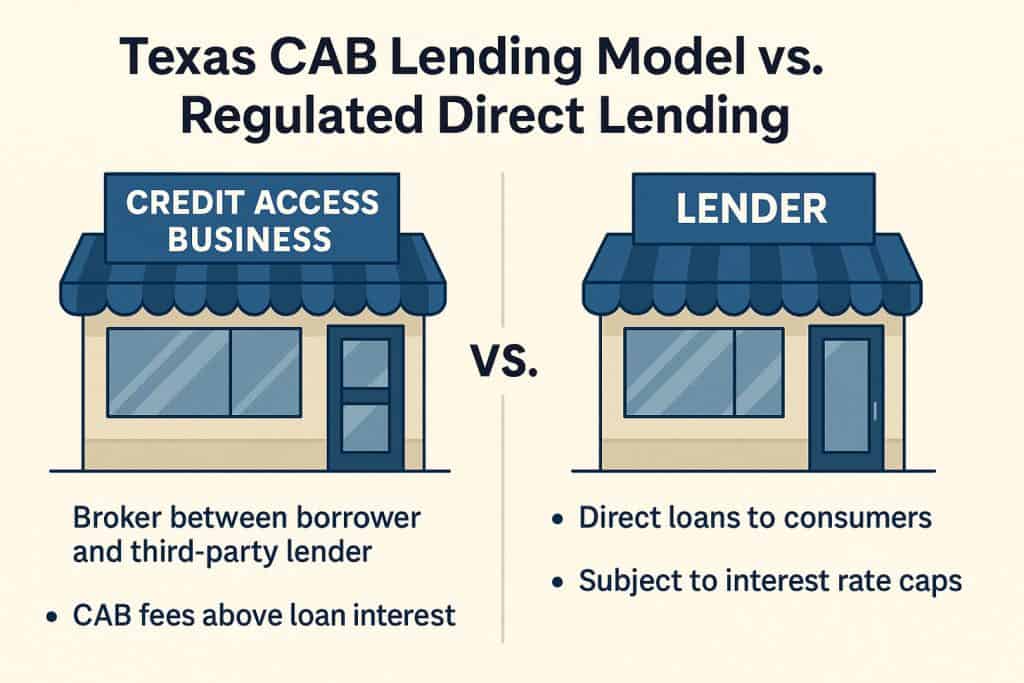

What’s a CAB Loan? Your Quick Guide to Fast Cash in Texas!

Hey there friend! Ever found yourself in a tight spot needing cash like yesterday for a busted car or an unexpected bill? I’ve been there, and lemme tell ya, it’s stressful as heck. That’s where somethin’ called a CAB loan comes into play, especially if you’re in Texas. If you’re scratchin’ your head wondering, “What’s … Read more