Many worry that China’s ownership of U.S. debt affords China economic leverage over the United States. This apprehension, however, stems from a misunderstanding of sovereign debt and of how states derive power from their economic relations. The purchasing of sovereign debt by foreign countries is a normal transaction that serves several legitimate economic policy goals. Consequently, China’s stake in U.S. debt has more of a binding than a dividing effect on bilateral relations between the two countries.

Even if China wished to “call in” its loans, the use of credit as a coercive measure is complicated and often heavily constrained. A creditor can only dictate terms for the debtor country if that debtor has no other options, but U.S. debt is a widely held and extremely desirable asset in the global economy. Whatever debt China does sell is likely to be simply purchased by other countries. In fact, China’s known holdings of U.S. debt have gradually declined after peaking in the mid-2010s, and Japan and the United Kingdom have overtaken China as the top holders of U.S. debt.

Furthermore, China needs to maintain significant reserves of U.S. debt to manage the exchange rate of the renminbi. Were China to suddenly unload its reserve holdings, its currency’s exchange rate would rise, making Chinese exports more expensive in foreign markets. As such, China’s holdings of U.S. debt do not provide China with undue economic influence over the United States.

The Trillion-Dollar Question That Keeps Washington Up at Night

Have you ever wondered what would happen if your biggest creditor suddenly demanded all their money back? Well, that’s kinda the situation the United States faces with China, which holds around $13 trillion in US Treasury securities. I’ve been researching this topic extensively, and the potential consequences are both fascinating and concerning.

China is one of America’s largest foreign creditors, and rumors of them “dumping” US debt periodically surface during times of heightened tension between the two economic superpowers. With recent trade wars and geopolitical conflicts, this question has become more relevant than ever.

So what exactly would happen if China started selling off its massive Treasury portfolio? Let’s dive into this economic rabbit hole together

How Much US Debt Does China Actually Own?

Before panicking we should understand the actual numbers

- China holds approximately $1.3 trillion in US Treasury securities

- This represents about 6% of US GDP

- China also owns roughly $200 billion in US Agency bonds

- Total Chinese holdings amount to around 7% of US GDP when counting both Treasuries and Agencies

While $1.3 trillion sounds massive (and it is!), it’s important to note that China’s holdings represent just a portion of the overall $31+ trillion US national debt. The majority of US debt is actually held domestically by American citizens, corporations, the Federal Reserve, and government entities.

The Immediate Market Impacts

If China decided to sell off its Treasury portfolio, here’s what would likely happen initially:

- Treasury yields would rise – When a major seller dumps securities, prices fall and yields rise

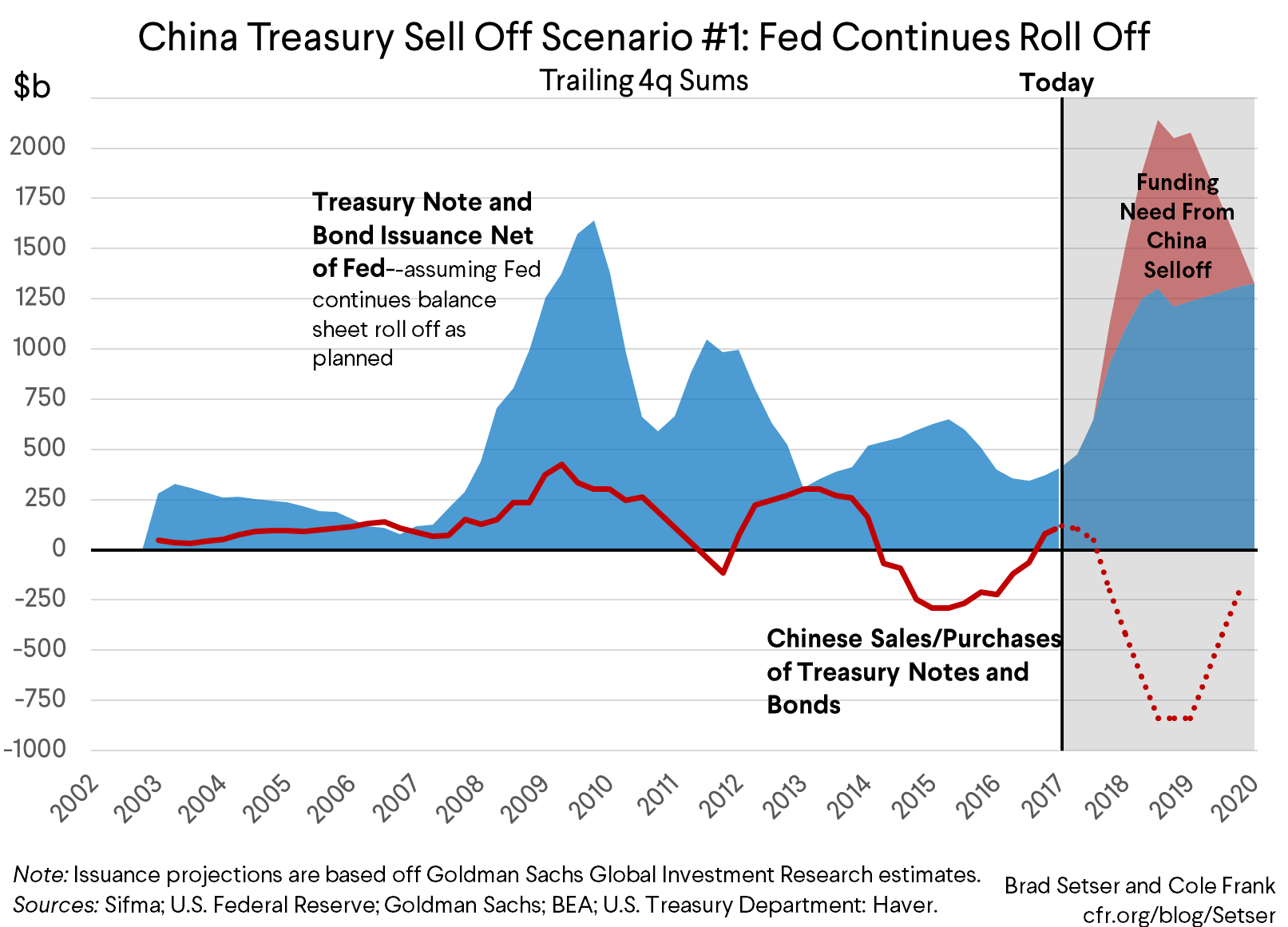

- Estimated impact: 30-60 basis points – Using the QE literature as a guide, a complete selloff might raise long-term interest rates by about 30 basis points (0.3%), though some pre-QE papers suggest it could be higher

- Market volatility would increase – The psychological impact could temporarily amplify market reactions

- Steepening yield curve – Longer-term bonds would likely be affected more than shorter-term ones

As the Council on Foreign Relations (CFR) notes, “If China sold its entire Treasury portfolio… in the first instance would be estimated to raise long-term interest rates by say 30 basis points. There is of course uncertainty around that estimate, as some of the pre-QE papers would suggest a bigger impact.”

Why The Doomsday Scenario Is Unlikely

Here’s the thing that many apocalyptic economic scenarios miss: the Federal Reserve would almost certainly respond.

The Fed has powerful tools at its disposal to counteract Chinese selling:

- Slowing rate hikes or even cutting rates

- Pausing or reversing quantitative tightening (balance sheet reduction)

- Implementing new rounds of quantitative easing if necessary

- Operation Twist – Selling short-term and buying long-term securities to flatten the yield curve

As the CFR points out, “The Fed is the one actor in the world that can buy more than China can ever sell.” This is a critical point! The Fed could simply purchase whatever China sells, effectively neutralizing the impact.

The Chinese Perspective: Why Wouldn’t They Sell?

While China could theoretically dump US Treasuries, there are compelling reasons why they probably won’t:

- Self-inflicted wound – By causing US rates to rise, China would devalue its own massive Treasury holdings

- Limited alternatives – Where would China put $1.3 trillion? Eurozone bonds? Japanese government bonds? These markets aren’t as deep as the US Treasury market

- Currency implications – Selling dollars to buy other currencies would strengthen those currencies against the dollar, hurting those countries’ exports (including to China)

- Political backlash – Such a hostile financial move would likely trigger severe US countermeasures

China uses its Treasury holdings as both an investment and a political tool. Maintaining this position gives them leverage, which would be lost if they sold everything at once.

The More Realistic Threat: Gradual Diversification

A more likely scenario isn’t a sudden dump of US debt but rather a gradual reduction over time:

- China reducing new purchases of Treasuries

- Allowing existing holdings to mature without replacement

- Slowly diversifying into other currencies and assets

- Potentially increasing gold reserves (which they’ve been doing)

This gradual approach would have much milder effects on markets while still reducing China’s dollar exposure over time.

A Real-World Test Case: 2015-2016

We actually have a recent example of significant Chinese Treasury selling:

- During 2015-2016, China sold roughly $600 billion in reserves

- About half of these sales were Treasuries

- The impact on US interest rates was modest

- Other factors (like expectations of Fed policy) had larger effects on rates

As the CFR analysis explains: “If Treasury sales came in the context of a decision by China that it wanted a weaker currency to offset the economic impact of Trump’s tariffs… the disinflationary impulse from a weaker yuan (and a broader fall in most Asian currencies and a rise in the dollar) would likely be more powerful than the mechanical impact of Treasury sales. That is the lesson of 2015-16.”

The Bigger Threat: Currency Devaluation

Interestingly, if China wanted to retaliate against the US in a trade war, selling Treasuries might not be their most effective weapon. A potentially more powerful move would be devaluing their currency:

- A 10% depreciation in the yuan could boost Chinese exports by about 1.5% of GDP

- This would offset much of the economic impact of US tariffs

- It would make US goods more expensive in China and Chinese goods cheaper in the US

- The economic impact would be more direct and harder for the US to counter

The CFR suggests that US policymakers should be more concerned about Chinese currency moves than Treasury sales: “I would encourage it to spend most of its time worrying about the consequences of a Chinese exchange rate move.”

How The US Could Mitigate Treasury Sales

If China did start selling Treasuries aggressively, the US has several potential responses:

- Fed policy adjustments – As mentioned earlier

- Treasury issuance changes – The Treasury could issue more bills (short-term) and fewer notes (longer-term)

- Foreign policy coordination – Work with allies to prevent a domino effect in currency markets

- Domestic investor incentives – Create incentives for domestic investors to purchase more government debt

Remember that foreign demand isn’t as central to the Treasury market as it once was. The US current account deficit (2.5% of GDP) is below the fiscal deficit (4-5% of GDP), meaning domestic savings are funding more of the government’s borrowing needs than in the past.

The Global Financial System Implications

A massive Chinese selloff would have ripple effects throughout the global financial system:

- Euro appreciation – If China bought euros with its dollar proceeds

- Japanese yen strength – If China diversified into yen assets

- Global interest rate adjustments – As markets repriced risk

- Banking system stress – Potential liquidity issues in certain markets

These effects would likely push other central banks to respond as well, potentially creating a coordinated global central bank response to stabilize markets.

Bottom Line: Concerning But Manageable

So what’s the verdict? While a Chinese Treasury selloff would certainly cause market turbulence, it wouldn’t be the economic doomsday some predict:

- Short-term pain – Yes, there would be market volatility and some increase in interest rates

- Long-term manageable – The Fed and Treasury have powerful tools to counteract the effects

- Mutually assured financial destruction – China would hurt itself significantly by taking such action

- Better alternatives for China – Currency devaluation would be a more effective economic weapon

As the CFR concludes, “Treasuries sales in a sense are easy to counter, as the Fed is very comfortable buying and selling Treasuries for its own account.”

What This Means For You

For the average American, the impacts would be:

- Potentially higher mortgage and consumer loan rates in the short term

- Possible stock market volatility

- Limited long-term effects if the Fed responds appropriately

For investors, it suggests:

- Having a diversified portfolio remains important

- Understanding that Treasury market dynamics involve many players, not just China

- Recognizing that economic warfare has limits

Final Thoughts

I think the fear of China “dumping” US debt makes for great headlines but overlooks the practical realities of global financial markets. China and the US remain economically interdependent despite their differences. While China will likely continue to gradually diversify away from US Treasuries, a sudden, massive selloff remains unlikely due to the self-inflicted damage it would cause.

The relationship between these two economic giants will continue to evolve, but financial markets have proven remarkably resilient to geopolitical tensions. As always in economics, the reality is more nuanced than the alarming headlines suggest.

What do you think? Would China ever use the “nuclear option” of dumping US debt, or will economic self-interest keep this financial weapon holstered? I’d love to hear your thoughts!

Why do countries accumulate foreign exchange reserves?

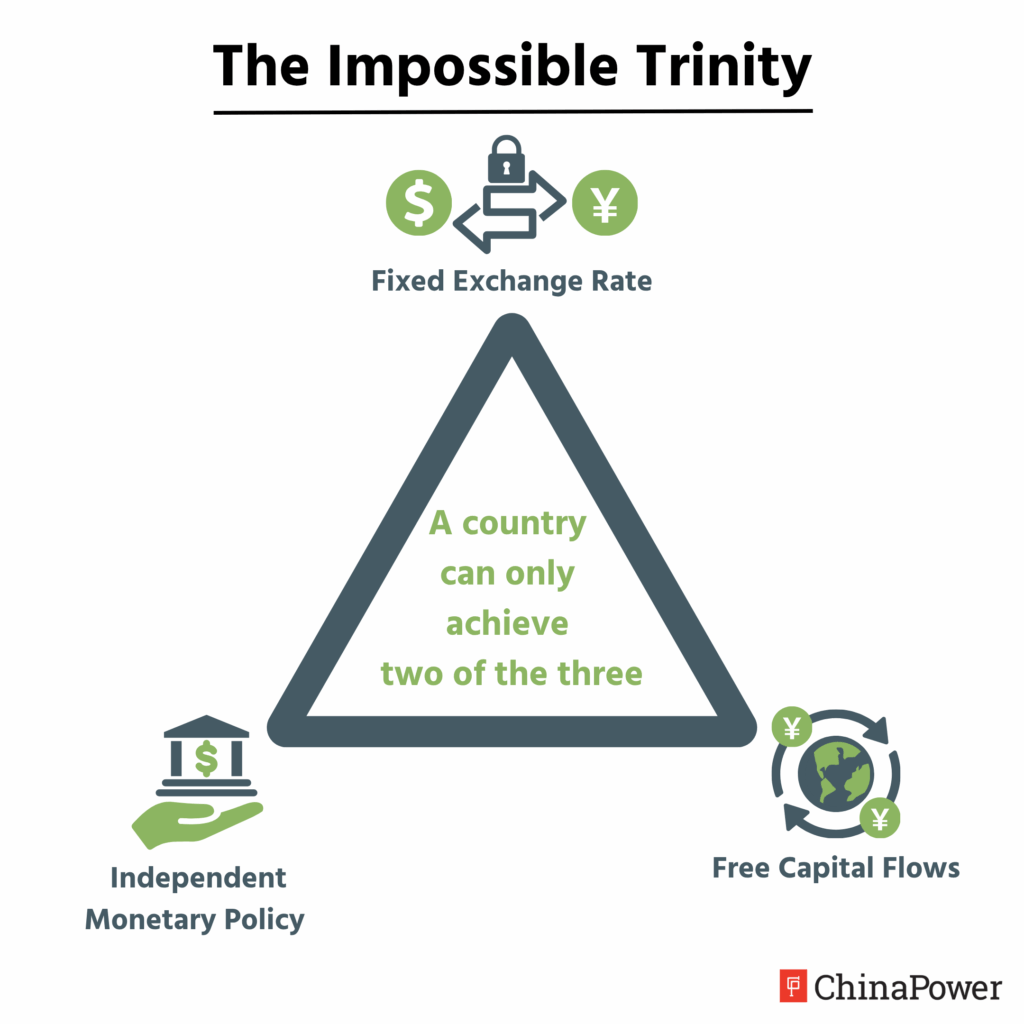

Any country that trades openly with other countries is likely to buy foreign sovereign debt. In terms of economic policy, a country can have any two—but not three—of the following: a fixed exchange rate, an independent monetary policy, and free capital flows. Foreign sovereign debt provide countries with a means to pursue their economic objectives.

For instance, China manages the exchange rate of the renminbi and it maintains an independent monetary policy, but to achieve that, it cannot allow capital to freely flow in and out of its economy. The United States has an independent monetary policy and allows capital to freely flow through the economy, but Washington does not directly manage the value the U.S. dollar’s exchange rate.

Owning foreign sovereign debt provides countries with a means to pursue the objectives of their respective monetary and trade policies. Specifically, it helps to achieve three main objectives. First, countries can hold sovereign debt as part of their foreign exchange reserves to facilitate trade. Second, central banks buy sovereign debt to maintain their currency’s exchange rate or forestall economic instability. Third, as a low-risk store of value, sovereign debt can be an attractive investment asset to central banks and other financial actors. Each of these functions is discussed briefly.

Any country open to international trade or investment requires a certain amount of foreign currency on hand to pay for foreign goods or investments abroad. As a result, many countries keep foreign currency in reserve to pay for these expenses, which cushions the economy from sudden changes in international investment. Domestic economic policies often require central banks to maintain a reserve adequacy ratio of foreign exchange and other reserves for short-term external debt, and to ensure a country’s ability to service its external short-term debt in a crisis. The International Monetary Fund (IMF) publishes guidelines to assist governments in calculating appropriate levels of foreign exchange reserves given their economic conditions.

A fixed or pegged exchange rate is a monetary policy decision. This decision attempts to minimize the price instability that accompanies volatile capital flows. Such conditions are especially apparent in emerging markets: Argentinian import price increases of up to 30 percent in 2013 led opposition leaders to describe wages as “water running through your fingers.” Since price volatility is economically and politically destabilizing, policymakers manage exchange rates to mitigate change. Internationally, few countries’ exchange rates are completely “floating,” or determined by currency markets. To manage domestic currency rates, a country might choose to purchase foreign assets and store them for the future, when the currency might depreciate too quickly.

Why does China buy U.S. debt?

China buys U.S. debt for the same reasons other countries buy U.S. debt, with two caveats. The crippling 1997 Asian Financial Crisis prompted Asian economies, including China, to build up foreign exchange reserves as a safety net. More specifically, China holds large exchange reserves, which were built up over time due in part to persistent surpluses in the current account, to inhibit cash inflows from trade and investment from destabilizing the domestic economy.

China’s large U.S. Treasury holdings say as much about U.S. power in the global economy as any particularity of the Chinese economy. Broadly speaking, U.S. debt is an in-demand asset. It is safe and convenient. As the world’s reserve currency, the U.S. dollar is extensively used in international transactions. Trade goods are often priced in dollars, and due to their high demand, the dollar can easily be cashed in. Furthermore, the U.S. government has never defaulted on its debt.

What Happens If China Sells All US Debt?

FAQ

What would happen if China called in the U.S. debt?

What is the safest place for money if the US defaults on debt?

If the US defaults. there is no safe place to put your US Dollars. The alternatives are commodities (gold,silver,collectibles) or possibly foreign currencies (euro,pound,etc). But really, if the US defaults the best assets you’ll have would be canned goods and ammunition.

How much of the U.S. debt is owned by China?

What happens if the world stops buying U.S. debt?