of credit. But with three major credit agencies in the UK—Experian, Equifax, and TransUnion—all calculating scores differently, it can get confusing to know which one you can rely on

In this article, we’ll break down what goes into your credit score, how the top agencies calculate it, and ultimately which credit score is the most reliable and trusted by lenders in the UK.

How Credit Scores Are Calculated in the UK

While the three major credit reference agencies (CRAs) use different scoring models and scales. they all rely on similar types of information from your credit report to calculate your score

-

Payment history – Have you made past credit payments on time? Late payments will lower your score.

-

Credit utilization – What percentage of your available credit are you using? High utilization can indicate higher risk.

-

Credit history length – How long have you held credit accounts? A longer history is better.

-

Recent credit applications – Too many “hard inquiries” from applying for credit can lower your score.

-

Credit mix – Having experience with different types of credit (credit cards, loans, etc) is ideal.

So while the actual numerical scores may differ between agencies, your relative creditworthiness remains consistent. A “good” or “fair” score with one agency means you likely have a comparable score with the others.

Experian Credit Score

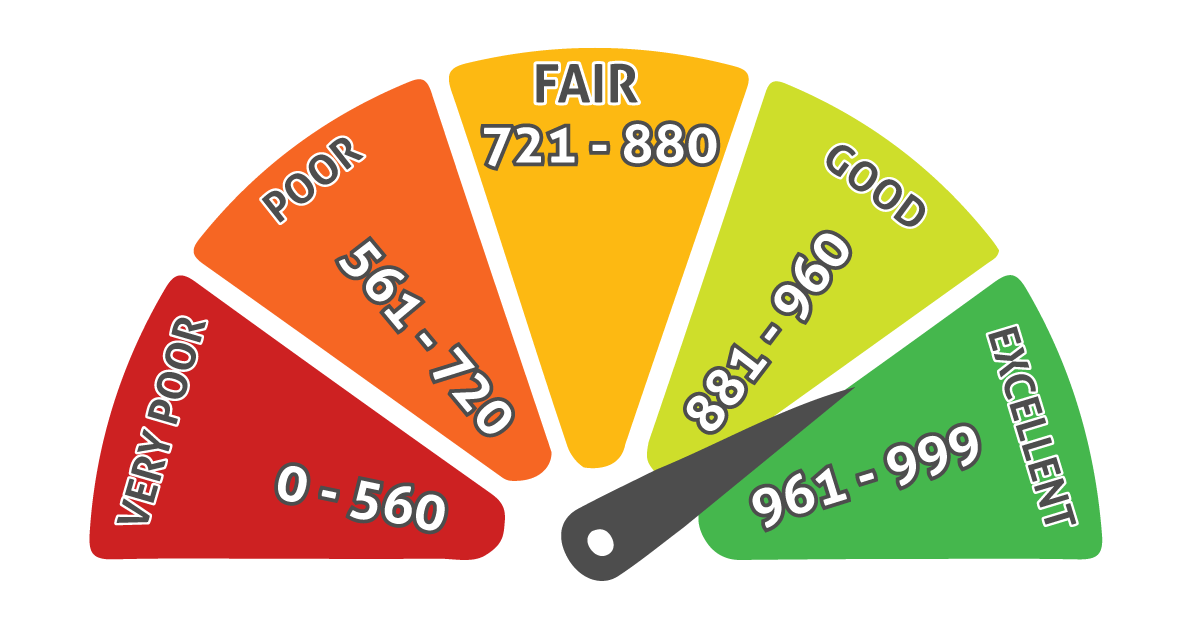

Of the three major CRAs, Experian is the largest and most widely used by lenders in the UK. Their credit scores range from 0-999. According to Experian:

- Excellent credit: 961-999

- Good credit: 881-960

- Fair credit: 721-880

- Poor credit: 566-720

- Very poor credit: 0-565

So if your Experian score is above 720, you can feel confident you have at least a “fair” credit standing in the UK. But to get the best rates, you’ll want to aim for the “excellent” range of 961 or higher.

TransUnion Credit Score

TransUnion (formerly Callcredit) has a scoring range of 0-710. Their rating scale is:

- Excellent credit: 628-710

- Good credit: 604-627

- Fair credit: 566-603

- Poor credit: 495-565

- Very poor credit: 0-494

So with TransUnion, a score of at least 566 is considered “fair.” But like Experian, you’ll need to reach the “excellent” band for the very best loan terms.

Equifax Credit Score

Equifax uses the largest scoring range, from 0-700. According to Equifax:

- Excellent credit: 466-700

- Good credit: 420-465

- Fair credit: 380-419

- Poor credit: 312-379

- Very poor credit: 0-311

So for Equifax, a credit score above 380 indicates a “fair” rating. But you’ll need to have a score over 465 to be considered in “good” standing.

Which UK Credit Score is Most Reliable?

When all three agencies consider your credit to be “fair” or better, you can feel confident you’re in pretty good financial shape in the eyes of UK lenders. However, Experian tends to be the most relied upon agency by creditors.

Experian is the largest CRA and has the most extensive data thanks to its partnerships with major banks. The company also pioneered credit scoring models in the UK. For these reasons, the Experian Credit Score is the UK’s most trusted rating* – a good Experian Credit Score is likely to mean you have a good credit score with companies.

How to Check Your Scores with All 3 Agencies

While your Experian score holds the most weight, checking your credit with all three major agencies gives the most complete picture:

- Experian: You can check your Experian credit report and score for free.

- TransUnion: You can access your TransUnion report and score online or by post.

- Equifax: Getting your Equifax credit score costs around £7-15 depending on the package.

I recommend using a service like Check My File that provides your reports and scores from all three agencies in one place for easy comparison.

Tips for Improving Your Credit Scores

Here are some top tips for boosting your credit scores with all three agencies:

- Make all credit payments on time – set up alerts if needed.

- Try to keep credit card balances below 30% of your limit.

- Avoid applying for a lot of new credit at once.

- Build long-term credit history by keeping old accounts open.

- Make sure your personal info is consistent across reports.

- Correct any errors on your reports that may be dragging down your scores.

By monitoring your credit with all three agencies and following healthy credit habits, you can build trust and confidence with lenders – and enjoy better access to credit when you need it!

Summary

- The 3 major consumer credit agencies in the UK are Experian, TransUnion, and Equifax.

- Each CRA uses different score ranges and models to calculate your credit score.

- However, the relative assessment of your creditworthiness remains similar across agencies.

- Experian scores hold the most importance as they are most widely used by lenders.

- Checking your credit reports and scores with all 3 CRAs gives the most complete view.

- There are many ways to check and improve your credit scores for free.

- Building a strong credit history and profile will open up better financing options.

So be sure to keep tabs on your Experian, TransUnion, and Equifax credit scores! Knowing where you stand is the first step toward accessing credit and loans at the best rates.

Why There Are Different Credit Scores

There are many different credit scores because credit scoring companies continually update and sell their scores to lenders.

Lenders use credit scores to make lending and account management decisions, such as who to approve and whether to change your credit limit. For the most part, lenders can choose which model they want to use.

FICO and VantageScore create and sell different credit scoring models, and both companies periodically release new versions of their credit scoresâsimilar to how a software company might offer a new operating system.

The latest scoring models might incorporate technological advances or changes in consumer behavior. Lenders can then decide to upgrade to a newer model, or to stick with the older version thats already integrated into their systems and processes.

Why Having a Good Credit Score Is Important

Having good credit can make achieving your goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. It can also directly impact how much youll have to pay in interest or fees if youre approved.

For example, the difference between taking out a 30-year, fixed-rate $350,000 mortgage with a 620 FICO® Score and a 700 FICO® Score could be $138.58 a month. Thats extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having the better score would save you $49,889 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports (but not your credit scores) before making a hiring or promotion decision. In most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

| FICO® Score | Interest Rate, 30-Year Fixed-Rate Mortgage | Monthly Payment | Total Interest Cost |

|---|---|---|---|

| 620 | 7.71% | $2,806.11 | $549,199 |

| 700 | 7.13% | $2,667.53 | $499,310 |

| 840 | 6.69% | $2,564.49 | $462,214 |

Source: Curinos LLC, December 6, 2024; assumes a $350,000 mortgage and 30-day rate-lock period

Learn more: Facts About Credit You May Not Know

Transunion vs Equifax – Which Credit Score Matters More? (What’s the Difference?)

FAQ

Which credit score is most accurate?

FICO Scoring Model. The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores.

Is a 900 credit score possible?

A credit score of 900 is not possible, but older scoring models that are no longer used once went up to 900 or higher. The highest possible credit score you can acheive now is 850.

Who gives the most reliable credit score?

- Experian. Credit score range 0-999 (a score above 961 is considered high/excellent).

- Equifax. Credit score range 0-1000 (a score above 811 is considered high/excellent).

- TransUnion. Credit score range 0-710 (a score above 628 is considered high/excellent).

Which credit rating is the most accurate?

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scoring models, however, there is a clear winner: FICO® Score is used in roughly 90% of lending decisions.