Wellcome To Meto Pay Trade Money the Fair Way

Exchange currencies with people all around the world in just minutes!

verwhelmed by bills? We can help! Get lower payments and better terms for your phone, cable, and internet services.

Lastest Articles

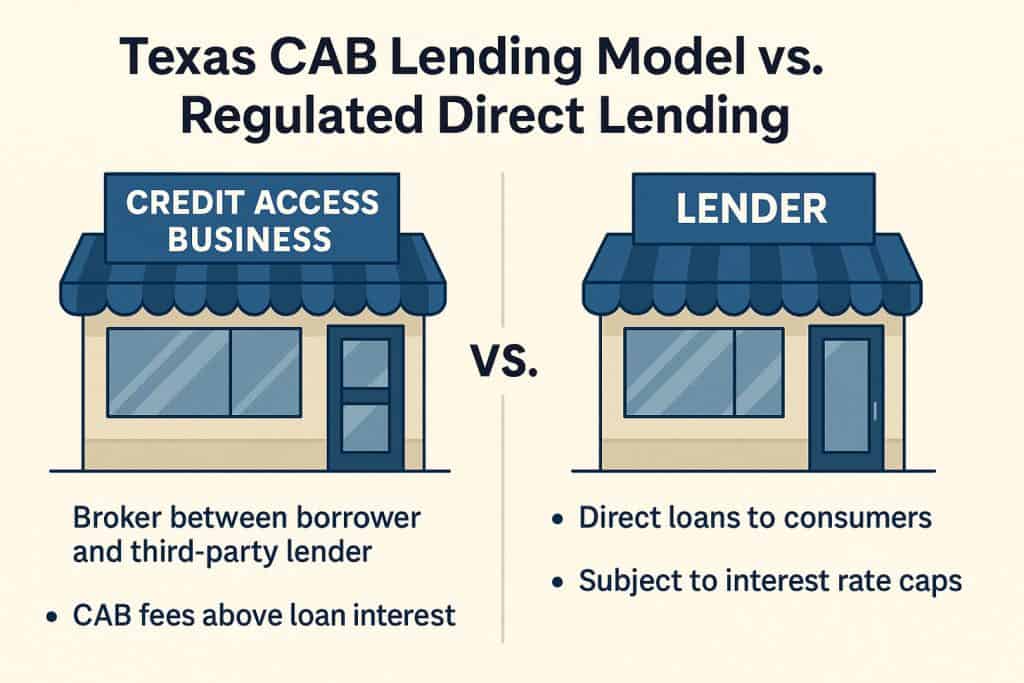

What’s a CAB Loan? Your Quick Guide to Fast Cash in Texas!

Hey there friend! Ever found yourself in a tight spot needing cash like yesterday for a busted car or an unexpected bill? I’ve been there, and lemme tell ya, it’s stressful as heck. That’s where somethin’ called a CAB loan comes into play, especially if you’re in Texas. If you’re scratchin’ your head wondering, “What’s … Read more

Can I Sue a Company for Running My Credit Without My Permission? Your Rights Unpacked!

Hey there, folks! Ever checked your credit report and spotted a hard inquiry you didn’t green-light? Man, that’s a gut punch, ain’t it? If a company ran your credit without your say-so, you’re prolly wondering, “Can I sue their sorry butts for this?” Well, I’m here to tell ya—yep, you sure can in many cases, … Read more

What Credit Score is Needed to Buy a HUD Home? A Complete Guide

With housing prices soaring, finding an affordable place to call home can be challenging. One option to explore is HUD homes, which are often sold for less than their market value. But what is a HUD home, and how can you determine whether it’s the right choice for you? Here’s what to know. Key takeaways … Read more

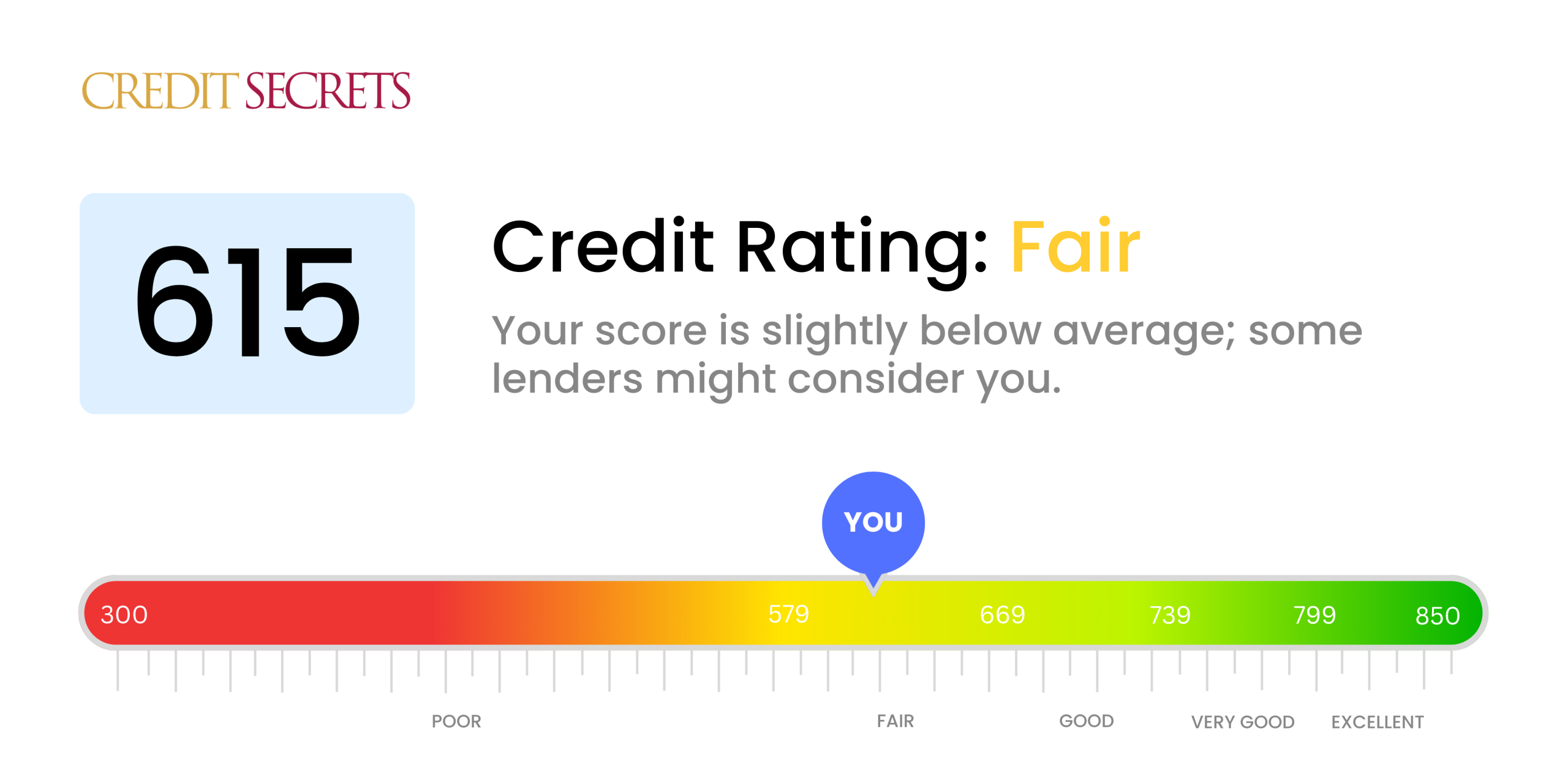

Is a 615 Credit Score Good or Bad?

Hey there, folks. If you’re wondering if a 615 credit score is something to brag about or if it’s time to panic a bit, I’ve got ya covered. Straight up, no, 615 ain’t considered a good credit score—it’s more in the fair to poor range, which can make things like getting loans or low interest … Read more

Are Mortgage Payments Considered Savings?

so you’re wondering if those monthly mortgage payments count as savings. Short answer? Not exactly in the traditional sense, but they do build something valuable over time—like equity in your home. It’s more like a forced investment than stashing cash in a piggy bank, and I’ll dive into why that matters for your finances. I … Read more

Evaluating State National Insurance Company: Reviews, Ratings, and More

Hey there, folks! If you’re hunting for honest takes on State National Insurance Company, I’ve got you covered. In this deep dive, we’ll break down what real customers are saying, the good, the bad, and everything in between, all in simple terms so you can decide if they’re worth your time and money. State National … Read more

When Should You Pull the Trigger? The Ultimate Guide to Stock Buying Frequency

Are ya feeling lost in the stock market jungle? Wondering ‘how often should i buy stocks’ without blowing your savings or missing golden opportunities? You’re definitely not alone! This question haunts both newbie investors and seasoned traders alike. I’ve spent years navigating these choppy market waters, making plenty of mistakes along the way (trust me, … Read more

Are Gold Dollars Real Gold? The Surprising Truth About These Coins

Gold dollars have captured the imagination of investors and coin collectors for decades, owing to their relative scarcity compared to other circulating coinage. The mystique surrounding these unique coins leads many people to wonder: Which gold dollars are worth more than their face value? Some versions yield impressive auction prices while others aren’t worth more … Read more

Why Holding Stocks for Years Is a Smart Investment Strategy (And Yes, You Absolutely Can!)

As long as markets have existed, investors have tried to maximize gains and minimize losses by timing the market. Timing the market involves attempting to buy when prices are low but rising and sell when prices are high but falling. However, when it comes to stock market timing, you must be successful twice: Once when … Read more

Is Trading Tax Free in UK? Complete 2025 Guide to Trading Taxes

Capital Gains Tax is a tax on the profit when you sell (or ‘dispose of’) something (an ‘asset’) that’s increased in value. It’s the gain you make that’s taxed, not the amount of money you receive. For example, if you bought a painting for £5,000 and sold it later for £25,000, you’ve made a gain … Read more

What Stocks Are Billionaires Buying Right Now? Following the Smart Money in 2025

In this time of economic uncertainty, what securities are the likes of George Soros and Warren Buffett betting on? The wild market volatility of the past couple of years due to the COVID-19 pandemic has investors interested in mitigating risks, which means more attention is being paid to hedge funds. Not all of that attention … Read more

Is SIP Tax Free? The Complete Truth About SIP Taxation in 2025

Youâve surely heard of Systematic Investment Plans (SIPs) – theyve become increasingly popular among investors because theyre easy to use and have the potential for wealth accumulation. SIPs are offered by mutual funds, which provide diversified portfolios managed by professionals. This makes mutual fund SIPs an excellent choice for regular investing to meet your financial … Read more

Should I Hold a Losing Stock? 4 Smart Strategies for Underwater Investments

We’ve all been there – checking our portfolio and seeing that red negative number next to a stock we were once excited about. The gut reaction is often to hold on hoping things will turn around. But is that always the smart play? As someone who’s made plenty of investing mistakes (trust me, my portfolio … Read more

Do You Really Need a Broker? The Unfiltered Truth About Mortgage Middlemen

Are you staring at your computer screen late at night, scrolling through endless mortgage rates and feeling completely overwhelmed? You’re not alone! The question that keeps popping up for many prospective homebuyers is do you really need a broker to navigate the complicated world of home loans? I’ve spent countless hours researching this topic and … Read more

Can I Trade at 4AM on TD Ameritrade? Understanding Extended Hours Trading

Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. If youre someone with a busy schedule, pre-market and after-hours trading may work for you. As an avid trader who’s had to squeeze in trades before my day job starts, … Read more